House Republicans wrapped up a pivotal week in their drive to finalize a sprawling reconciliation package aligned with President Donald Trump’s domestic agenda. But deep internal divides over tax priorities, energy incentives, and offsets—coupled with new demands from the President—have added a new layer of complexity.

Busy Week on Capitol Hill

- House Republicans faced a flurry of high-stakes meetings this week as they worked to finalize a massive reconciliation package before the self-imposed Memorial Day deadline. (Politico, May 5)

- Speaker Mike Johnson privately told Republicans on Thursday that they would only be able to pay for $4 trillion in tax cuts, versus the $4.5 trillion they had targeted to enact the president’s sprawling tax demands. (PoliticoPro, May 8)

- The House Ways and Means Committee tentatively plans to begin marking up the tax portion of the reconciliation package next Tuesday. (Tax Notes, May 9)

- A high-level “Big Six” meeting convened on Wednesday, led by Secretary Scott Bessent, to align House, Senate, and White House tax priorities.

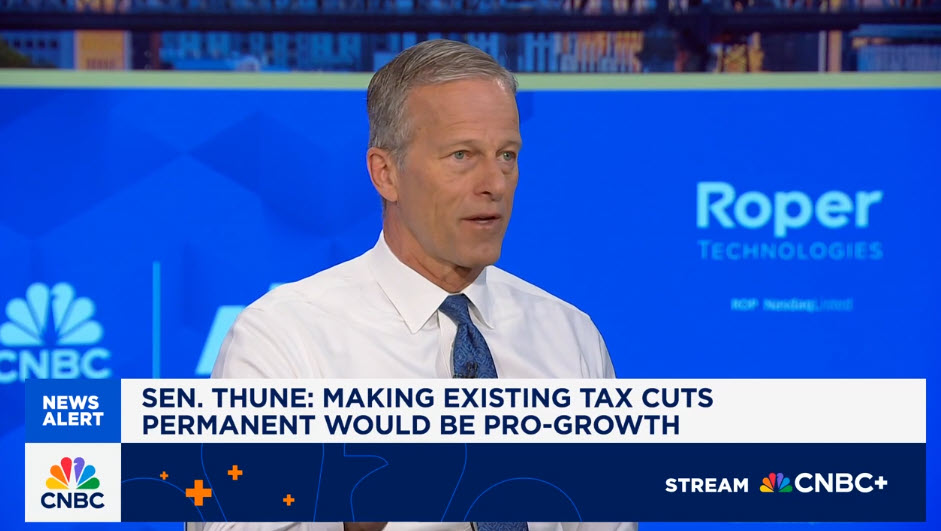

- Speaking this morning, Senate Majority Leader John Thune noted another new tax proposal now on the table. “The President has proposed expensing for factories, for domestic manufacturing, which would be very stimulative.” (CNBC, May 9)

- Meanwhile, during a private call with Speaker Johnson on Wednesday, President Trump reportedly urged the Speaker to include a new 39.6% tax rate for high-income earners and reform of carried interest tax rules—further complicating an already difficult path forward. (NBC News, May 8)

- However, President Trump said Friday that GOP lawmakers should “probably not” raise taxes on the wealthy, though he acknowledged he would accept such a measure, as Republicans continue to negotiate the final details of the bill. (The Hill, May 9) (NYT, May 9)

- House Ways and Means Chair Jason Smith (R-MO) is scheduled to meet with the President today to discuss the tax package. (Politico, May 8)

Carried Interest

- Among his new requests to Speaker Johnson this week, President Trump revived his long-standing call to eliminate the carried interest tax “loop hole.” (Politico, May 9)

- Since carried interest and its tax treatment first emerged as a controversial political issue in 2007, RER has consistently opposed legislative proposals to tax all carried interest at ordinary income rates.

- Current tax rules recognize that risk-taking can take many forms other than just invested cash. The rules allow entrepreneurial risk-takers to earn income on appreciated assets at rates that align with outside investors and limited partners.

- Senate Leader Thune defended the current treatment of carried interest this morning on CNBC’S Squawk Box, “I’m not a fan of taxing carried interest … these are the people out there investing and creating jobs.” (CNBC, May 9)

- RER urges its members to contact lawmakers on the House Ways and Means Committee to express strong support for preserving the current law on carried interest and the full deductibility of business-related property taxes. (RER’s Tax Talking Points | Hot Button Items | Tax Policy Priorities) (Contact Members of Congress)

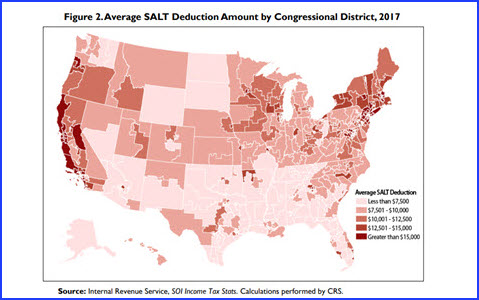

Business SALT

- A key priority of The Roundtable (RER) and the real estate industry is preserving the full deductibility of business-related property taxes. The deductibility of business-related state and local income and property taxes emerged as a key issue early in the tax debate as lawmakers looked for ways to pay for new tax provisions.

- A cap on the deductibility of property taxes paid by U.S. businesses could have devastating consequences for commercial real estate owners, developers, and investors nationwide.

- State and local property taxes are an ordinary and necessary business expense for commercial real estate owners. On average, property taxes represent 40% of the operating costs of U.S. commercial real estate, a greater expense than utilities, maintenance, and insurance costs combined. (RW, April 11)

Potential Challenges Ahead

- The week saw intense negotiations behind closed doors, with unresolved disagreements over SALT, clean energy tax credits, and offsets threatening to delay progress.

- SALT: Negotiations around the state and local tax (SALT) deduction cap remained deadlocked despite numerous meetings over the past week. (The Hill, May 8)

- The Energy and Commerce Committee faces internal GOP friction over Medicaid reductions, balancing fiscal hawks demanding significant cuts against moderates worried about political fallout. (Politico, May 1)

- In response to the new $4 trillion budget in tax cuts, Rep. Ron Estes (R-KS), said Wednesday that he expects a number of tax provisions to be temporary, with some extended for four, six or eight years. (PoliticoPro, May 8)

- Bessent and Senate Majority Leader Thune, have said they are targeting July 4 to pass President Trump’s “big beautiful bill.”

IRA & Energy Tax Credits

- Republicans on the House Ways and Means Committee are still struggling to find consensus on repealing clean energy tax credits from the Inflation Reduction Act (IRA). (PoliticoPro, May 7)

- While some lawmakers push to repeal IRA subsidies to free up revenue, others— including a group of moderate Republicans led by Rep. Mariannette Miller-Meeks (R-IA) urged Chair Smith this week to preserve technology-neutral electricity tax credits. The letter warned that repeal could lead to a 10% rise in electricity costs by 2026. (PoliticoPro, May 8)

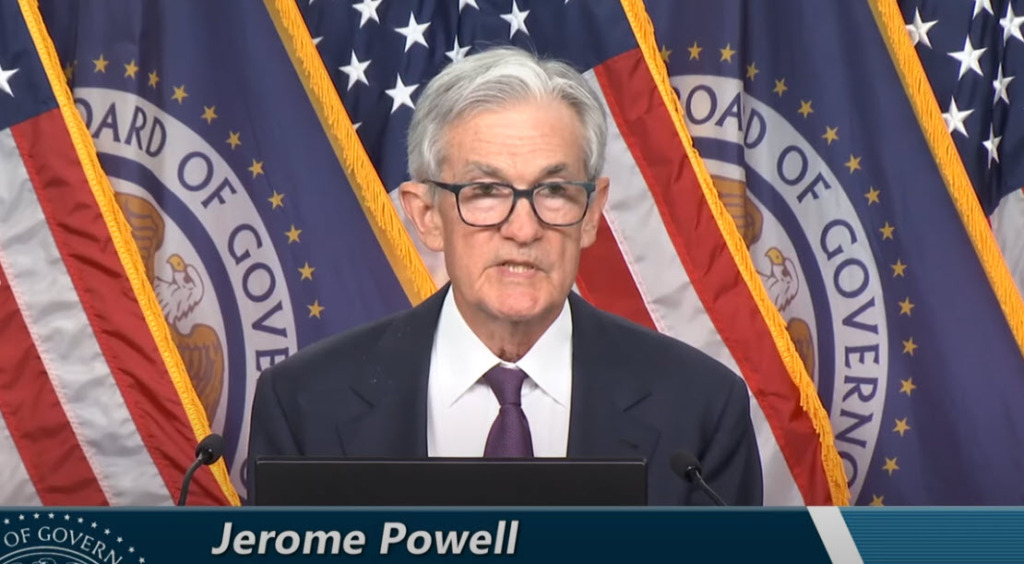

Fed and Trade Developments Add Pressure

- Adding to the week’s complexity, the Federal Reserve held interest rates steady at 4.25%–4.5% for a third consecutive meeting, citing heightened risks from tariffs and overall economic uncertainty. Fed Chair Jerome Powell signaled no immediate plans for rate cuts, emphasizing caution amid market volatility. (CNBC, May 7)

- On the trade front, the Trump administration unveiled a new U.S. and U.K. trade agreement, signaling a temporary pause in tariff escalation. (Axios, May 9)

Roundtable on the Road

- This week, Roundtable on the Road was in Los Angeles, CA where RER Chair Kathleen McCarthy (Global Co-Head of Real Estate, Blackstone) and RER President and CEO Jeffrey DeBoer gathered local RER members and friends for a timely discussion on Washington’s policy outlook. The conversation focused on reconciliation legislation, interest rates, and market conditions.

What’s Next

With key markups expected next week, Republican leaders face significant hurdles in reaching a consensus on a final package that preserves tax provisions, satisfies fiscal hawks, and delivers wins on energy and trade all before Memorial Day.

Tax provisions affecting individuals and small businesses originally enacted as part of the Tax Cuts and Jobs Act (TCJA) of 2017—along with the state and local tax (SALT) deduction cap—would be made permanent under legislation reintroduced this month by House Ways and Means Committee Vice Chairman Vern Buchanan (R-FL), above. (

Tax provisions affecting individuals and small businesses originally enacted as part of the Tax Cuts and Jobs Act (TCJA) of 2017—along with the state and local tax (SALT) deduction cap—would be made permanent under legislation reintroduced this month by House Ways and Means Committee Vice Chairman Vern Buchanan (R-FL), above. (