RER advocates for tax policies that promote capital formation, reward risk-taking, and bolster investment. RER strongly supported the tax provisions in the One Big Beautiful Act (OB3 Act) signed into law in July. The OB3 Act tax reforms, once fully implemented, will spur investment in our nation’s housing supply, strengthen urban and rural communities, and grow the broader economy to the benefit of all Americans.

RER's October 2025 Policy Priorities

Summary

Real estate generally is owned and operated through “pass-through” entities that allow income to pass through to individual owners rather than taxing the income at the entity level. Pass-through entities such as partnerships, limited liability companies (LLCs), S corporations, and REITs are ideal for real estate because they give investors flexibility in how they structure the risks and rewards of these capital-intensive and relatively illiquid businesses.

Congress enacted a 20 percent deduction for pass-through business income in the Tax Cuts and Jobs Act of 2017 (Section 199A). Congress permanently extended the pass-through deduction in the One Big Beautiful Bill Act (OB3 Act), signed into law on July 4, 2025. More recently, a handful of Democratic members of the House of Representatives have introduced legislation to repeal the pass-through deduction for taxpayers with incomes over $1 million.

Key Takeaways

Our pass-through regime is a competitive strength of the U.S. tax system. Most countries rely on inflexible corporate regimes that provide little ability for an entrepreneur to tailor the capital and ownership structure to meet the needs of the business and its investors.

Half of the 4 million partnerships in the U.S. are real estate partnerships, and real estate activity constitutes a large share of pass-through business activity.

Publicly traded REITs allow small investors to invest in diversified, commercial real estate using the same single tax system available to partners and partnerships.

Small and closely-held businesses drive job growth and entrepreneurial activity in the United States. Entity choice is a differentiator that contributes to our entrepreneurial culture.

See the full fact sheet.

Summary

A “carried” interest is the interest in partnership profits that a general partner receives from the investing partners for managing the investment and taking on the entrepreneurial risks of the venture, such as funding predevelopment costs, guaranteeing construction budgets, and potential litigation. Carried interest is also granted for the value the general partner adds beyond routine services, such as business acumen, experience, and relationships. Carried interest may be taxed as ordinary income or capital gain depending on the character of the income generated by the partnership.

This year, both Republican and Democratic leaders have proposed making policy changes that would increase the tax burden on carried interest. President Trump urged Republican lawmakers to include a tax increase on carried interest as part of budget reconciliation legislation.

Since carried interest and its tax treatment first emerged as a controversial political issue in 2007, RER has consistently opposed legislative proposals to tax all carried interest at ordinary income rates.

Key Takeaways

Carried interest is essential to real estate investment, supporting housing development, economic growth, and the modernization of U.S. infrastructure.

Carried interest is not compensation for services. General partners receive fees for routine services (leasing, property management). Those fees are taxed at ordinary tax rates.

Proposals to tax all carried interest as ordinary income would result in an enormous tax hike on the 2.2 million real estate partnerships and 9.7 million real estate partners across the country who develop, own, and operate income-producing real estate.

Unfair retroactive application of carried interest legislation to existing partnerships would distort the

economics of private-sector agreements with unknown and potentially damaging consequences for real

estate markets and the overall economy.

See the full fact sheet.

Summary

Created in 2017, Opportunity Zones (OZs) are designated, low-income census tracts where qualifying investments are eligible for reduced capital gains taxes. By channeling investment where it is needed, OZs help stimulate jobs, generate economic opportunity, and improve the built environment in low-income communities. The decentralized design of OZs allows more investors and stakeholders to participate in the market and invest in these projects.

The One Big Beautiful Bill Act (OB3 Act), signed into law on July 4, 2025, permanently extended the OZ tax incentives and made a number of helpful reforms that will further increase the provisions’ positive impact in low-income communities.

Key Takeaways

In their short tenure, OZs have created jobs and spurred billions of dollars of new investment in economically struggling communities across the country.

Opportunity Funds finance affordable, workforce, and senior housing; grocery-anchored retail centers; and commercial buildings that create spaces for new businesses and jobs.

In 2020, the White House Council of Economic Advisers estimated that the Opportunity Funds had raised $75 billion in private capital in the first two years following the incentives’ enactment, including $52 billion that otherwise would not have been raised. The council projected this capital could lift one million people out of poverty in OZs by 11 percent.

Despite major hurdles such as COVID-19 and high interest rates, more recent estimates suggest OZs have attracted over $120 billion in capital.

Today, 72 percent of U.S. counties contain at least one OZ, and 32 million people live in the 8,764 OZ-designated census tracts.

See the full fact sheet.

Summary

For over 100 years, with one brief exception (1987-1990), the United States has taxed long-term capital gain at a lower rate than ordinary income. The previous Biden administration proposed raising the capital gains rate to be on par with the top rate on ordinary income. Former President Biden also proposed increasing the tax rate on net investment income and applying it to active business owners, including real estate professionals.

RER encourages Congress to continue to support investment and job creation with a meaningful capital gains incentive.

Key Takeaways

Unlike other tax policies, such as immediate expensing, the capital gains preference only rewards smart, productive investments that generate profits.

The reduced capital gains rate partially offsets the higher risk that comes with illiquid, capital-intensive real estate projects, as well as the economic effects of inflation.

High taxes on capital income make it harder to attract the investment needed to rebuild our urban centers. Opportunity Zone capital gains incentives facilitated $75 billion in new investment in low-income communities in the first two years after enactment.

A tax on unrealized gains would require the IRS to police households as they identify, tabulate, and value all their worldly possessions. The tax would thrust the IRS into a new and unwelcome role. The agency would become a permanent, live-in accountant and watchdog over every aspect of household finances, consumer activity, and economic life.

See the full fact sheet.

Summary

Currently, the tax code allows taxpayers to defer capital gain when exchanging real property used in a trade or business for a property of a like-kind. The last six budgets offered by Democratic presidents have proposed restrictions on gains deferred through like-kind exchanges. In addition, Republicans’ 2017 tax bill repealed like-kind exchanges for non-real estate transactions. RER advocates for preserving the current tax treatment of like-kind exchanges.

Key Takeaways

15-20 percent of commercial transactions involve a like-kind exchange. Exchanges get languishing properties into the hands of new owners who improve them and put them to their best use.

Academic and outside research has found that exchanges spur capital expenditures, increase investment, create jobs for skilled tradesmen and others, reduce unnecessary economic risk, lower rents, and support property values.

Like-kind exchanges allow businesses to grow organically with less unsustainable debt, creating a ladder of economic opportunity for minority-, veteran-, and women-owned businesses and cash-poor entrepreneurs that lack access to traditional financing.

Land conservation organizations rely on exchanges to preserve open spaces for public use or environmental protection.

See the full fact sheet.

Summary

The 2017 tax bill included strict new limits on the deductibility of business interest, generally restricting this to 30 percent of the taxpayer’s EBITDA (earnings before interest, tax, depreciation, and amortization). However, the bill also included a key provision that allows commercial real estate (a real property trade or business) to opt out of the interest limitation.

The One Big Beautiful Bill Act (OB3 Act) included a provision that will allow more real estate businesses to fully deduct their business interest and qualify for 100 percent bonus depreciation on their nonresidential, interior improvements.

Key Takeaways

Debt is a fundamental part of a real estate entity’s capital structure and, in addition to property acquisition costs, is used to finance day-to-day operations like meeting payroll, buying raw materials, making capital expenditures, and building new facilities.

The ability to finance investment and entrepreneurial activity with borrowed capital has driven jobs and growth in the United States for generations. America’s capital markets are the deepest in the world and provide our economy with a valuable competitive advantage.

Commercial banks are the dominant source of financing for commercial real estate investment. Like other entrepreneurs, small and medium-sized real estate developers and investors lack access to equity markets and rely on traditional lending to grow and expand.

See the full fact sheet.

Summary

Foreign investment is a major source of capital for U.S. commercial real estate, but new federal regulations, a wave of state-level restrictions, and proposed legislation threaten to deter the deployment of global capital in U.S. assets.

First, in April 2024, the Treasury Department issued final regulations that greatly expanded the reach of the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), a law that imposes a discriminatory capital gains tax on foreign investment in U.S. real estate. The regulations created a new and unprecedented “look-through” rule that largely nullified the longstanding, statutory exemption from FIRPTA for domestically controlled REITs, thereby raising the tax burden on inbound real estate capital. Newly proposed tax regulations issued by the Trump administration would repeal the 2024 look-through rule.

Second, at the state level, 20 states have enacted restrictions on foreign investors in real estate and agricultural land, and eight states have considered similar measures.

Third, Congress recently considered a tax proposal—known as Section 899—that would impose higher U.S. tax rates on income, dividends, and capital gains earned by investors from foreign countries deemed as maintaining “unfair” tax regimes. Although Section 899 was ultimately dropped from the One Big Beautiful Bill Act (OB3 Act) passed this year, key lawmakers have indicated that they will revive the proposal if Europe does not exempt U.S. companies from the global minimum tax.

Key Takeaways

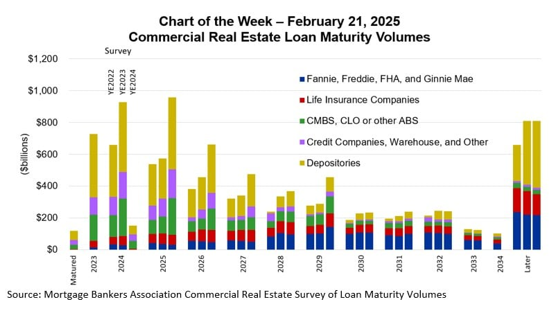

With approximately $1.5 trillion of U.S. commercial real estate debt coming due in the next three years,

foreign equity investments in U.S. assets are often an important source of capital as commercial real

estate owners seek to restructure, refinance, or sell their properties.

Discouraging foreign investment weakens U.S. competitiveness, raises the cost of capital for U.S.

developers, and undermines efforts to revitalize urban cores, modernize infrastructure, and expand the

housing supply.

The FIRPTA look-through rule is legally unsound, economically harmful, and inconsistent with

congressional intent. Treasury should act quickly to finalize proposed regulations repealing the look-through rule.

The enactment of Section 899 as proposed would create uncertainty that in turn would substantially deter foreign investment, increase borrowing costs, and dampen property values.

See the full fact sheet.

RER advocates for energy policies that promote a robust supply of affordable, reliable energy, and encourage energy efficiency.

RER's October 2025 Policy Priorities

Summary

President Trump’s executive order on “Unleashing American Energy” calls for policies to: cut energy costs; strengthen the nation’s electric grid by developing “base load” power resources (coal, gas, nuclear) over intermittent sources (solar, wind); streamline federal permitting of energy infrastructure projects; and ensure America wins the global race for AI leadership.

The U.S. commercial real estate industry has a central role to play in achieving the country’s energy and economic goals. With energy demand surging, real estate is a critical partner to support energy investments, increase energy efficiency, and deliver energy savings across the economy.

Key Takeaways

Avoided energy use—or “nega-watts”—represents the most cost-efficient strategy for strengthening U.S. energy security. Building upgrades that reduce power demand save consumers money, support grid reliability, and free up energy use for AI data centers, mining crypto, and the re-shoring of the U.S industrial base.

Grid reliability is essential. It is crucial to expand grid capacity and invest in long-distance transmission. Federal permitting reform is critical to speed up energy infrastructure projects.

RER supports a national “all of the above” energy strategy that invests in building efficiency, grid modernization, faster permitting, and innovation across all energy sources.

See the full fact sheet.

Summary

On July 4, 2025, President Trump signed the One Big Beautiful Bill (OB3) Act into law. It makes significant changes to energy-related tax benefits pre-dating and modified by the Biden-era Inflation Reduction Act (IRA).

This document summarizes how the OB3 Act treats solar, storage, energy efficiency, and similar projects in commercial and multifamily real estate. A detailed fact sheet on RER’s website (here) provides a deeper analysis of the complex rules regarding tax incentives that may accelerate ROI for energy-related cap ex projects.

Key Takeaways

Energy-related building investments that begin construction in 2025 and after should consider:

Tax credits that start to phase out over the next one to five years (e.g., the Section 48E “tech neutral” credit for solar generation; the Section 179D deduction and 45L credit for energy efficiency projects; and the 30C credit for EV charging stations);

Tax credits that remain available well into the 2030s (e.g., Section 48E for energy storage); and

Permanent options for “full expensing” that may accelerate tax write-offs of energy-related building investments, regardless of Section 48E or other tax credit availability.

See the full fact sheet.

Summary

The federal ENERGY STAR program must be preserved as a voluntary, non-regulatory public-private partnership. Proposed budget cuts and agency staff reorganizations from the Trump administration indicate that it may eliminate the program. Commercial, residential, and manufacturing stakeholders all rely on the program heavily and are united in advocating for its preservation.

Meanwhile, a number of progressive cities and states (map) have enacted building performance standards (BPS) mandates—with widely varying rules on emissions, electrification, and compliance timelines. The regulatory specifics vary from jurisdiction to jurisdiction—making compliance exceedingly complex and expensive. To help bring consistency to the nationwide “patchwork” of BPS regulations, RER has developed a peer-reviewed policy guide outlining 20 key considerations for any jurisdiction adopting a BPS law.

In addition, non-governmental organizations (NGOs) have developed their own BPS-type standards and climate accounting frameworks—chief among them the Science Based Targets Initiative (SBTi) and the World Resources Institute’s Greenhouse Gas (GHG) Protocol. These NGO standards increasingly influence both regulatory policy and private capital markets. Many real estate lenders and equity investors have adopted SBTi and GHG Protocol frameworks to align with their ESG investment principles.

Key Takeaways

Voluntary, non-regulatory federal guidelines like ENERGY STAR recognizing “high performance” real estate remain critical. These programs help quantify energy savings, attract capital, place less strain on the grid, and promote innovation in U.S. buildings.

More than 330,000 buildings—representing nearly 25 percent of U.S. commercial building floor space—utilized EPA’s Portfolio Manager software last year.

ENERGY STAR-certified buildings achieve an average of 35 percent less energy usage compared to similar non-certified buildings. The program has saved businesses and families nearly $200 billion in utility bills since 1992, including $14 billion in 2024 alone

States and cities are adopting BPS mandates that often impose rigid electrification or net zero emissions targets. These laws vary significantly and frequently penalize buildings already recognized as high-performance assets under federal programs.

See the full fact sheet.

RER supports public policy that minimizes regulatory burdens and encourages the availability of credit and the formation of capital while maintaining appropriate systemic safeguards.

RER's October 2025 Policy Priorities

Summary

More than $950 billion of U.S. commercial real estate mortgages are estimated to mature in 2025. To help rebalance the wave of maturing loans, it is important to advance measures that will encourage additional capital formation and loan restructuring.

It is also important to avoid pro-cyclical regulatory actions such as the Basel III Endgame.

A revised Basel III Endgame proposal announced in September 2024 would have increased Tier 1 capital requirements for global systemically important banks by roughly 9 percent. Concerns remain that any increase in capital requirements will have a pro-cyclical impact on credit capacity and carry a cost to commercial real estate and the overall economy, increasing the cost of credit and constraining capacity. Implementation remains uncertain.

In a January 2024 letter, RER raised industry concerns about the negative impact of the Basel III Endgame proposal, including the higher cost of credit and diminished lending capacity, and requested that the proposal be withdrawn.

The Fed and other regulators remain deadlocked on advancing the revised proposal. With the appointment of Michelle Bowman to the post of Vice Chair for Supervision, however, there is speculation that the proposal could ultimately be withdrawn or end up being capital neutral.

Key Takeaways

Providing banks with the flexibility to work constructively with their borrowers during times of economic stress has led to billions of dollars of loan restructurings and reduced undue stress in bank loan portfolios.

The proposed Basel III Endgame regulations would come at a significant economic cost without clear benefits to the economy.

The largest U.S. banks’ capital and liquidity levels have grown dramatically since the original Basel III standards were implemented in 2013 in response to the 2008 Global Financial Crisis. Since 2009, Tier 1 capital has increased by 56 percent and Common Equity Tier 1 capital has tripled. Today, as the Federal Reserve recently observed, the U.S. “banking system is sound and resilient, with strong capital and liquidity.”

Further, it is important to bring more foreign capital into U.S. real estate by lifting legal barriers to investment, as well as repealing or reforming the archaic Foreign Investment in Real Property Tax Act (FIRPTA).

See the full fact sheet.

Summary

The proliferation of natural catastrophe threats has raised concerns about commercial insurance coverage for real estate. These concerns have highlighted the lack of—and need for—insurance capacity and various lines of commercial insurance. Risks from natural disasters like floods, hurricanes, wildfires, hail, tornadoes, and drought cost the U.S. billions of dollars each year. Even if policyholders are able to find coverage for these various lines, prices are increasing dramatically. A lack of adequate coverage will lead to economic uncertainty, harm stakeholders, and undermine the growth of communities.

The budget debate in Congress has called into question the future of the National Flood Insurance Program (NFIP), which is subject to temporary funding extensions. A federal government shutdown began on Oct. 1, 2025, after Congress failed to pass a budget for the new fiscal year. As a result of this funding lapse, the NFIP has also expired, halting the sale and renewal of millions of flood insurance policies.

RER, along with its industry partners, continues to work constructively with policymakers and stakeholders to address market failure and enact a long-term reauthorization of an improved NFIP.

Key Takeaways

The increased frequency and severity of natural disasters is leading to increased premiums for commercial properties.

As economic losses caused by disasters increase, it is important to find new strategies in order to effectively manage natural catastrophe risk.

Expanding coverage gaps and increased costs present challenges for businesses across many industries, including real estate.

Without adequate coverage, the vast majority of natural catastrophe losses are likely to be absorbed by policyholders. These widening coverage gaps and price hikes bring about serious economic concerns about protection gaps, coverage capacity, and increased costs from natural catastrophes and business interruption losses.

Commercial property owners can take steps to mitigate the risk of natural disasters and potentially lower their insurance costs.

See the full fact sheet.

Summary

The Corporate Transparency Act (CTA) requires certain companies to disclose information about their beneficial owners to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN). The goal was to create a national directory of beneficial owners to curb illicit finance, drug cartels, terrorist groups, and other harmful activities.

As of March 2025, the Treasury Department announced it will suspend enforcement of the CTA against U.S. domestic reporting companies and their beneficial owners, focusing solely on foreign entities. This means U.S. commercial real estate entities are now exempt from providing beneficial ownership information to FinCEN.

FinCEN intends to issue new rules to narrow the scope of the CTA’s reporting requirements to only apply to foreign-formed companies that have registered to do business in the U.S.

The Real Estate Roundtable continues to work with policymakers in support of a balanced approach that would inhibit illicit money laundering activity without the imposition of costly reporting requirements for real estate investors.

Key Takeaways

Thanks to the Treasury’s action to suspend CTA enforcement for domestic reporting companies, much of the concern about the CTA’s far-reaching scope and its impact on many commercial and residential real estate businesses that use the LLC structure for conducting business is allayed.

See the full fact sheet.

Summary

In 2023, the Securities and Exchange Commission (SEC) proposed changes to require SEC-registered investment advisers to put all their clients’ assets, including all digital assets like Bitcoin and certain physical assets like real estate, with “qualified custodians.” The proposal would also require a written agreement between custodians and advisers, expand the “surprise examination” requirements, and enhance recordkeeping rules. These rules were originally designed for digital assets. “Reasonable” safeguarding requirements is ambiguous as applied to real estate. Furthermore, the SEC’s release contains an inaccuracy regarding the way deeds evidencing ownership of real estate are recorded.

RER sees no policy reason to impose the proposed rule on real estate and has advocated for an exception for real estate.

Key Takeaways

Due to a variety of factors, real estate cannot readily be stolen, making the rule seem irrelevant to this asset class.

In addition to the proposed Custody Rule, the SEC has a number of proposed rulemaking measures that could have a chilling effect on real estate capital markets, further impair liquidity, and be a “death by a thousand cuts” for commercial real estate.

Capital formation is vital when credit markets tighten to restructure maturing debt.

See the full fact sheet.

Summary

On Sept. 19, 2025, the White House released an Executive Order, fact sheet, and website announcing Gold and Platinum “Trump Cards.” The program is intended to grant permanent residency in the U.S. for immigrants with high net worth. The administration’s announcement directs the Secretaries of Commerce, State, and Homeland Security to coordinate and establish a program that expedites “green cards” issued under the EB-1 and EB-2 visa categories for foreign nationals who make a “significant financial gift to the Nation.”

This new green card program raises important questions:

It will take some time to see how Trump Cards resonate in foreign capital markets, and what further program guidelines entail, before these and similar questions are fully sorted out.

Key Takeaways

The new Trump Cards and the EB-5 visa program should play complementary roles in efforts to attract global capital and top-tier talent. By supplementing the existing EB-5 program, the Trump Cards can accelerate private investments to create jobs for American workers.

Trump Cards do not replace EB-5 visas. However, it is not yet clear how or whether EB-5 investors will be able to take advantage of the Trump Card program.

The value of Trump Cards to foreign investors, U.S. developers, and employers will likely depend on the varying country-specific backlogs and wait times for EB-1 and EB-2 visas, and how quickly extra Trump Card payments can speed up visa issuance.

The EB-5 program is the established, statutorily authorized pathway to attract foreign investors to the U.S. It has delivered $350 billion in economic impact and created over 1.5 million American jobs—at no cost to taxpayers—and should continue to be fully supported by Congress and the administration.

See the full fact sheet.

Summary

Today, the risk of terrorism remains as strong as ever. According to the 2025 Annual Threat Assessment from the Office of the Director of National Intelligence (ODNI), “A diverse set of foreign actors are targeting U.S. health and safety, critical infrastructure, industries, wealth, and government. State adversaries and their proxies are also trying to weaken and displace U.S. economic and military power in their regions and across the globe.”

For more than two decades, at almost no cost to the taxpayer, the national terrorism insurance program established by the Terrorism Risk Insurance Act (TRIA) in 2002 has made it possible for businesses to purchase the terrorism risk coverage they need. Threatened with acts of terrorism, and in the absence of a viable private market, business insurance consumers would be unable to secure adequate coverage without such a program. The Real Estate Roundtable supports a long-term reauthorization of TRIA and urges prompt congressional action to renew this critical program in advance of its expiration on Dec. 31, 2027.

Key Takeaways

Terrorism risk is a national security challenge that requires a federal solution.

TRIA has successfully maintained market stability for over 20 years at minimal taxpayer cost.

Without TRIA, terrorism risk coverage would become scarce or unaffordable, threatening economic resilience and recovery.

Should a terrorist attack occur without adequate coverage in place, underinsured businesses will face the risk of ruin, with potentially catastrophic local economic effects, and the federal government will face significant pressure to hastily assemble financial assistance to underinsured victims.

Early reauthorization will ensure continued business confidence and prevent market disruption as the program approaches its 2027 expiration.

See the full fact sheet.

RER supports measures to more effectively address terrorism and criminal threats through a multi-faceted approach involving intelligence gathering, law enforcement, community engagement, and information sharing partnerships, with a focus on prevention, disruption, and prosecution.

RER's October 2025 Policy Priorities

Summary

The rising incidence of violent crime, organized retail crime, civil unrest, cyber-attacks, artificial intelligence (AI), and the renewed threat of terrorism have prompted increased vigilance, information sharing, and legislative efforts to improve our nation’s resilience. The proliferation of these threats has raised concerns in the commercial facilities sector about how to protect commercial properties and the people who occupy them from such threats.

In addition to the challenges posed by these threats, the Russian invasion of Ukraine, conflict in the Middle East, and rising tensions in Asia have raised security concerns about the increased incidence of cyber-attacks from the Russian Federation, the People’s Republic of China (PRC), Iran, North Korea, and other state actors.

Information sharing is vital for the commercial facilities sector to enhance cybersecurity, improve incident response, mitigate physical threats, build community resilience, and maintain a competitive edge by fostering collaboration and innovation among different facilities and organizations.

The real estate industry, in partnership with policymakers and law enforcement officials, must remain vigilant to potential threats to our critical infrastructure from cyber or physical threats.

Key Takeaways

Recent high-profile hacking attacks have brought to the fore the necessity of fortifying the nation’s IT infrastructure against cyber-attacks. Additionally, there are growing concerns about AI having the potential to create new risks. Key concerns include the risk of cyberattacks exploiting AI vulnerabilities, leading to unauthorized access to facilities or sensitive data.

RER continues to promote security measures against both physical and cyber threats by facilitating increased information sharing and cooperation among its membership with key law enforcement and intelligence agencies, including as part of RER’s Homeland Security Task Force and Real Estate Information Sharing and Analysis Center (RE-ISAC).

Policymakers should avoid imposing duplicative and inconsistent regulations that create additional challenges for those tasked with defending the nation’s critical infrastructure, including the commercial facilities (CF) sector, and undermine cyber preparedness.

See the full fact sheet.

RER supports innovative policy incentives that expand the nation’s housing supply and improve housing affordability.

RER's October 2025 Policy Priorities

Summary

There is a chronic shortage of housing in the U.S. that is driving up housing prices and making it more difficult for lower-income individuals to find safe, affordable housing. Housing production in the U.S. is not keeping pace with expanding housing needs. The underbuilding gap in the U.S. now totals more than 5.5 million housing units. The impact of this growing problem of an under-supply of affordable housing is far-reaching and undermines economic growth—particularly in urban areas.

Key Takeaways

Safe, decent, and affordable housing is critical to the well-being of America’s families, communities, and businesses. The COVID-19 pandemic intensified the nation’s persistent housing crisis and heightened the need to expand the supply of affordable housing.

Having a robust housing finance system is critical to meeting the nation’s longstanding goal of ensuring decent and affordable housing for all. Debate over reforms to the government-sponsored enterprises (GSEs) continues, but no legislative proposals are currently under consideration.

Confronting the housing crisis requires a national transformation in housing policy, including a strategic plan to expand the supply of affordable housing.

Policymakers should look at the full scope of tools available to bridge the underbuilding gap as part of this national strategy, including:

RER has partnered with 16 other national real estate organizations to jointly advocate for policies that will help to increase housing supplies, grow jobs, and modernize our nation’s critical infrastructure.

See the full fact sheet.

Summary

The U.S. faces a severe shortage of affordable housing. Current production has just not kept up with demand. At the same time, certain other commercial real estate assets like office buildings are under significant stress due to pandemic-related issues, including employers’ greater reliance on remote work arrangements. RER is encouraging lawmakers to help revitalize cities, boost local tax bases, and address housing challenges by enacting a tax incentive and federal loan support for converting older, underutilized buildings to housing. RER also supports a meaningful expansion of the Low-Income Housing Tax Credit (LIHTC).

Key Takeaways

Congress should help expand and grow the supply of affordable and workforce housing by investing greater resources in time-tested tax incentives like the LIHTC and adopting creative new approaches that support the conversion of underutilized, existing buildings to housing.

The conversion of underutilized and often vacant buildings offers a tremendous opportunity to improve the built environment and lift the surrounding locality. Property conversions are a cost-effective means to develop new housing supply, create jobs, and generate critical sources of local property tax revenue.

The LIHTC is an efficient, market-based housing solution that relies on the private sector to finance, build, and operate affordable housing by creating a federal incentive for new construction and redevelopment.

See the full fact sheet.

Summary

In response to the Global Financial Crisis in September 2008, the U.S. Treasury placed Fannie Mae and Freddie Mac into conservatorship under the oversight of the Federal Housing Finance Agency (FHFA). This action was intended to stabilize the mortgage market and restore confidence in the government-sponsored enterprises (GSEs). It also involved an injection of $190 billion of capital, while creating an explicit U.S. government guarantee. The ongoing conservatorship means that the government has total control over these huge government-backed mortgage enterprises, with $7.7 trillion in combined assets.

Conservatorship was not meant to be indefinite. More than 17 years later, the GSEs are in a much stronger financial position and have repaid the $187 billion used to preserve Fannie and Freddie during the financial crisis. Yet, retiring the government’s preferred and common equity stake would require a refinancing of massive scale, a taxpayer gift from the U.S. Treasury of tens of billions of dollars to Fannie and Freddie, or both.

Policymakers have increasingly discussed various reform proposals, including ending the conservatorship, full privatization, hybrid models, and continued government backing with additional safeguards. The administration has set reform as a key priority, yet concrete details have yet to emerge.

As policymakers consider privatization or structural reforms, it is essential to the real estate industry and the broader economy to preserve a well-functioning housing finance system that supports homeownership, expands affordable housing supply, and sustains economic growth.

Key Takeaways

GSE reform will involve transitioning these government-sponsored enterprises to private entities, which necessitates significant recapitalization, potentially through an Initial Public Offering (IPO), to meet regulatory capital requirements and address outstanding liabilities.

As a practical matter, it will be challenging for Fannie and Freddie to exit conservatorship and remain effective in the marketplace without a government guarantee. Determining the cost of this guarantee is one of the key challenges of reform.

An explicit guarantee, similar to Ginnie Mae, might be one solution, but this would likely require an act of Congress and a fee paid to the Treasury for assuming the risk. This could increase costs for underlying borrowers.

If Fannie and Freddie are transitioned to private ownership, the process must ensure financial stability, avoid market disruptions, and protect access to affordable mortgages.

Reforms to the GSEs should be part of a larger national transformation in housing policy to unleash a wave of new housing construction and fully address the underbuilding gap, including Yes In My Backyard (YIMBY) policies, property conversion incentives and reforms to zoning and permitting rules, Opportunity Zones, and the Low-Income Housing Tax Credit (LIHTC).

See the full fact sheet.