Republicans are divided on how to approach a sweeping legislative package in 2025, as debates intensify between House and Senate GOP leaders considering whether to consolidate tax, border security, energy, and defense priorities into a single reconciliation bill or pursue a two-step approach. (TaxNotes, Dec. 12)

The Debate

- The outcome will shape the GOP’s legislative strategy as they prepare to extend key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and deliver on other campaign promises.

- House Ways and Means Committee Chair Jason Smith (R-MO) is advocating for a single reconciliation bill that combines tax policy with border and energy reforms, arguing that this approach maximizes the slim Republican majority’s ability to pass ambitious legislation.

- Rep. Smith’s stance has put him at odds with incoming Senate Majority Leader John Thune (R-SD), who prefers a two-bill strategy—one focused on border security and energy early in the year, followed by a tax package later. (PoliticoPro, Dec. 11)

- Sen. Thune, backed by Senate Budget Chair Lindsey Graham (R-SC) and incoming White House policy advisor Stephen Miller, see an early legislative win on immigration as critical to setting the stage for more complex tax negotiations. (Axios, Dec. 9)

- Rep. Smith, contends that splitting the package could jeopardize tax policy priorities, including extensions of TCJA provisions set to expire at the end of 2025. (Roundtable Weekly, Dec. 6)

- Failure to act on tax reform by the end of 2025 will lead to the expiration of many provisions of the 2017 tax law, resulting in tax increases for most individuals and some businesses. (Bloomberg, Dec. 3)

View from the Senate

- While negotiations continue, Sen. Thune said he’s eyeing a “big early win” for President-elect Trump with a party-line push on border security, military and energy provisions. “Failure is not an option as far as tax is concerned.” (Politico, Dec. 11)

View from the House

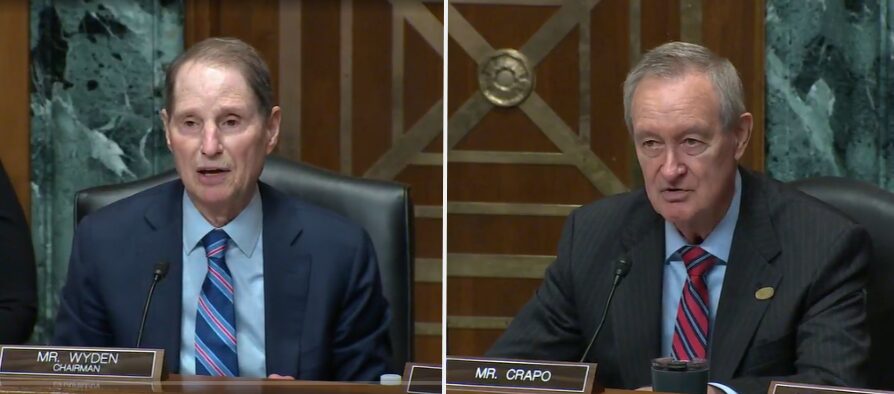

- House Majority Leader Steve Scalise (R-LA) said Tuesday House leadership is still deciding on a one- or two-bill strategy, and that they have been meeting with House and Senate members, including Sen. Thune and incoming Senate Finance Committee Chair Mike Crapo (R-ID). He warned it would be challenging to pass multiple budget resolutions. (TaxNotes, Dec. 11)

- “Donald Trump is the whip right now,” Scalise said, describing how Trump would corral votes from House Republicans. “You don’t have to worry about me; I’m actually a nice guy. The guy at 1600 Pennsylvania is going to send out a tweet, a truth, or whatever, and it’s not going to be as nice.” (TaxNotes, Dec. 11)

Government Funding

- Members on both sides of the aisle expect the government will stay open past the Dec. 20 shutdown deadline. (GlobeSt. Dec. 11)

- Lawmakers anticipate leadership will settle on a stopgap measure extending through next March, though some Republicans in both chambers are advocating for a CR that ends sooner to expedite Congress’s funding work. (The Hill, Dec. 11).

Challenges Ahead

- Narrow majorities: House Republicans can only afford to lose a handful of votes, making consensus critical. Senate Republicans face their own challenges under reconciliation rules requiring compliance with strict budget parameters. (NBC News, Dec. 12)

- SALT deduction disputes: Republicans from high-tax states like New York and New Jersey are expected to push for raising the $10,000 cap on state and local tax (SALT) deductions, which could complicate efforts to unify the caucus.

- Economist Stephen Moore, a member of President-elect Trump’s economic advisory transition team, told Bloomberg that expanding the tax write-off limit from $10,000 to $20,000 has been discussed. (TaxNotes, Dec. 11 | Bloomberg, Dec. 12)

What’s Next

- House Speaker Mike Johnson (R-LA) faces mounting pressure to navigate the narrow majority and align the party’s legislative strategy with President-elect Trump’s priorities.

- Johnson has indicated flexibility in the approach, noting ongoing discussions with Trump and GOP leaders.

- House Republicans are preparing to move swiftly in early January, with Budget Committee Chair Jodey Arrington (R-Texas) leading efforts on a budget resolution to lay the groundwork for reconciliation. Arrington has emphasized the need for a streamlined process, warning that delays could jeopardize Republican priorities. (TaxNotes, Dec. 12)

- Passage of a budget resolution, which is the first key step in the reconciliation process, will be crucial to move forward—a challenge in itself given the slim GOP majority in the House.

The text of the funding bill is anticipated to be released over the weekend or early next week, enabling both chambers to pass the measure before lawmakers adjourn until January.