Real Estate Roundtable Congratulates President-Elect Trump and Incoming Congress

Looks Forward to Jointly Addressing Key Policy Initiatives

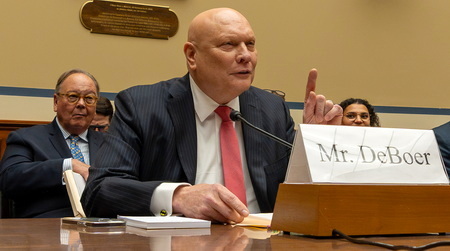

Statement by Real Estate Roundtable President and CEO Jeffrey D. DeBoer

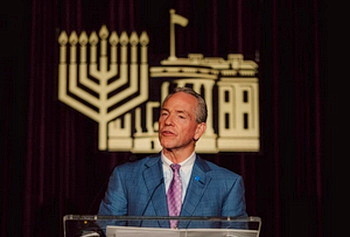

(WASHINGTON, D.C.) — Real Estate Roundtable President and CEO Jeffrey D. DeBoer today congratulated President-Elect Trump and pledged to work with the new Administration and Congress on compelling issues affecting the nation’s economy, job creation, housing, and the health of real estate markets.

“We look forward to working with the President-elect and his team to advance policies that will expand the nation’s economy, boost job creation, increase the supply and affordability of housing, and address the many important national policy issues related to constructing, financing and maintaining modern real estate, work, living, and recreational buildings.

Strong real estate markets provide millions of American jobs, support strong local budgets, and help millions of people plan for retirement through their pension and retirement savings investments in real estate.

The strength of real estate and the benefits the industry provides to all Americans, depends on fair, consistent, and forward-looking policies at all levels of government.

Real estate public policies are nonpartisan. The Real Estate Roundtable supports policies based on objective economic principles that are responsive to changing economic cycles and sensitive to societal demands.

Tax and financial regulatory reform, housing investment, immigration issues, energy policy, and physical and cyber security each present opportunities to advance the economy and stability of U.S. real estate markets.

We are excited to offer our support, expertise and assistance to President-Elect Trump and the new Congress. We are honored to contribute meaningfully to the strength and prosperity of our nation,” said DeBoer.

About The Real Estate Roundtable

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending, and management firms with leaders of major national real estate trade organizations to jointly address key national policy issues relating to real estate and its important role in the global economy.

The collective value of assets held by Roundtable members exceeds $4 trillion. The Roundtable’s membership represents more than 3 million people working in real estate; 12 billion square feet of office, retail, and industrial space; over 4 million apartments; and more than 5 million hotel rooms. It also includes the owners, managers, developers, and financiers of senior, student, and manufactured housing—as well as medical offices, life science campuses, data centers, cell towers, and self-storage properties.

The Roundtable’s policy news and more are available on The Roundtable website.

# # #