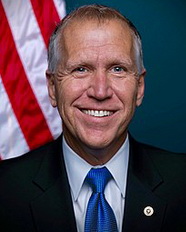

Legislation introduced May 21 by Sen. Thom Tillis (R-N.C.) would delay implementation of the Current Expected Credit Losses (CECL) accounting standard, which will force banks to book losses on bad loans much faster. (ABA Journal, May 22)

|

|

Legislation introduced May 21 by Sen. Thom Tillis (R-N.C.) would delay implementation of the Current Expected Credit Losses (CECL) accounting standard, which will force banks to book losses on bad loans much faster. |

- The independent Financial Accounting Standards Board (FASB) is proceeding with its plan to implement CECL for publicly traded U.S. banks at the beginning of 2020 – and later for other financial institutions. (Roundtable Weekly, April 5)

- FASB Chairman Russell Golden reiterated the organization’s commitment to implementing CECL in an interview this week with Bloomberg Tax. “We think we need to continue to work with community banks to make sure that they understand what CECL is and what it’s not,” Golden said. (BGov, May 22)

- The new CECL model will require certain financial institutions to estimate the expected loss over the life of a loan – a significant change to the way banks calculate reserves on assets. The regulatory change in how banks estimate loan and lease losses (ALLL) will require substantial changes in data analytics and financial methodologies. (Wall Street Journal, April 3) The accounting rule change was issued by the FASB in June 2016 as a result of the 2008 financial crisis.

- For real estate, there is concern is that banks may reduce lending volumes as they build up additional capital reserves to be in compliance with CECL. The new standard may cut into earnings and regulatory capital by forcing some banks to boost their loan-loss reserves. (Roundtable Weekly, March 8)

- A business coalition that included The Real Estate Roundtable in March urged further study amid concerns that CECL may soon begin to reduce aggregate bank lending. (Coalition Letter, March 5)

The Financial Accounting Standards Board (FASB) plans to implement CECL.

- Sen. Tillis’ bill (S. 1564) would require the Securities and Exchange Commission (SEC) and bank regulators to study CECL’s effect on the availability of credit and on bank capital before the new accounting standard takes effect.

- Fourteen Senators – seven Democrats and seven Republicans – on May 10 sent a letter to the Federal Reserve Board and the Federal Deposit Insurance Corp. requesting a delay of CECL until the regulators analyze how the new rules could impact lending. Twenty five members of Congress on May 6 sent a letter to the SEC requesting a delay in implementation of the new FASB rule until the SEC studies it.

At a House Financial Services Committee hearing May 22, Treasury Secretary Steven Mnuchin responded to a question about the ability of community banks to lend under CECL. “I share some of your concerns. This is an issue we continue to study,” Mnuchin said. (BGov, May 22)