Global markets, Wall Street and Main Street all watched this week as we entered a “new dawn” of American trade and commerce. The impacts on industry—including real estate—have been mixed and continued volatility is anticipated.

Recap

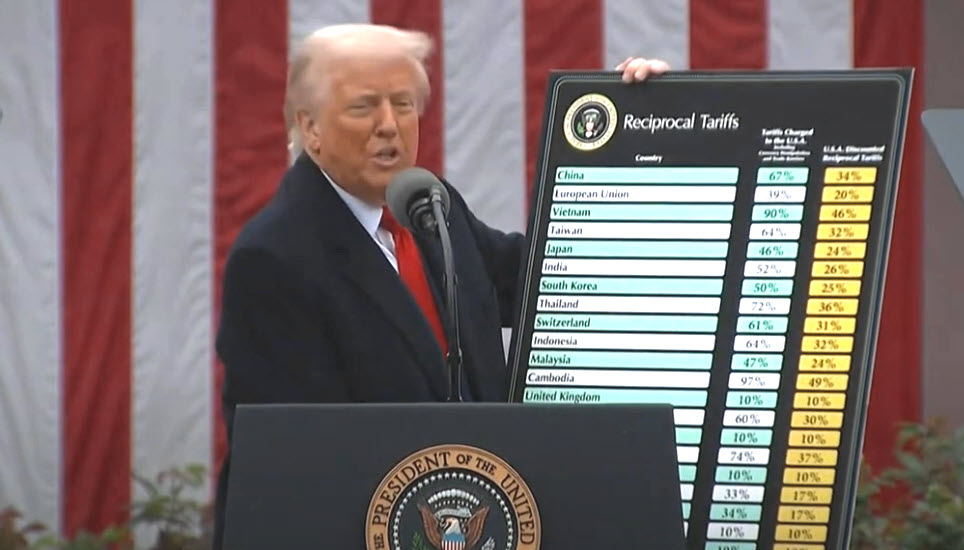

- Monday marked the first full week of economic activity since President Trump’s “Liberation Day” announcement on Tuesday, April 2, which featured a baseline 10% tariff on all imports with higher, targeted reciprocals for specific countries. (CBS News, April 2; Roundtable Weekly, April 4)

- Markets rebounded on Wednesday after President Trump said he would pause some —but not all—of his sweeping tariffs. Trump offered a 90-day reprieve on the reciprocal tariffs he had imposed on dozens of countries, including global partners such as Japan and the EU. (Axios, April 9)

- On Thursday, the White House announced the overall tariff imposed on most goods imported from China now stands at 145 percent (after stating the day before that the levy on Chinese goods was 125 percent). Stocks again tumbled at the announcement, (WSJ, April 9; BBC, April 10)

Implications for CRE

- Real estate stocks were not immune to what many are calling the “whipsaw” in prices stemming from to-the-minute changes in tariff policies. (Real Deal, April 9)

- The pause on the 20 percent reciprocal tariff on EU imports eases the burden for the costs of glass, with many firms relying on Portugal and other EU manufacturers as the primary supplier of this material—especially as glass-and-steel skyscrapers have become the preferred choice for builders. (Commercial Observer, April 4)

- Wednesday’s pause was an encouraging development for the real estate industry. However, higher tariffs on imported Chinese steel and aluminum will raise structural material costs, increasing expenses for developers and complicating efforts to address the housing shortage. (Roundtable Weekly, Jan. 24 | Nov. 27)

- CRE investors and developers must also still contend with the tariffs that remain in place and potential announcements of new tariffs in the future. The ultimate strategy and intended outcome behind the Trump administration’s trade policies remain unclear.

As trade negotiations continue, RER will continue to raise concerns about the negative impact that uncertainty in tariff policy is having on construction costs, particularly in the affordable housing sector.