This week, the Senate conducted confirmation hearings for several of President-elect Donald Trump’s Cabinet nominees, providing critical insights into the nominees’ perspectives and potential policy directions on real estate, housing, the economy, and tax policy under the incoming administration.

Senate Confirmation Hearings

- Scott Bessent – Nominee for Secretary of the Treasury: Treasury nominee Scott Bessent faced bipartisan scrutiny during his Senate Finance Committee confirmation hearing over tax policy, tariffs, and China on Thursday. (Axios, Jan 17)

- He emphasized the importance of extending the 2017 Tax Cuts and Jobs Act, stating, “This is the single most important economic issue of the day.” (Roll Call, Jan. 16 | PoliticoPro, Jan. 16)

- “We must make permanent the 2017 Tax Cuts and Jobs Act and implement new pro-growth policies to reduce the tax burden on American manufacturers service workers and seniors,” Bessent said in his testimony. He also praised the Opportunity Zones program as a “resounding success,” highlighting its potential to address housing challenges, promote inner-city redevelopment, and support rural growth. (Politico, Jan, 16)

- He also called for spending cuts and shifts in existing taxes to offset the costs that extending the tax cuts would add to the federal deficit. (AP News, Jan. 16)

- Lee Zeldin, nominee for EPA Administrator, Chris Wright, nominee for Energy Secretary, and Doug Burgum, nominee for Housing and Urban Development Secretary, also testified this week and are expected to be confirmed. (see Energy story below)

- Sean Duffy – Nominee for Secretary of the Department of Transportation: Appearing before the Senate Commerce Committee, Duffy emphasized his commitment to safety and pledged to streamline regulatory processes that delay infrastructure projects. Promising to uphold the 2021 infrastructure law, he stated, “I commit to implementing the law,” and vowed to expedite funding distribution, addressing delays to ensure critical projects move forward efficiently. (Politico, Jan. 17)

Federal Housing Finance Agency (FHFA) Nominee

- On Thursday, Trump announced he would nominate Bill Pulte for Director of the Federal Housing Finance Agency (FHFA). (HousingWire | Reuters Jan. 16)

- If confirmed, Pulte would oversee Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) standing behind roughly half of the U.S. residential mortgage market.

- The Trump administration is expected to pursue a plan to release Fannie and Freddie from government control. (GlobeSt., Jan. 17)

- GOP lawmakers have raised the idea of including language to mandate Fannie and Freddie’s release in this year’s reconciliation package as a way to offset the cost of extending expiring tax cuts. (Politico, Jan. 16)

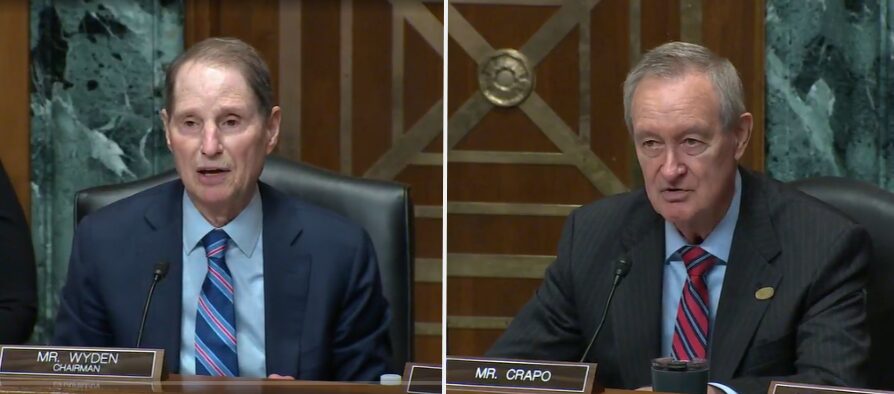

House Ways and Means Committee Hearing – TCJA

- The tax debate kicked off Tuesday with the House Committee on Ways and Means’ first hearing on extending key provisions of the TCJA led by Chairman Jason Smith (R-MO). (Fox News, Jan. 14)

- At the hearing, lawmakers discussed expiring provisions of the TCJA including the SALT deduction, Section 199-A, opportunity zones, and child tax credits.

- Congress faces the dual challenge of addressing expiring tax provisions while managing fiscal pressures. While bipartisan cooperation is possible on certain issues like affordable housing, divisions over business tax rates, SALT deductions, and the debt ceiling could stall progress.

What’s Next: RER President & CEO Jeffrey DeBoer will be on Marcus & Millichap’s 2025 Economic & CRE Outlook webinar next Thursday, January 23. He will be joined by Mark Zandi and a panel of industry leaders discussing the macro environment and the potential policies of the new administration and key trends on jobs, the FED outlook, tax policy expectations and more. (Register)