This week, House Republicans approved a major budget framework that moves President Trump’s tax and spending agenda closer to the finish line and set the stage for Congressional Committees to “mark up” the key details in May—including tax cuts, revenue raising provisions, and spending reductions.

State of Play

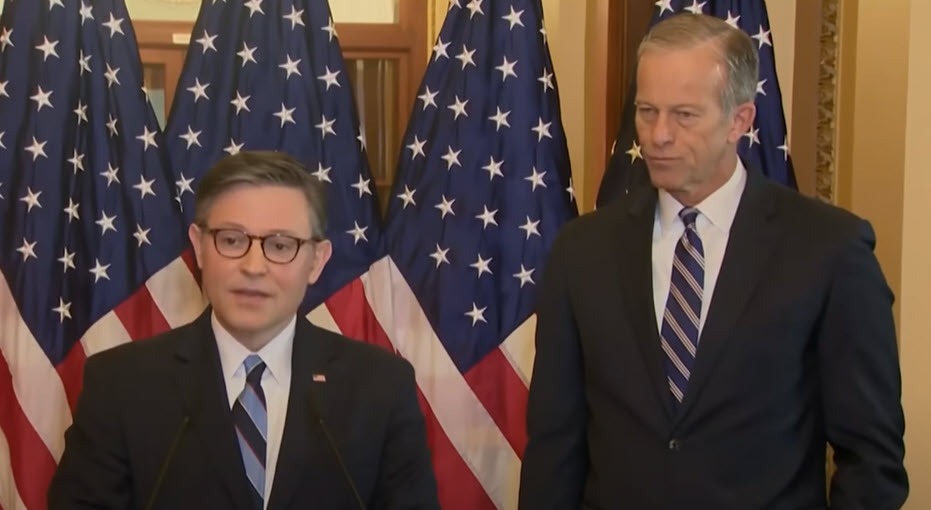

- Despite tight margins, on Thursday House Speaker Mike Johnson (R-LA) was able to corral his caucus into passing a new budget resolution that was approved by the Senate over the prior weekend, bringing the president’s goal of “one big beautiful bill” closer to fruition. (WSJ, April 10)

- Senate Republicans adopted a budget resolution on Saturday morning after an all-night voting marathon. Senate Republicans unveiled their 70-page budget blueprint last Wednesday. It lays out a fiscal framework for implementing Trump’s border security, defense, energy and tax priorities. (CBS News, April 9)

- The budget outline punts many of the hard decisions for lawmakers to hammer out later in the tax-cut negotiations. That could lead to a standoff between the House and Senate at the end of the process, where several Senators are resistant to large cuts in safety-net programs while House conservatives are seeking significant deficit reduction. (Bloomberg, April 10)

Next Steps and Implications for CRE

- Lawmakers in the House and Senate now turn their attention to “marking up” their respective Committee instructions, as provided in the budget resolution. The House and Senate instructions do not align, so their differences will have to be resolved later in the process.

- The budget resolution allows the House Ways and Means Committee to pass a tax cut of up to $4.5 trillion, using a current law budget baseline. The resolution allows the Senate Finance Committee to pass a $1.5 trillion tax cut, but assumes a current policy baseline in the Senate. The practical effect of the current policy baseline is to increase the size of the Senate tax cut to $5.3 trillion.

- On the spending side, the budget resolution directs the House Committees to identify at least $1.5 trillion in spending cuts. The spending reductions for the Senate Committees are de minimis ($4 billion spread across four committees).

- Besides tax cuts and spending reductions, the resolution calls for increased spending on the military ($150 billion), along with another $175 billion for border security and immigration enforcement work. (Politico, April 10)

- The debt limit fight will also shape the legislative timeline. House and Senate Republicans have different reconciliation instructions for increasing the nation’s borrowing authority. (Punchbowl News, April 11)

- Through meetings, outreach, and aggressive advocacy efforts, The Roundtable and the real estate industry continue to urge lawmakers to reject a revenue proposal to limit the deductibility of state and local business-related property taxes as part of the tax bill. The proposal could have a devastating impact on property values, rents, the health of the financial system, local communities, and consumer prices.

- In addition, members in both chambers continue to raise concerns about repealing clean energy tax credits from the Inflation Reduction Act (IRA) as part of the upcoming budget reconciliation bill. This week, four senators sent a letter to Senate Republican Leader John Thune warning that a full repeal would undermine investment, hurt businesses, and threaten jobs. (Punchbowl News, April 11) (RW, March 14)

- At our Spring Roundtable Meeting, House Ways and Means Chairman Jason Smith (R-MO) engaged with RER members, acknowledging their concerns about proposals to change the treatment of business SALT and carried interest. He emphasized the importance of using data to inform policy discussions and commended RER for its impactful work educating policymakers on the issues.

As the budget process enters its next phase, RER will continue to advocate for key real estate priorities and inform members on policy updates from Capitol Hill and their impact on the industry.