The Biden Administration today issued its FY22 budget proposal, which serves as a benchmark of its tax policy priorities, accompanied by the Treasury Department’s “General Explanations of the Administration’s Revenue Proposals.” Meanwhile, negotiations continued this week between Senate Republicans and the White House on the scope and cost of President Biden’s multitrillion infrastructure investment proposal.

Budget Pay-fors

- The administration’s $6 trillion 2022 budget beginning Oct. 1 represents some of the highest levels of federal spending of the postwar era. The revenue portion of the proposal would sharply raise taxes on corporations and high-income households to fund President Biden’s infrastructure, climate change and social safety net goals. (BGov, White House Fact Sheet and budget appendix, May 28)

- Although Congress will eventually determine final legislation that controls the federal government’s annual spending, today’s White House budget influences the debate on how to pay for its proposed programs with a variety of taxes, including:

- An increase in the corporate tax rate to 28% from 21%;

- Nearly doubling the tax rate on long-term capital gains to 40.8% from 23.8%;

- Limiting capital gains treatment to invested cash and disregarding other forms of risk taken by partners;

- Limiting taxpayers’ ability to defer gain that is reinvested in property of a like-kind; and

- Making death a taxable event at far lower levels of income and potentially taxing the unrealized gain on appreciated assets not once but twice when an individual dies.

- The administration’s proposed capital gains tax rate increase assumes it would be retroactive to April, preventing investors from quickly selling assets before the end of the year to avoid such a change. (Wall Street Journal, May 27)

- The Real Estate Roundtable, along with 16 other national real estate trade organizations, last week submitted detailed comments to the Senate Finance Committee and House Ways and Means Committee, which held hearings on how to fund recent Biden Administration infrastructure investment proposals. (Roundtable Weekly, May 21)

- The Roundtable plans to analyze the details of the White House budget proposal for its potential impact on CRE with its policy advisory committees and national real estate organization partners to remain engaged at all levels of the tax policy debate.

GOP Infrastructure Counteroffer

- Senate Republicans yesterday outlined a $928 billion infrastructure proposal over eight years as a counteroffer to Biden’s $1.7 trillion infrastructure initiative. The GOP proposal would repurpose funds from the $1.9 trillion pandemic relief law enacted in March, an approach rejected by Democrats. The Republican proposal also includes $257 billion in new spending for traditional “hard” infrastructure such as roads, bridges and other public works. (NPR / New York Times / AP, May 27)

- Democrats are weighing whether to advance the Biden infrastructure plan under the same “reconciliation” budget process that was used to pass the March pandemic relief package by a simple majority vote – thereby bypassing the 60-vote requirement typically needed to advance most legislation in the 50-50 Senate.

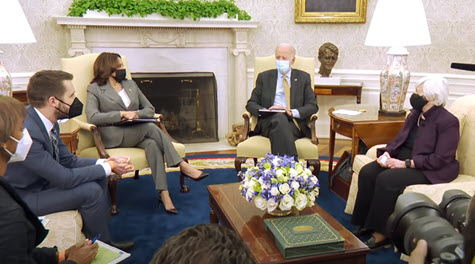

- President Biden yesterday referred to the infrastructure talks, stating, “We’re going to have to close this down soon.” He added that he plans to meet next week with Sen. Shelley Moore Capito (R-WV), above at podium, who has led Republican policymakers in infrastructure negotiations. (Bloomberg, May 27)

- Senate Majority Leader Chuck Schumer (D-NY) on May 25 said, “The bottom line is very simple, that it has always been our plan regardless of the vehicle to work on an infrastructure bill in July. And that’s our plan, to move forward in July.” (The Hill, May 28)

- Senate Minority Leader Mitch McConnell (R-KT) stated during a May 27 CNBC interview, “We’re open to spending some more … we’re going to keep talking.”

- White House Press Secretary Jen Psaki issued a May 27 statement on the Republican infrastructure proposal. “We are concerned that the proposal on how to pay for the plan remains unclear: we are worried that major cuts in COVID relief funds could imperil pending aid to small businesses, restaurants and rural hospitals using this money to get back on their feet after the crush of the pandemic.” The statement added, “As for the path forward … we will work actively with members of the House and Senate next week, so that there is a clear direction on how to advance much needed jobs legislation when Congress resumes legislative business during the week of June 7.”

According to Axios, Senate Democrats intend to continue working on bipartisan infrastructure negotiations through the week after Memorial Day congressional recess “… then forge ahead on their own if there’s no deal.” (Axios, May 24)

# # #