President Trump issued executive orders this week for a policy agenda to develop domestic energy supplies, ensure grid reliability, and meet increased electricity demands driven by artificial intelligence (AI). (AP News, April 8)

Grid Reliability Executive Order (EO)

- The EO on “Strengthening the Reliability and Security of the U.S. Electric Grid” declares the administration’s policy “to ensure the reliability, resilience, and security of the electric power grid.”

- It states that America’s leadership in technological innovation “depends on a reliable supply of energy from all electric generation sources, particularly those secure, redundant fuel supplies that are capable of extended operations.” (Politico, April 8)

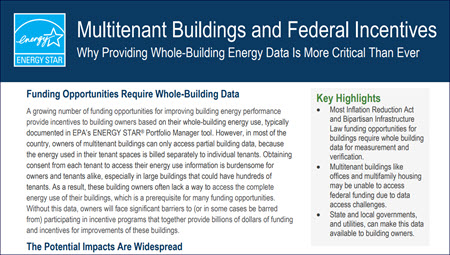

- Building efficiency measures that yield energy savings are also key to relieving electricity grid constraints to accommodate more energy users. RER and a broad coalition of real estate organizations urged heightened focus on efficiency programs by voicing strong support for ENERGY STAR in a recent letter to EPA Administrator Lee Zeldin. (RW, April 4)

State Overreach EO

- The EO on “Protecting American Energy from State Overreach” reflects the administration’s view that “American energy dominance is threatened when State and local governments seek to regulate energy beyond their constitutional or statutory authorities.” (Axios, April 9)

- The EO requires the U.S. Attorney General to scrutinize state climate laws, referencing New York’s law and plan aiming for net-zero emissions statewide by 2050, and the California program for businesses to “cap” emissions and “trade” pollution allowances. (Politico, April 9)

- Governors committed to reducing the use of fossil fuels and combat climate change within their borders said they were not “intimidate[d]” by the Trump order, signaling likely litigation. (E&E News, April 9; Reuters, April 9)

- In February, RER submitted a letter to Congress requesting oversight of federal DOE grants that induce states and localities to require all-electric buildings and zero emissions “targets,” through onerous Building Performance Standards (BPS). (RW, Feb. 28)

- RER’s peer reviewed 20-point policy guide for fair BPS mandates emphasizes that states and localities receiving federal grants should not levy fines on buildings that meet US-EPA and US-DOE high performance industry leadership standards. (RW, Oct. 11)

Tariffs and Energy

- While the administration’s recent executive orders could bolster grid reliability, the potential for broad tariffs may introduce new costs and complexities undermining energy affordability and infrastructure investment. (PoliticoPro, April 8)

- Tariffs on critical grid components could exacerbate supply chain shortages and drive up electricity prices. (CNet, April 4)

- On Tuesday, U.S. Senators Bill Cassidy (R-LA) and Lindsey Graham (R-SC) introduced the latest version of the Foreign Pollution Fee Act (FPFA), a carbon tariff aimed at penalizing imported goods manufactured with higher CO2 emissions than domestic alternatives. (E&E News, April 9) (Press Release, April 8)

- Prospects for imminent passage of the FPFA are remote. Yet, the bill signals some interest by Republican Senators to tie climate policy to tariff policy where overseas manufacturers produce aluminum, cement, iron, steel, and glass with higher carbon emissions compared to like-kind U.S. manufactured products. (American Action Forum, April 8)

- RER submitted comments on the FPFA in January, raising concerns regarding the impact of a carbon tariff on affordable housing construction, rebuilding after natural disasters, and technical issues on calculating “indirect emissions” associated with product manufacturing. (RW, Feb. 7)

RER will continue engaging with policymakers to ensure federal actions promote reliable, affordable energy without unintended economic repercussions.