Three U.S. Senators discussed national housing policy with industry leaders and Roundtable members during this week’s State of the Industry (SOI) meeting. (See Meeting agenda)

Need for Housing Incentives

- Senate Finance Committee Chairman Ron Wyden (D-OR) discussed the importance of expanding and extending the Low-Income Housing Tax Credit (LIHTC), which was included in a tax package advanced by the House Ways and Means Committee last week by a vote of 40-3. Sen. Wyden negotiated the $77 billion bill with Ways and Means Chairman Jason Smith (R-MO) and commended the overwhelming margin of bipartisan support in the committee vote. (Roundtable Weekly, Jan. 19)

- Sen. Maggie Hassan (D-NH), center, discussed what can be done to address U.S. housing challenges with Kathleen McCarthy, left, (Chair-Elect, The Real Estate Roundtable | Global Co-Head of Real Estate, Blackstone), and Shaun Donovan, right, (CEO and President, Enterprise Community Partners |former HUD Secretary and OMB Director). Sen. Hassan spoke about the urgent need for national policy to encourage development of more workforce housing, while Mr. Donovan noted the congressional tax bill under consideration would create 200,000 new affordable housing units.

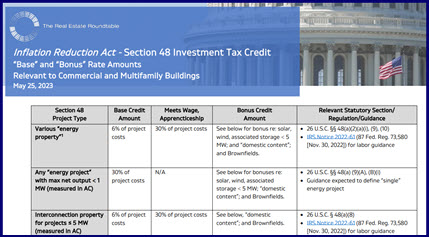

- Sen. Debbie Stabenow (D-MI)– introduced by Roundtable Chair Emeritus (2012-2015) Robert Taubman (Chairman, President & CEO, Taubman Centers, Inc.) – spoke about legislative efforts to revitalize downtowns. Sen. Stabenow referred to the recent tax package as an encouraging development for affordable housing, yet noted how more is needed to incentivize conversions of commercial properties to multifamily use. Stabenow is an original co-sponsor of the Revitalizing Downtowns Act (H.R. 4759) to encourage adaptive use of older buildings.

Housing policy and incentives advocated by The Roundtable to encourage more affordable housing supply are topics weaved throughout RER’s 2024 Policy Priorities. (See Executive Summary)

# # #

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “