A major escalation in the White House’s trade agenda this week introduced new tariffs on imports from major global partners—while sparing Canada and Mexico in a move important for construction and development.

Recap

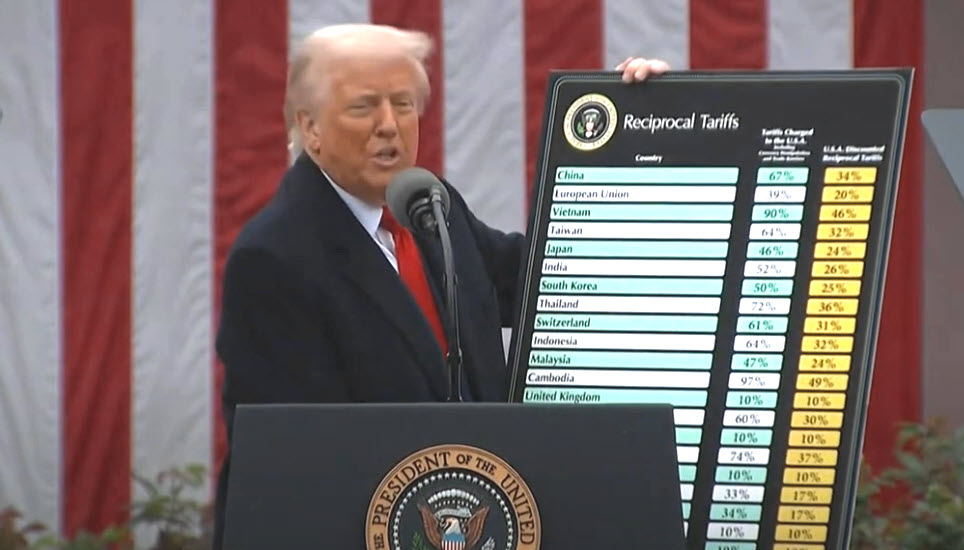

- On Wednesday, President Trump announced a minimum 10 percent tariff on imports from most countries, set to take effect Saturday. In addition, individualized, “reciprocal” tariffs that apply to specific countries will take effect next Wednesday, including raising overall tariffs on China to 54 percent. (White House, April 2)

- While Canada and Mexico did not receive any new tariffs, other key trading partners were affected. The European Union was hit with a new 20 percent tariff, along with Japan (24 percent) and South Korea (25 percent), spurring a statement from the European Commission President indicating that plans for countermeasures are in motion. (Reuters, April 3)

- The tariff exceptions for Canada and Mexico are positive for the real estate industry. Canada supplies about 85% of all U.S. softwood lumber imports—nearly a quarter of the total domestic supply in the U.S. Further exempting Mexican products is also a win given major construction cost drivers such as gypsum, concrete and near-shored appliances. (NAHB, April 3)

- National Association of Home Builders Chairman Buddy Hughes said, “While the complexity of these reciprocal tariffs makes it hard to estimate the overall impact on housing, they will undoubtedly raise some construction costs. However, NAHB is pleased President Trump recognized the importance of critical construction inputs for housing and chose to continue current exemptions for Canadian and Mexican products, with a specific exemption for lumber from any new tariffs at this time.” (NAHB, April 3)

- In TV interviews after the announcement, Treasury Secretary Scott Bessent called for patience to not immediately retaliate and “asking to let’s see where this goes.” (Politico, April 3)

- Markets and financial experts remain concerned about the ultimate endgame of the tariffs—whether they are meant to be permanent or represent negotiating leverage for the Trump administration to garner better deals with trading partners.

- Speaking with reporters on Thursday, Trump seemed to indicate the latter, saying that “the rest of the world wants to see if they can make a deal.” (NBC News, April 3; Forbes, April 3)

Implications for CRE

- Tariffs may present several challenges for commercial real estate, including increased construction costs, potential project delays, and heightened uncertainty among investors. (CBRE, March 19 | Roundtable Weekly, Feb. 14)

- Higher tariffs on imported Chinese steel and aluminum will raise structural material costs, increasing expenses for developers and complicating efforts to address the housing shortage. (Roundtable Weekly, Jan. 24 | Nov. 27)

- New tariffs also threaten to escalate energy costs by disrupting supply chains and raising prices for essential clean-tech components, underscoring the need to prioritize energy conservation strategies in commercial buildings. (E&E News, April 3 | NYT, April 3 | Forbes, March 20)

- Embracing efficiency measures such as EPA’s ENERGY STAR program is now more important than ever—ensuring grid reliability, controlling operational costs, and unleashing American energy dominance amid growing economic pressures. [See ENERGY POLICY story below]

For now, deep uncertainties around trade and the administration’s tariff strategy leave long-term planning for investment and development in limbo. This latest round of tariffs is unlikely to be the last. RER will continue to track coverage on tariffs, and the implications for commercial real estate.