The Biden administration today announced that fully vaccinated travelers from Mexico and Canada will be allowed to enter the United States starting Nov. 8 for “non-essential purposes, including to visit friends and family or for tourism.” The easing of travel restrictions provides a renewed opportunity for international travel to boost domestic economic growth. Additionally, next month will see the end of a pandemic-driven, 18-month ban on travel from 33 countries, including members of the European Union. (Reuters, Oct. 15 and New York Times, Oct. 12 | Oct. 8)

- The easing of travel restrictions could help rejuvenate the U.S. tourism industry and commercial real estate’s hospitality and retail sectors, which have been hit hard by the pandemic. Inbound international travel may help CRE through increased spending at hospitality, retail, attractions, health, and investment properties, generating revenues and creating American jobs. According to Marketwatch, relaxed travel restrictions may also

lead to an increase in foreign investment in U.S. real estate.

- Secretary of Homeland Security Alejandro Mayorkas stated, “Cross-border travel creates significant economic activity in our border communities and benefits our broader economy.” He added, “This new travel system will create consistent, stringent protocols for all foreign nationals traveling to the United States – whether by air, land, or ferry – and accounts for the wide availability of COVID-19 vaccinations.” (DHS news release, Oct. 12)

- Senate Majority Leader Chuck Schumer (D-NY) this week commented, “Since the beginning of the pandemic, members of our shared cross-border community have felt the pain and economic hardship of the land border closures. That pain is about to end.” (Schumer news release, Oct 12)

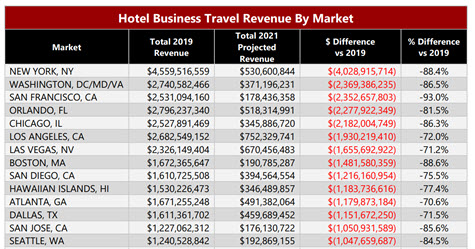

- The American Hotel & Lodging Association (AH&LA) also issued a Sept. 15 report on how hotels are projected to end 2021 with a loss of 500,000 jobs and more than $59 billion in business travel revenue compared to 2019. (AH&LA news release | state-by-state breakdown | market-by-market breakdown)

Bipartisan Senate Efforts

- The Senate is preparing legislation to boost inbound travel and tourism to the United States, according to a Sept. 21 Senate Commerce subcommittee hearing chaired by Sen. Jacky Rosen (D-NV), above.

- Executives from AH&LA and the U.S Travel Association testified at the hearing, entitled Legislative Solutions to Revive Travel and Tourism and Create Jobs.

- Rosen, who leads the Subcommittee on Tourism, Trade, and Export Promotion, announced that bipartisan legislation is in the works to “support the recovery of the travel and tourism economy in the wake of the COVID-19 pandemic and help us build a brighter future for businesses and workers in this key sector for every state in our nation.” (Rosen news release, Sept. 22)

- The imminent Omnibus Travel and Tourism Act would establish permanent federal leadership on travel policies, invest in public-private partnerships to increase visits to the U.S., and create a task force to address the pandemic’s impact on air travel. (BGov, Sept. 21)

Full committee ranking member Roger Wicker (R-MS) added his support for the emerging bill, saying that the nation’s travel and tourism challenges are a “bipartisan issue.”

# # #