The Federal Reserve announced Wednesday that it will maintain its benchmark federal funds rate at the current 4.25-4.50 percent range, citing heightened economic uncertainty linked primarily to recent tariff policies.

Fed’s Decision

- The decision reflects cautiousness by Fed policymakers amid rising inflation expectations and slower projected economic growth. (AP, March 19)

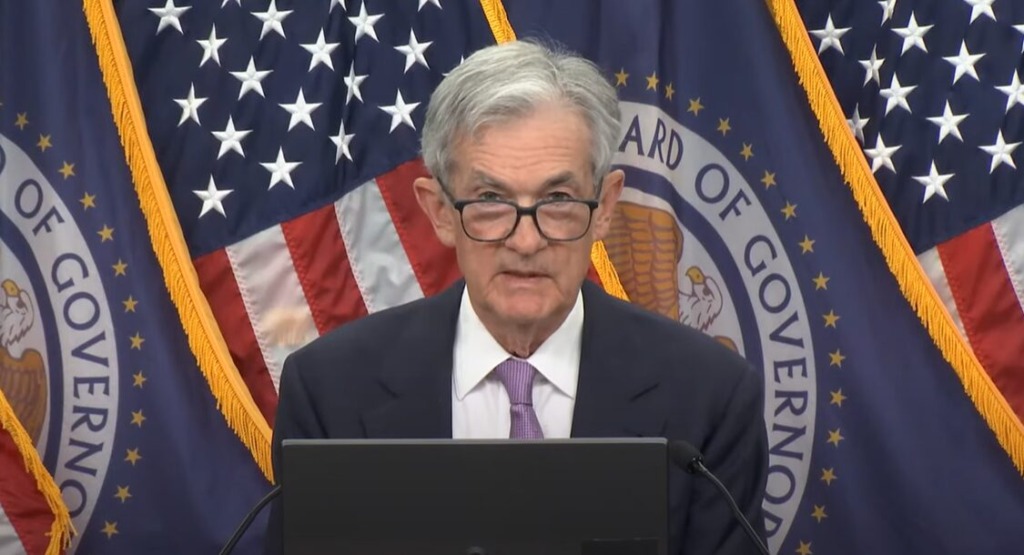

- Fed Chair Jerome Powell highlighted ongoing economic uncertainty, citing the Trump administration’s potential “significant policy changes” on trade, immigration, fiscal policy, and regulation. (Opening Statement, March 19)

- “It’s the net effect of these policy changes that will matter for the economy and for the path of monetary policy,” Powell said. “Uncertainty around the changes and their effects on the economic outlook is high.”

- Fed Chair Jerome Powell also emphasized that uncertainty is “unusually elevated,” largely due to the Trump administration’s extensive import tariffs.

- “Clearly, a good part of [inflation] is coming from tariffs,” Powell stated, adding that while tariffs may temporarily delay inflation reduction, he believes the effect will ultimately prove transitory.

Looking Ahead

- Powell stated that the Fed will take a patient, data-driven approach to future rate decisions.

- “We’re not going to be in any hurry to move,” Powell said. “Our current policy stance is well-positioned to deal with the risks and uncertainties we face.”

- According to the Fed’s quarterly projections, officials expect GDP to grow 1.7 percent this year, a drop from their 2.1 percent estimate in December.

- While Fed policymakers still anticipate two quarter-percentage-point rate cuts by year-end, consistent with their December forecast, this expectation primarily reflects concerns over slowing economic growth counterbalancing rising inflation and what Powell described as uncertainty-driven “inertia” given the unclear outlook. (Reuters, March 19)

Pressure From The White House

- President Trump criticized the Fed’s cautious approach via Truth Social, advocating for rate cuts, stating, “The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy. Do the right thing.” (ABC News, March 20)

- Earlier this week, President Trump nominated Federal Reserve governor Michelle Bowman as vice chair for supervision, the central bank’s top regulatory position. (Bloomberg, March 17)

- Senate Banking Committee Chair Tim Scott (R-SC) applauded the nomination and called Bowman an important voice in “pushing back on burdensome rules.”

Implications for CRE

- The decision to maintain current interest rates carries significant implications for commercial real estate. Stable and lower interest rates can provide a more predictable environment for financing and investment decisions.

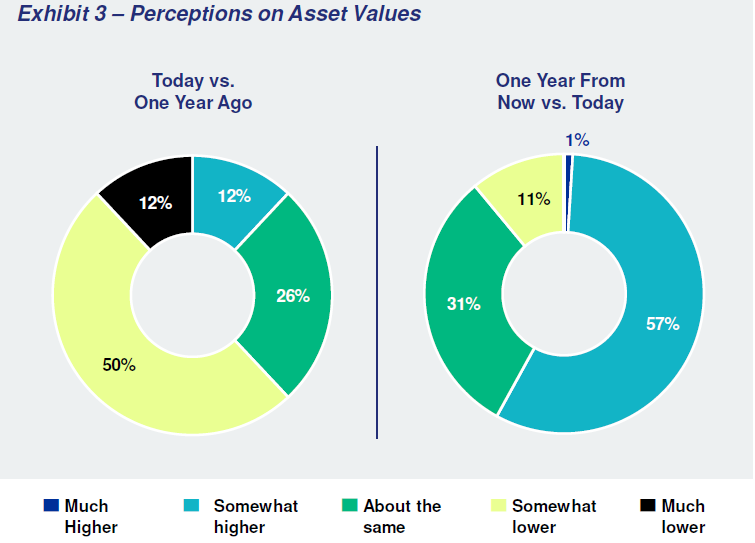

- The Fed’s decision reinforces findings from our Q1 2025 Sentiment Index that the CRE industry remains in a transitional period. Released in February, the Index showed signs of market stability—but also lingering uncertainty over tariffs, expiring tax cuts and regulatory reforms that could slow investment and economic growth. (Roundtable Weekly, Feb. 21)

- Heightened economic uncertainty, particularly from tariff policies, could dampen investment activity and make it challenging to attract foreign capital—both critical elements needed to drive economic growth.

- Reduced investment activity also risks hindering development projects, including the creation of affordable housing, and could slow ongoing efforts to revitalize communities and cities still recovering from pandemic disruptions. (CBRE, March 19)

RER will continue to track coverage on interest rates and tariffs, and the implications for commercial real estate.