Congressional lawmakers are taking steps to improve key terms of the Paycheck Protection Program (PPP) to help small business borrowers deal with the economic impact of the global pandemic. (Washington Post, May 20 and Wall Street Journal, May 21)

- Under the CARES Act, a portion of PPP loans can be forgiven for the eight week period after origination. (See “CARES Act and Implications for Real Estate”)

- Implementing rules and guidance from the U.S. Treasury and Small Business Administration further establish a “75/25 Rule,” whereby 75% of PPP loan proceeds and forgiven amounts must be for payroll. No more than 25% can be devoted to non-payroll business expenses like rent, mortgage interest, and utility bills.

- Business coalitions (including the The Real Estate Roundtable) sent letters yesterday urging policymakers to take immediate action to modify these requirements by extending the PPP loan forgiveness period and striking the “75/25 Rule.”

- A broad business coalition initiated by the U.S. Chamber of Commerce also recommends extension of the PPP’s June 30 safe harbor date for rehiring and restoration of pay.

- A separate letter focuses support for specific legislation, the Paycheck Protection Flexibility Act (H.R. 6886). This bipartisan bill is a stand-alone “spin-off” of PPP reform provisions passed by House Democrats last week in the HEROES Act. (Roundtable Weekly, May 15, 2020) H.R. 6886 would likewise strike the “75/25 Rule” and extend the PPP forgiveness period to 24 weeks after loan origination.

- A sponsor of the PP Flexibility Act, Rep. Dean Phillips (D-MN), informed in a press release that House leadership has committed to bring up H.R. 6886 for its own vote possibly as early as next week. House Speaker Nancy Pelosi (D-CA) reportedly called the 75/25 limitation on small businesses “debilitating.” (Roll Call, May 20)

- Over in the Senate, Marco Rubio (R-FL), Chairman of the Senate Small Business Committee and author of the PPP provisions in the CARES Act, predicted in a tweet yesterday that the Senate would pass reforms (S. 3833) to extend the time period beyond the current June 30 deadline by which qualifying small businesses can apply for and use PPP loans.

- Senator John Cornyn (R-TX), meanwhile, has spearheaded a bipartisan effort to amend the “75/25 Rule” to a “50/50 Rule” – where up to 50% of PPP loan and forgiveness amounts could be used for rent and other ordinary business expenses. (Cornyn letter, May 5) (Roundtable Weekly, May 8, 2020)

- Since passage of the CARES Act on March 27, The Roundtable has recommended elimination of the “75/25 Rule” as an inappropriate “one-size-fits-all” restriction that unduly limits businesses in meeting their rent obligations and paying for other ordinary operating expenses. (RER’s “8-Point Plan to Reform the PPP”)

- Treasury Secretary Steven Mnuchin yesterday endorsed congressional efforts regarding extension of the PPP loan forgiveness period. “One of the things we’re working with Congress on, and there is bipartisan support, is lengthening the eight-week period. [T]hat’s something we definitely want to fix,” he said. (Advancing America’s Economy forum, May 21)

- At The Hill’s Advancing America’s Economy forum, Mnuchin also stated he did not support reforming the “75/25 Rule.” “We want most of this money to go to workers and that we believe the 75 percent was exactly consistent with the way the program was designed,” he said.

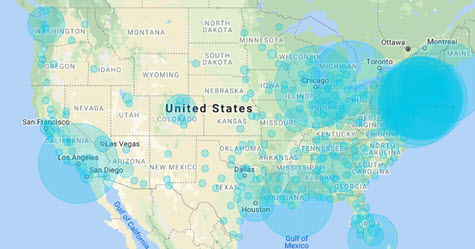

- A recent “tracker tool” released by the American Action Forum charts the allocation of PPP loans since the program’s inception in the CARES Act.

The Paycheck Protection Program will be discussed at The Roundtable’s Remote Annual Business and Committee Meetings from June 11-12.

# # #