More than two dozen Republicans on the House Financial Services Committee, led by Chairman Patrick McHenry (NC), recently urged banking regulators to withdraw a sweeping set of proposed changes that would significantly increase capital requirements for large banks. The federal Agencies’ proposal—known as the “Basel III Endgame”—represents the final stages of the global regulatory response to the 2008-09 financial crisis. (Bloomberg Government, Sept. 14)

Proposed Agencies’ Rulemaking

- In July, the Federal Reserve, Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) jointly approved the 1,100-page proposed rulemaking, which would substantially revise the regulatory capital framework for banking organizations with total assets of $100 billion or more.

- The Agencies’ proposal would have a long phase-in period and have not impact community banks. (CNBC, Fed news release, and Interagency Overview of the Notice of Proposed Rulemaking for Amendments to the Regulatory Capital Rule, July 27)

- Fed Chairman Jerome Powell voted for the proposal, but noted a significant tone of caution. Powell stated, “Raising capital requirements also increases the cost of, and reduces access to, credit … threatening a decline in liquidity in critical markets and a movement of some of these activities into the shadow banking sector. I look forward to hearing from all stakeholders on how best to strike that balance,” (Federal Reserve Board Chair Powell statement, July 27)

- The House Committee Republicans’ letter claims the scope and process of the banking regulators’ plan is flawed, while noting how the proposal was opposed by some members on the Federal Reserve and FDIC Boards. The letter concludes, “Given those fatal problems with your Basel III Endgame proposal, we urge that it be withdrawn. The proposal should be replaced with one based on sound, objective analysis supported by data.”

- The Sept. 13 letter was sent in conjunction with last week’s House Financial Services Committee hearing, “Implementing Basel III: What’s the Fed’s Endgame?”

- A subsequent hearing on Sept. 19 held by the House Financial Services Subcommittee on Financial Institutions and Monetary Policy—“A Holistic Review of Regulators: Regulatory Overreach and Economic Consequences”—explored the interaction and economic impact of recent federal regulatory proposals, including the Basel III Endgame, new and expanded long-term debt requirements, and changes to resolution plans.

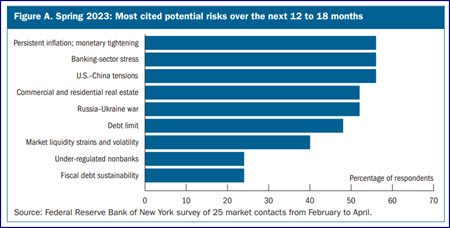

- Subcommittee Member William Timmons (R-SC), expressed concern during the hearing about how the Basel III capital requirements may exacerbate the strain on bank capital availability. He emphasized “… the fact that billions of dollars of commercial real estate projects must be refinanced the next 36 months, and not all those projects will be profitable when their mortgage payments more than double and banks are prevented from extending additional credit due to increases in capital requirements and an unfavorable interest rate environment.” Rep. Timmons added, “That is the looming crisis that we need to be preparing for, not further restricting capital availability.” (CQ, hearing transcript)

Impact on CRE

- The proposed changes would increase capital requirements for the nation’s largest banks by as much as 20%, with far broader indirect impacts on bank counterparties and customers and the broader financial markets. The Agencies’ rulemaking could significantly affect available liquidity for commercial real estate transactions, impact asset values, and hinder economic growth. (Roundtable Weekly, July 28)

- Mortgage Bankers Association (MBA) President and CEO Robert Broeksmit testified during the Sept. 14 House Financial Services Committee hearing. “MBA strongly opposes certain provisions of the proposal that undermine the mortgage market and takes exception to the extremely scant economic analysis regarding how the changes will affect the economy, single-family housing market, and commercial real estate finance markets,” Broeksmit testified. (MBA Newslink, Sept. 19)

- Real Estate Roundtable President and CEO Jeffrey DeBoer stated in a March 2023 comment letter to Fed Vice Chair Michael Barr and other key regulators, “At this critical time, it is important that the Agencies do not engage in pro-cyclical policies such as requiring financial institutions to increase capital and liquidity levels to reflect current mark to market models. These policies would have the unintended consequence of further diminishing liquidity and creating additional downward pressure on asset values. A deflationary spiral must be avoided at all costs. As recent events are only amplifying the contraction of credit, it is important for the Agencies to take measures to maintain sufficient liquidity levels and support positive economic activity.”

The Roundtable’s Real Estate Capital Policy Advisory Committee (RECPAC) has established a working group on Basel III that is developing comments, due by Nov. 30, on the Basel III Endgame proposal.

# # #