View Full Report – 2022 Annual Report – Building a More Resilient and Dynamic Future

Tag: Tax Policy

Inflation, National Policy Agenda, and CRE Market Conditions Focus of Roundtable Annual Meeting

The Roundtable’s 2022 Annual Meeting in Washington, DC this week focused on key policy issues affecting the commercial real estate industry—including inflation and interest rates; prospects for a scaled-back Build Back Better (BBB) Act; proposed climate risk disclosure rules; and a new industry Equity, Diversity, and Inclusion initiative.

Policy Focus

- Roundtable President and CEO Jeffrey D. DeBoer, left, launched the June 16 business meeting with an overview of The Roundtable’s Policy Agenda and newly released 2022 Annual Report, Building a More Resilient and Dynamic Future. Annual Meeting guests included:

- Sen. Joe Manchin (D-WV)

Sen. Manchin, above right, discussed the benefits of a bipartisan approach to legislation and the role of inflation in considering any additional spending bills this year. - Sen. John Thune (R-SD)

Sen. Thune spoke about supply chain issues, aid for Ukraine, the Fed and monetary policy, and the upcoming elections. - Rep. Abigail Spanberger (D-VA)

Rep. Spanberger addressed efforts to produce common-sense gun policy, lower inflationary costs for families and policymaking in the House during the upcoming lame duck session. - Jim VandeHeiAxios and Politico co-founder and CEO discussed the current political environment, potential challengers to President Biden, the upcoming congressional elections, and the advantages of delivering news and analysis about today’s policy landscape in an efficient, “smart brevity” style.

- Jonathan KarlABC New’s Chief Washington Correspondent spoke about the current political environment and the midterm elections.

- Sen. Joe Manchin (D-WV)

Supplier Diversity & CRE

- The Annual Meeting also included an initiative of The Roundtable’s Equity, Diversity, and Inclusion (ED&I) Committee, chaired by Jeff T. Blau (Chief Executive Officer and a partner of Related Companies).

- A proposed two-year pilot program was discussed with SupplierGATEWAY—a firm that assists companies interested in hiring Minority- and Women-Business Enterprises (MWBEs) as contractors, service providers, JV partners, and other “vendors” in their “supply chains.” (Photo: SupplierGATEWAY’s Rock Irvin, left, Chief Commercial Officer, with Adenuga Solaru, Chief Executive Officer)

- The proposed online SupplierGATEWAY portal would support CRE firms interested in accessing a broad and centralized MWBE vendor database, posting hiring opportunities for those contractors, and utilizing tools to assist with corporate ESG reports.

- SupplierGATEWAY’s executives demonstrated a CRE-specific “prototype” of their MWBE management portal that could be available by the fall for companies who may subscribe to the service.

- For more information regarding The Roundtable’s supplier diversity initiative, contact Roundtable Senior Vice President and Counsel, Duane Desiderio (ddesiderio@rer.org).

CRE Markets & Policy Advisory Committees

- The Roundtable’s Policy Advisory Committee leadership discussed their policy issue activities during the business meeting and referred to a Policy Issues Toolkit for background information on how key issues impact commercial real estate (see Executive Summary). Each committee met in conjunction with the Annual Meeting to address the following:

- The Sustainability Policy Advisory Committee (SPAC) focused on a recent Securities and Exchange Commission (SEC) proposed rule that would require registered companies to report on climate-related financial risks. The Roundtable submitted a comment letter to the SEC last week on the proposed rules. (Roundtable Weekly, June 10 and Roundtable comments | SPAC Agenda).

- The Research and Real Estate Capital Policy Advisory Committees (RECPAC) met jointly with Rep. Rep. French Hill (R-AR) to discuss the congressional legislative agenda and capital markets from his perspective as a member of the House Financial Services Committee and Ranking Member of its Subcommittee on Housing, Community Development and Insurance. (Joint RECPAC-Research Agenda)

- The Tax Policy Advisory Committee (TPAC) drilled down on a Senate proposal to tax unrealized gains associated with appreciated assets, partnership tax rules, like-kind exchanges, Opportunity Zone incentives, and energy-efficiency tax provisions. (TPAC Agenda)

- The Homeland Security Task Force (HSTF) and Risk Management Working Group (RMWG) met jointly to discuss current threat issues, with presentations by Kevin Vorndran, Deputy Assistant Director, Counterterrorism Division, FBI and Nitin Natarajan, Deputy Director of the Cybersecurity and Infrastructure Security Agency (CISA). (Joint HSTF-RMWG Agenda)

- The Sustainability Policy Advisory Committee (SPAC) focused on a recent Securities and Exchange Commission (SEC) proposed rule that would require registered companies to report on climate-related financial risks. The Roundtable submitted a comment letter to the SEC last week on the proposed rules. (Roundtable Weekly, June 10 and Roundtable comments | SPAC Agenda).

Next on The Roundtable’s calendar is the Sept. 20-21 Fall Meeting (Roundtable-level members only).

# # #

Senate Republicans Propose Middle-Class Tax Relief, Financed by SALT Cap Extension

Congressional Republicans this week proposed legislative measures—aimed at helping middle-class savers and spurring investment without further increasing inflation—as a precursor of GOP economic policies that may be promoted during the fall’s midterm elections. Senate and House announcements on inflation followed last week’s Labor Department report showing the consumer price index reached 8.6 percent in May. In response, the Federal Reserve raised interest rates by 75 basis points, its largest hike since 1994. (Wall Street Journal and Tax Notes, June 14 | CNBC, June 15)

Senate GOP Proposal

- This week, Sens. Chuck Grassley (R-IA), John Barrasso (R-WY), Steve Daines (R-MT), and James Lankford (R-OK) introduced the Middle-Class Savings and Investment Act. The legislation aims to help the middle class through tax cuts and savings incentives, paid for by extending the current $10,000 cap on the deduction for state and local taxes. (Sen. Grassley news release, June 14)

- The Republican-introduced bill would:

- Expand the Zero Rate Bracket for Capital Gains and Dividend IncomeThe legislation would increase the size of the zero percent tax bracket for long-term capital gains and qualified dividends. Under the proposal, a married couple with income under $178,000 would not owe tax on capital gains and dividend income.

- Provide Relief from the Net Investment Tax for a Married CoupleThe legislation would exempt the first $400,000 earned by a married couple from the 3.8 percent net investment income tax that otherwise applies to capital gains, dividends, and passive rental income. Currently, the first $200,000 earned by an individual and $250,000 earned by a married couple is exempt from the tax.

- Create and Expand Tax Relief for Interest Income and Retirement SavingsThe legislation would allow individuals to exclude up to $300 ($600 if married) of interest income from taxation. Additionally, the bill would expand the tax credit that encourages low-income taxpayers to contribute to a qualified retirement account. (Backgrounder on the Senate legislation)

- The bill would be paid for by extending the current $10,000 cap on the deductibility of state and local taxes for three years, or however long is needed. The deduction is scheduled to expire at the end of 2025.

House Republican Outline

- On June 14, House Ways and Means Committee Republicans released a one-page document outlining a six-point plan to combat inflation. The GOP calls for repurposing $170 billion in unspent pandemic federal aid for deficit reduction while pursuing permanent tax relief. The list of principles also urges policymakers to reject the Biden administration’s proposed overhaul of the tax code affecting corporations and wealthy individuals. (BGov, June 15)

- The proposals to fight inflation by congressional Republicans seek to provide a contrast to the approach by Democrats, which includes cutting prescription drug costs and increasing taxes on oil company profits. (PoliticoPro, June 14)

The Roundtable’s Tax Policy Advisory Committee (TPAC) met today in conjunction with The Roundtable’s 2022 Annual Meeting to discuss policy issues affecting the taxation of commercial real estate. (See story above).

# # #

Coalition Requests Changes to Treasury Tax Regulations Affecting Outbound Foreign Real Estate Investment

The Real Estate Roundtable and four other national trade groups submitted recommendations to modify proposed Treasury regulations regarding partnerships and other pass-through entities that own direct or indirect interests in a passive foreign investment company (PFIC). (Read PFIC comment letter, April 25)

The Real Estate Roundtable and four other national trade groups submitted recommendations to modify proposed Treasury regulations regarding partnerships and other pass-through entities that own direct or indirect interests in a passive foreign investment company (PFIC). (Read PFIC comment letter, April 25)

Passive Foreign Investment Companies and Proposed Regulations

- A PFIC is a foreign corporation that derives a significant share of its income from passive sources or primarily owns assets that are held for the production of passive income, including capital gains, interest, dividends and rent. PFICs commonly arise when structuring investment funds and pooling capital to invest in foreign real estate.

- Special U.S. tax rules apply to PFIC income. The rules generally accelerate the recognition of PFIC income by PFIC shareholders, or impose an interest charge if the income is deferred. PFIC shareholders can elect which tax regime to apply.

- Recently proposed Treasury regulations would require any U.S. partner of a partnership that directly or indirectly owns a PFIC to make PFIC-related tax elections at the individual partner level, in addition to other changes.

Recommended Changes

- The April 25 coalition letter suggests the proposed rules would result in an exponential increase in the number of separate PFIC filings, greater administrative burdens and a higher cost of compliance. The rules would also lead to inadvertent failures to file elections since small investors are less well-versed in the PFIC rules than the investment partnerships and their advisors.

- The letter also urges the IRS to allow partnerships to make PFIC elections at the entity level for all partners, including on behalf of indirect partners who own their interest through an upper-tier partnership. A partnership could make the election for a partner through a partner’s grant of a power of attorney to the general partner of the partnership. An implicit delegation of this authority (e.g., the authority in the partnership agreement to file tax returns) would be sufficient.

- “If Treasury incorporates these changes,” said Real Estate Roundtable President and CEO Jeffrey DeBoer, “the end result will be less friction and expense for real estate funds as they raise and deploy capital for productive real estate investment.”

Other signatories of the letter include the Alternative Investment Management Association, the American Investment Council, the Managed Funds Association, and the S Corporation Association.

# # #

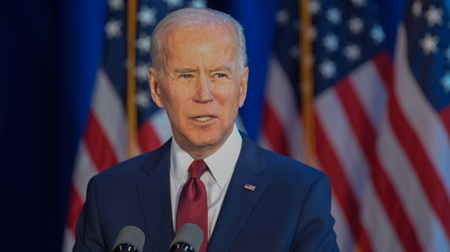

Roundtable CEO Questions Wisdom of Administration’s Proposed Carried Interest Tax Increase

This week, Real Estate Roundtable President and CEO Jeffrey DeBoer, above, challenged the Administration’s recently proposed budget, which would recharacterize nearly all real estate carried interest as ordinary income, in Bisnow, a prominent commercial real estate media outlet. (Bisnow, April 13)

Taxing Carried Interest as Ordinary Income

- President Biden’s budget includes tax proposals recycled from last year that failed to pass congressional negotiations, including taxing long-term capital gains at ordinary income rates – and taxing carried interest in real estate partnerships as ordinary income. (Roundtable Weekly, April 1)

- In Bisnow’s “Taxing Carried Interest as Ordinary Income: The Idea that Never Dies, but Never Becomes Law Either,” DeBoer noted, “The president’s carried interest budget proposal would, for the first time, limit capital gain tax treatment to the return on cash and cash-equivalent investment. This would ignore the reality that real estate owners and developers bear significant financial risks beyond their capital contribution.”

- DeBoer added, “The capital gains tax incentive has always recognized and rewarded other factors beyond just invested cash, including the assumption of construction, litigation and market risk, as well as the sweat equity associated with owning investment real estate.“

- Targeting tax evaders and illegal transactions is appropriate, DeBoer noted, but he emphasized that penalizing entrepreneurship and discouraging noncash risk-taking by recharacterizing all carried interest as ordinary income would be a mistake.

- Proposals to recharacterize carried interest as ordinary income have been introduced in Congress perennially since 2007. The Tax Cuts and Jobs Act of 2017 included a provision extending the holding period requirement from one to three years for carried interest to qualify for the reduced long-term capital gains tax rate.

Carried interest and other tax issues outlined in The Roundtable’s recently released 2022 Policy Agenda will be discussed during the April 25-26 Spring Meeting (Roundtable-level members only) in Washington DC.

# # #

Republican Members Propose Shortening Depreciation Period of Buildings

Legislation introduced by a handful of influential Republicans in the House and Senate would shorten the depreciation period for structures to 20 years and adjust depreciation deductions upwards every year to account for inflation and a real rate of return on capital. (Tax Notes, April 13)

Legislation vs. Biden Budget Proposal

- The Renewing Investment in American Workers and Supply Chains Act was introduced in the House by senior Ways and Means Committee Member Jackie Walorski (R-IN) and Republican Study Committee Chairman John Banks (R-IN). Senator Mike Braun (R-IN) introduced companion legislation in the upper chamber. (Joint news release, April 11)

- The bill would reduce the cost recovery period for nonresidential property from 39 years to 20 years, and for residential rental property from 27.5 to 20 years.

- In addition to shortening depreciation periods, the bill would enhance depreciation deductions by providing an adjustment for inflation and a return on capital (3%). The deduction adjustment would not be counted against the property’s basis or for purposes of depreciation recapture.

- The changes would not be limited to new construction, but would apply to existing properties (adjusted for remaining basis), as well as properties that change ownership.

- The nonpartisan Tax Foundation, a highly regarded research institution in Washington, estimated the bill would boost long-run GDP by 1.2 % and expand employment by 230,000 full-time equivalent jobs. Over the current 10-year budget window, when factoring in the positive macroeconomic feedback, the policy would increase federal revenue by $126.6 billion. (Tax Foundation, March 24)

- The legislation stands in stark contrast to President Biden’s proposed budget, which would raise the tax burden on structures by eliminating the reduced 25% tax rate that applies to recaptured depreciation deductions when a property is sold. The Biden budget would tax depreciation recapture at a rate of 39.6%. (Roundtable Weekly, April 1)

The release of President Biden’s second budget launched the annual congressional appropriations process, which aims to fund the FY23 government budget starting Oct. 1. The prospects for tax increase proposals before the Nov. 8 mid-term elections are highly uncertain. (Politico, March 28 – “Here’s what’s in Biden’s $5.8 trillion budget proposal – and what’s next”)

# # #

Legislators Introduce Bipartisan Bill to Reform Opportunity Zone Incentives

Members of Congress introduced bipartisan, bicameral legislation yesterday to update and amend the Opportunity Zones (OZs) program. If enacted, the bill would extend expired OZ benefits, sunset certain high-income OZ census tracts, and apply additional information reporting requirements for opportunity funds and their investors. (Congressional news release, April 7)

OZ Reforms

- The Opportunity Zones Transparency, Extension, and Improvement Act was introduced in the Senate by Tim Scott (R-SC), above, and Cory Booker (D-NJ) – and in the House by Ron Kind (D-WI) and Mike Kelly (R-PA). (Full text of the legislation | One-page summary | Section by Section).

- The bill includes a Roundtable-requested, 2-year extension of the initial capital gains deferral period for prior gain that is rolled into an opportunity fund by an investor. (Roundtable Comment letters: Dec. 21, 2021 and May 14, 2020)

- The 2-year extension, from the end of 2026 until the end of 2028, will allow OZ investors to benefit from a partial step-up in basis that reduces their tax liability on their prior gain if their opportunity fund investment is maintained for at least 5 years. The extension would help OZs continue attracting capital and investment that is boosting job growth and supporting the local tax base in these communities.

- Other provisions include a detailed process for sunsetting certain high-income census tracts from the OZ program; new information reporting rules for Opportunity Funds and investors; and creation of a $1 billion State and Community Dynamism Fund to support OZ projects and businesses in underserved communities.

- Census tracts subject to the sunset provision include those with a median family income that exceeds 130 percent of the national median. The sunset includes transition rules that grandfather in existing and planned investments.

- The information reporting proposals were previously introduced by Senator Scott in 2019. They aim to improve program transparency and facilitate improved tracking of the OZ investment outcomes in the designated communities. The Roundtable and other real estate organizations previously encouraged Congress to adopt enhanced OZ information reporting, data collection, and transparency measures. (Roundtable Comment letter: Dec. 21, 2021)

- In the short time since their enactment, Opportunity Zones have created jobs and spurred billions of dollars in new investment in economically struggling communities. The Roundtable worked closely with Members of Congress and the Treasury Department to ensure OZ implementing regulations would facilitate the program’s success, and has long-supported OZ legislation that could spur greater investment, promote capital formation and bolster job growth in economically disadvantaged communities. (Roundtable Weekly: May 15, 2020 and (Roundtable Comment letter: Dec. 21, 2021)

In the current legislative environment, prospects for the new bill are uncertain, but it will likely be the basis for any serious consideration of OZ changes going forward.

# # #

Biden Administration Submits FY2023 Budget to Congress, Proposes Tax and Other Measures Impacting Real Estate

The Biden administration on Monday released its $5.8 trillion FY2023 Budget, a package of spending, tax, and policy proposals that will face extensive congressional scrutiny and revisions over the coming months. The March 28 budget was accompanied by the Treasury Department’s “Greenbook,” which details the Administration’s $2.5 trillion in tax increases on corporations, high-earning households, and certain business activities, including real estate investment. (New York Times and BGov, March 29)

Billionaire Minimum Income Tax

- The new budget proposes to tax the wealthiest households on their unrealized capital gains, including real estate. The so-called “Billionaire minimum income tax” would impose a minimum levy of 20 percent on a comprehensive tax base that includes both realized income and the unrealized annual appreciation of a taxpayer’s assets.

- The new tax would apply to future appreciation of assets and all unrealized, built-in gains at the time of enactment. The tax on pre-enactment, built-in gains would be collected over a 9-year transition period.

- Although marketed as a tax on “billionaires,” the proposal would apply to any taxpayer with $100 million or more in wealth. This initial high threshold arguably represents a first step towards a wealth tax regime with much broader application. The original income tax applied to the top 1/3 of one percent of the U.S. population and now applies to over 150 million American households.

- In certain cases, holders of illiquid assets like real estate could elect to defer the minimum tax until the property is sold, provided they pay an additional charge.

- The budget leaves many of the most difficult questions unanswered, including:

- How would the tax survive a constitutional challenge on the grounds that direct taxes must be apportioned among the states by population?

- Why would taxpayers continue to make patient, long-term investments, knowing that they could be taxed before the investment generates cash income?

- Will much of the tax burden fall on noneconomic inflationary increases in asset values?

- How will the IRS administer the tax without building a highly intrusive compliance system that is based on subjective valuation measures?

- Another new revenue proposal in the budget relates is to tax depreciation recapture at ordinary income rates. The provision generally would treat gain on real estate held for more than one year as ordinary income to the extent of cumulative depreciation deductions taken in tax years beginning after 2022. Depreciation recapture is currently taxed at a rate of 25 percent.

- The White House budget also includes tax proposals recycled from last year that failed to pass congressional budget negotiations, including:

- repealing the deferral of gain from real estate like-kind exchanges;

- taxing long-term capital gains at ordinary income rates;

- taxing carried interest in real estate partnerships as ordinary income; and

- treating transfers of property at death as realization events subject to capital gains tax.

Immediate Congressional Pushback

- The spending and revenue proposals faced immediate pushback on Capitol Hill by Republicans and Democrats, including Sen. Joe Manchin (D-WV), a key centrist who stated he opposes President Biden’s 20% minimum tax on unrealized capital gains for households worth at least $100 million. (CQ News, March 29)

- Manchin told The Hill, “You can’t tax something that’s not earned. Earned income is what we’re based on. Everybody has to pay their fair share, that’s for sure. But unrealized gains is not the way to do it, as far as I’m concerned.”

- Manchin also recently stated he is open to negotiating some limited remnants of the defunct Build Back Better (BBB) Act, with a focus on energy-related incentives, prescription drug costs ,and deficit reduction. (Business Insider, March 24)

Other Measures Directly Affecting Real Estate

- Biden budget proposals impacting other aspects of The Roundtable’s 2022 Policy Agenda include:

- Energy and Climate – the president’s budget request outlines $44.9 billion for increased spending on several climate-related initiatives, yet does not address specific clean energy provisions that were part of last year’s BBB bill. Instead, a “deficit neutral reserve fund” is noted in the FY23 budget to accommodate a potential future deal on clean energy legislation with Democratic Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-AZ). (E&E News, March 28 and Axios Generate, March 29)

- Affordable Housing – the FY23 budget seeks to ease the nation’s affordable housing shortage with $50 billion in federal funding for housing construction and supply, including $35 billion for state and local housing finance agencies. (PoliticoPro, March 28)

- SEC Reporting Requirements – The Securities and Exchange Commission would receive $2.15 billion in the FY2023 budget proposal, an 11.4% increase from FY2021 (BGOV, March 28). The SEC has ramped up its activity recently with proposed rules on reporting requirements for investment advisers, climate risks and cybersecurity incidents that may have significant impacts for the real estate industry.

- The release of President Biden’s second budget launches the annual congressional appropriations process, which aims to fully fund the FY23 government budget starting Oct. 1. The prospects for certain tax increase proposals before the Nov. 8 mid-term elections are highly uncertain. (Politico, March 28 – “Here’s what’s in Biden’s $5.8 trillion budget proposal – and what’s next”)

Issues outlined in The Roundtable’s recently released 2022 Policy Agenda in the areas of tax, climate, capital and credit and cybersecurity will be discussed during the April 25-26 Spring Meeting (Roundtable-level members only) in Washington DC.

# # #

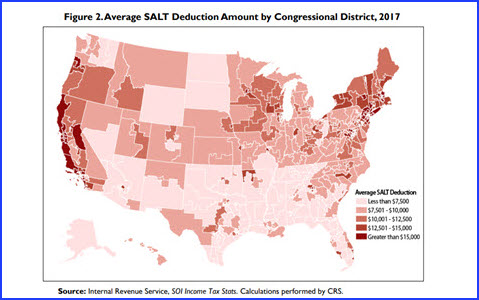

State and Local Tax (SALT) Deduction Relief in Doubt as Democrats Seek to Narrow Build Back Better Act

Several Democratic Senators favor retaining current law as it relates to the deductibility of state and local taxes and eliminating SALT relief from any pared down version of the Build Back Better (BBB) Act, The Hill reported on Jan. 26.

SALT Fix

- Speaking both on the record and anonymously to The Hill, policymakers said that they expect proposed changes to SALT will be cut from the next generation of the BBB Act, despite the issue being a top priority of Senate Majority Leader Chuck Schumer (D-NY).

- The 2017 Tax Cuts and Jobs Act limited the itemized, individual deduction for state and local taxes (including property taxes) to $10,000. The provision does not restrict the deductibility of business taxes paid or incurred at the entity level. The limitation expires after 2025. (The SALT Cap: Overview and Analysis, Congressional Research Service, March 6, 2020)

- Sen. Joe Manchin (D-WV), a key centrist vote in the Senate, has not publicly stated his position on SALT relief, but reportedly has sent signals he is not a supporter. (Politico, Jan. 27 and Roll Call, Jan. 28)

SALT & BBB

- If negotiations resume, congressional Democrats are expected to reduce the size and scope of the BBB Act. Manchin recently said he prefers “starting from scratch” after Democratic negotiations on the House-passed $2.2 trillion package collapsed in December. (Roundtable Weekly, Jan. 21)

- There are also challenges in the House, where Democrats have only a four-vote majority. “No SALT, no deal,” wrote New York Rep. Tom Suozzi and New Jersey Reps. Josh Gottheimer and Mikie Sherrill in a joint statement last week. “If there are any efforts that include a change in the tax code [in a revised BBB proposal], then a SALT fix must be part of it.” (CNBC, Jan. 21)

# # #

Roundtable Members Engage Policymakers on Economic, Energy, ESG and Other National Issues

The Real Estate Roundtable’s Virtual 2022 State of the Industry (SOI) Meeting this week included discussions with national policymakers and industry leaders on the future of the Build Back Better (BBB) Act, the Fed and monetary policy, energy policy, regulatory oversight of ESG reporting, along with equity, diversity and inclusion issues in CRE. The Roundtable’s policy advisory committees also met, drilling down on timely issues with policy and industry experts in the areas of tax, sustainability, capital and credit, and homeland security.

Speakers & Policy Issues

Roundtable Chair John Fish (Chairman and CEO, Suffolk), right, and Roundtable President and CEO Jeffrey DeBoer, left, launched the meeting and led discussions with three U.S. Senators and other prominent policymakers, including:

- Sen. John Thune (R-SD)

Senate Republican Whip

Committees: Senate Commerce, Finance, Agriculture

… joined Roundtable Board Member Ross Perot. Jr. (Chairman, Hillwood) to discuss upcoming Senate legislation and the political outlook.

- Sen. Amy Klobuchar (D-MN)

Committees: Joint Economic, Senate Commerce, Judiciary, and Rules

… expressed her support for the recently-enacted bipartisan infrastructure bill and additional pandemic aid for the hard-hit tourism industry and hospitality sectors.

- Sen. Catherine Cortez Mastro (D-NV)

Committees: Senate Finance, Banking, and Energy

… noted her support for expanding the low-income housing tax credit to build affordable homes for working families, along with business incentives to invest in energy efficiency projects.

- John Kerry

President Biden’s Special Envoy for Climate and former Secretary of State

… discussed the significant role of the real estate industry in efforts to combat the impact of climate change and emphasized the need for nations to adopt new green energy technologies.

- Larry Summers

Former Treasury Secretary under President Clinton and Former White House National Economic Council Director under President Obama

… discussed a wide range of policy topics, including his views on the Fed’s reaction to market volatility, inflation, and the tight labor market. (Watch Summers video)

Equity, Diversity & Inclusion

- The SOI meeting also included a discussion about exploring a potential industry initiative that would aim to accelerate opportunities for minority and women business enterprises (MWBEs) in the commercial real estate industry.

- The goals of the initiative were discussed by The Roundtable’s Equity, Diversity and Inclusion (E,D&I) Committee Chairman, and Roundtable Board Member, Jeff Blau (CEO, Related Companies); Ken McIntyre, CEO of The Real Estate Executive Council; and Thomas Baltimore, Jr., Chairman, President and CEO of Park Hotels & Resorts.

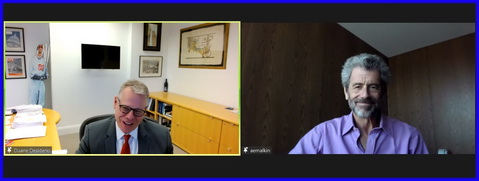

Roundtable Policy Advisory Committees

(Above: Sustainability Policy Advisory Committee (SPAC) Chair Tony Malkin (Chairman, President and CEO, Empire Realty Trust), right, and Roundtable SPAC Liaison, Senior Vice President and Counsel Duane Desiderio, left.)

The Roundtable’s policy advisory committee meetings on Jan. 25-26 analyzed national issues impacting CRE, including:

- Research and Real Estate Capital Policy Advisory Committees (RECPAC)

Rep. French Hill (R-AR) provided his insights on the congressional legislative agenda from his perspective as a member of the House Financial Services Committee and Ranking Member of its Subcommittee on Housing, Community Development and Insurance. Research Committee co-chairs Spencer Levy (CBRE’s Global Chief Client Officer) and Paula Campbell Roberts (KKR Managing Director) provided their perspectives on real estate capital markets. RECPAC co-chair Kathleen Farrell, Head of Commercial Real Estate for Truist, moderated a joint committee meeting capital market discussion, along with co-chairs Gregg Gerken, Head of Commercial Real Estate with TD Bank, and Mike Lowe, Co-CEO with Lowe.

- Tax Policy Advisory Committee (TPAC)

Potential tax revenue policies that may be considered by Congress were a focus of a discussion moderated by Russ Sullivan (Brownstein Hyatt Farber Schreck) with Bethany Bell, staff director for the House Ways and Means Subcommittee on Select Revenue Measures. Additionally, Derek Theurer, chief tax counsel for Ways and Means’ Republicans, discussed tax legislative priorities prior to the upcoming mid-term elections.

- Homeland Security Task Force (HSTF)

HSTF members were briefed on the escalation of organized “smash and grab” looting incidents affecting the retail sector by Dan Kennedy, Senior Vice President of US Security Operations for Unibail-Rodamco-Westfield, Chris Woiwode, Vice President and Chief Security Officer for Macerich and Terry Monahan, former New York City Senior Advisor for Recovery Safety Planning and NYPD Department Chief. Additionally, HSTF co-chairs Amanda Mason (Executive Director of Global Intelligence for the Related Companies) and Keith Wallace (Vice President for Global Safety & Security with Marriott International) led HSTF in a discussion on current threats to CRE and mitigation strategies. (HSTF on Jan. 20 held a virtual exercise simulating hostile events and adverse weather impacting CRE).

- Sustainability Policy Advisory Committee (SPAC)

Environmental Protection Agency (EPA) staff demonstrated a new, powerful Building Emissions Calculator to estimate historical, current and future annual greenhouse gas emissions resulting from a building’s energy use. SPAC also discussed the SEC’s expected rule on Environmental, Social, and Corporate Governance (ESG) reporting requirements. (Reuters, Jan. 19). Additional speakers from the U.S. Energy Information Administration provided an update on the Commercial Building Energy Consumption Survey (CBECS), which tracks federal data on U.S. CRE energy use.

Next on The Roundtable’s FY2022 meeting calendar is the Spring Meeting on April 26. This meeting is restricted to Roundtable-level members only.

# # #