This week, the White House unveiled a nationwide rent price control plan that calls on Congress to “pass legislation giving . . . landlords a choice to either cap rent increases on existing units at 5% or risk losing current valuable federal tax breaks.” (White House Fact Sheet)

While the package is focused on imposing flawed rent price control policies and eliminating long-standing depreciation write-offs, it also includes policies to help build more housing. (WSJ, July 16)

Housing Proposals

- Under President Biden’s plan, beginning this year and for the next two years, owners of rental housing would only be able to take advantage of faster depreciation write-offs if they limit annual rent increases to no more than 5%, effectively trading depreciation deductions for rent price controls.

- This would apply to landlords with over 50 units in their portfolio, covering more than 20 million units nationwide—nearly half the U.S. rental market. It would include an exception for new construction and substantial renovation or rehabilitation. (White House Fact Sheet)

- While intended to make renting more affordable, these proposals would impede the production of much-needed housing, particularly for affordable units. (Bloomberg, July 17)

- The Biden-Harris Housing Plan also includes initiatives to:

- Call on all federal agencies to assess surplus federal land that can be repurposed to build more affordable housing;

- Rehabilitate distressed housing, build more affordable housing, and revitalize neighborhoods; and

- Authorize $325 million in Choice Neighborhoods grants under the U.S. Department of Housing and Urban Development (HUD) to build new deeply-affordable homes and spur economic development in communities across the country.

- The proposal would require congressional action to become law.

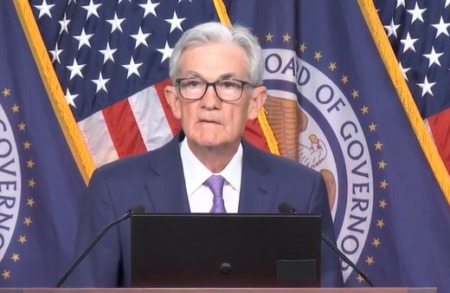

FHFA Proposed Tenant Protections

- Last week, the Federal Housing Finance Agency (FHFA) announced a set of required tenant protections for multifamily properties financed by Fannie Mae and Freddie Mac (the Enterprises). (FHFA News Release)

- This is the first time tenant protections will be a standard component of Enterprise multifamily financing.

- These protections apply to future loans acquired by the Enterprises and would include:

- Requiring 30-day notice before rent increases;

- Requiring 30-day notice on lease expiration; and

- Providing a 5-day grace period before imposing late fees on rental payments.

Industry & Roundtable Response

- This week at the Republican National Convention, our National Real Estate Organizations (NREO) partnered with POLITICO to host a series of discussions on the elections, affordable housing, revitalizing cities, the commercial real estate industry, and proactive policy solutions. (Watch here)

- The Roundtable’s President & CEO Jeffrey DeBoer was a featured speaker alongside Shannon McGahn (National Association of Realtors), joining Heidi Sommer (POLITICO) for a discussion on affordable housing, upcoming tax priorities, interest rates, and the economy.

- DeBoer stated in response to the administration’s recent rent cap proposal, “Rent control is fundamentally flawed and historically ineffective. Wage and price controls, even during wartime, have consistently failed to deliver the intended results. Implementing such measures now will only exacerbate the root cause of America’s housing problem by discouraging new housing development and reducing investment in existing housing.”

- Many of our NREO colleagues, including NAR also spoke out against the proposal. (NAR statement) (NMHC statement) (Housing Solutions Coalition statement)

The Roundtable is developing comments on the proposed plans and will continue work to enact measures that will help spur the expansion of America’s affordable housing infrastructure.