As 2024 comes to a close, the commercial real estate industry has made significant strides in recovery and adaptation.

2024 Roundtable Highlights

- Over the past year, industry confidence has rebounded. RER’s Q4 Sentiment Index reached 73—a three-year high—and a 12-point jump from Q1 of this year. Despite ongoing challenges, the industry has demonstrated resilience and emerged stronger.

- RER President & CEO Jeffrey DeBoer spoke about the industry’s 2025 priorities in a recent episode of the Leading Voices in Real Estate podcast, saying, “Real estate cuts across all aspects of our economy, and it’s what makes cities strong. You can’t find a time in history where nations have been strong without healthy cities. Right now, cities are struggling, and we want to help them back.”

- Looking ahead to 2025, RER remains focused onadvancing policies that support liquidity, innovation, and adaptive reuse to ensure CRE remains a pillar of economic growth and community development.

- 2025 Policy Priorities Survey: Next week we will be distributing our Policy Issues Survey to all members to gather input on our policy priorities for 2025.

Top Takeaways from 2024

- Key drivers of the industry’s growing confidence include easing interest rates and improving financial conditions, which have helped to stabilize asset values and encourage investment activity. By year-end, easing monetary policy and growing investor confidence have started to open up capital availability, with more progress expected in 2025. (Roundtable Weekly, Nov. 8)

- Office-to-residential conversions saw a banner year, with more than 70 projects completed in 2024. Bolstered by the growing number of state and local incentive programs, 71 million sq. ft. (1.7% of U.S. office inventory) was undergoing or planned for conversion as of Q3. Property conversions will continue to see growing momentum in 2025, helping to alleviate elevated vacancy rates. (CBRE, Nov. 11)

- Loan modifications and extensions, encouraged by regulators and supported by RER, have helped many distressed owners stabilize properties and avoid defaults. While 2024 was a challenging year for the office sector, markets have started to reach an inflection point as capital becomes more available, vacancy rates start to peak, return-to-office momentum grows, and transaction activity picks up. (Roundtable Weekly, Nov. 15)

- Meanwhile, multifamily and industrial assets—especially data centers—continued to demonstrate strength, benefiting from robust tenant demand and the rapid expansion of AI-driven technologies. (CBRE, Dec. 11)

Prospects for 2025 and Trends to Watch

- Economic growth: The CRE sector is poised to benefit from moderate economic growth and a more favorable interest rate environment. Investors are cautiously optimistic about improving liquidity and stabilizing valuations, which could unlock much-needed capital. (Commercial Observer, Dec. 10, CBRE, Dec. 11)

- Office recovery: In San Francisco, office vacancy rates have dropped for the first time in four years—a sign that the office sector is beginning to turn the corner on the pandemic-era economy. Conversion activity is also expected to remain robust, supported by state and local incentives. (S.F. Chronicle, Dec. 16, GlobeSt., Dec. 17)

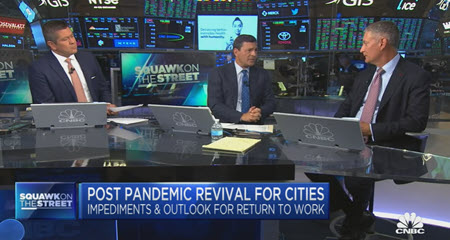

- As RER Chair Emeritus William C. Rudin (Co-Executive Chairman, Rudin) recently told Squawk Box, “the demise of office and New York City are greatly exaggerated…there is capital, the CMBS market is back, the banks are coming back to the market,” indicating a welcome trend that could help drive an office revival across America’s downtowns.

- As RER Chair Emeritus William C. Rudin (Co-Executive Chairman, Rudin) recently told Squawk Box, “the demise of office and New York City are greatly exaggerated…there is capital, the CMBS market is back, the banks are coming back to the market,” indicating a welcome trend that could help drive an office revival across America’s downtowns.

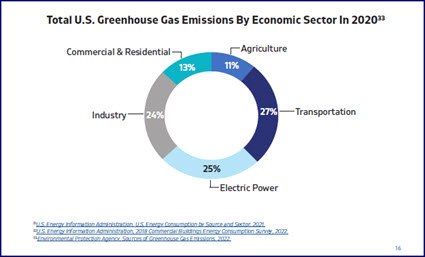

- The data center market will likely see explosive growth driven by artificial intelligence and cloud computing, although power constraints may limit development. Demand for data centers is expected to grow 160% by 2030, driving the buildout of the physical infrastructure needed to support the next digital revolution. (Goldman Sachs, May 14) (McKinsey, Oct. 29)

- Political and regulatory shifts following the 2024 election—including potential changes to trade, immigration, and fiscal policies with a new Congress and presidential administration—could pose new opportunities or risks in 2025. Collaborating with and educating policymakers on the impact these policies have on real estate will be crucial to ensuring that public policies support economic growth, job creation, housing affordability, and industry stability.

Heading into 2025, RER will continue advocating for policies that strengthen economic growth and capital availability while addressing industry challenges, including expanded tax credits for affordable housing and property conversions, permitting reform, and other initiatives that support a vibrant and resilient CRE sector.