The unanticipated commitment by Speaker Pelosi to allow a stand-alone vote on the bipartisan Senate infrastructure bill no later than September 27 has scrambled the Congressional calendar and put increased attention and focus on the potential for major tax changes.

Why It Matters

- House Leaders are urging committees, including the powerful Ways and Means Committee, to complete their work on the $3.5 trillion budget reconciliation bill by September 15. Ways and Means Chairman Richie Neal has indicated a formal mark-up could start the week of Sept. 6 and continue 4-5 days. (E&E Daily, Aug. 25)

- Accelerating the consideration of the $3.5 trillion reconciliation bill may allow its supporters and advocates to retain political momentum for the massive package of social safety net, environmental, tax, and other policies—momentum that could be lost once the infrastructure bill is sent to the President.

- The shortened timetable, however, puts pressure on lawmakers who are considering complex changes to the tax code that would normally require hearings, extended debate, and substantial vetting.

Industry Concerns

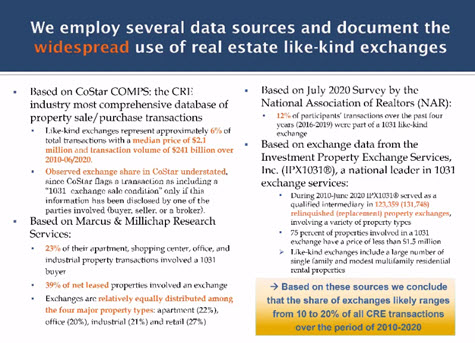

- The Real Estate Roundtable has raised concerns regarding a number of proposals in the President’s plan that would raise the tax burden on capital formation, undermine property values and the functioning of real estate markets, and harm the industry’s ability to create jobs and support local communities through property tax revenue. These proposals include restrictions on like-kind exchanges, an elimination of the reduced tax rate on capital gains, and the taxation of unrealized gains at death.

- On Tuesday, the accounting industry expressed strong concerns with the President’s proposed changes to capital income. The letter noted that, “[t]he taxation of the capital gains on gift or death in many cases would be the third time that the gain is taxed.” Imposing immediate tax on transfers by gift or death is an unreasonable requirement when the transfers are non-liquid assets such as real estate, business interests, etc., because it may require the forced liquidation of some or all of the assets transferred,” they continued.

- Last Friday, the Tax Foundation challenged the Administration’s claim that their tax proposals would spare 97 percent of small businesses. The organization analyzed the most recent IRS data and concluded the President’s proposals would reach more than half of pass-through business income (because 54% of pass-through income is earned by taxpayers making more than $500,000).

- At the same time, lawmakers are mobilizing to ensure that the $3.5 trillion bill includes priorities such as increased investment in affordable housing. On Thursday, 111 House Democrats led by Reps. Suzan DelBene (D-WA) and Don Beyer (D-VA) wrote to Speaker Pelosi urging that the legislation include a significant expansion of the low-income housing tax credit.

Contact Congress

- Real Estate Roundtable members and others are encouraged to weigh in with their lawmakers regarding the proposed tax changes and their potential impact on real estate and the broader economy. Here are some resources:

- Real Estate Roundtable sample letter to Congress

- Real Estate Roundtable budget reconciliation tax talking points and priorities

- Real Estate Roundtable Tax Policy Agenda