The Real Estate Roundtable submitted comments today on a proposed rule from the IRS and Treasury Department regarding “bonus” tax credits for renewable energy investments in low-income communities, passed by Congress as part of the Inflation Reduction Act (IRA). (Roundtable Comment Letter, June 30)

Solar, Wind Bonus Credits

- IRA Section 48(e) establishes a Low-Income Communities Bonus Credit Program to address climate, affordable housing, and environmental justice challenges. (Treasury news release, Feb. 13, 2023)

- Taxpayers must apply to the IRS through a competitive process to receive any bonus credits under the Program.

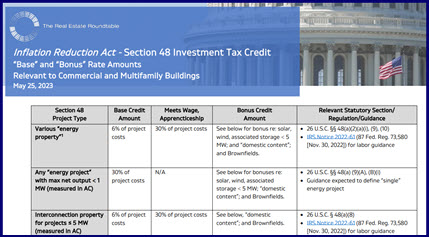

- The bonus can provide extra tax credits to help cover the costs of solar, wind, and storage facilities. See The Roundtable’s chart, “Base” and “Bonus Rate” Amounts Relevant to Commercial and Multifamily Buildings (May 25, 2023).

- Taxpayers who qualify can layer an extra 10% bonus—above “base rate” credit amounts—for renewable projects in low-income communities defined in the IRA as census tracts that qualify for new markets tax credits.

- The bonus can increase to an extra 20% for clean energy investments that are part of low-income rental housing—such as housing supported by LIHTCs or Section 8 “housing choice” vouchers.

Roundtable Comments

- Treasury and IRS proposed a rule on June 1 to implement the low-income bonus program. Today’s comments from The Roundtable seek greater clarity and certainty for building owners that may access the bonus credits, raising the following points:

- The bonuses are available only for solar or wind projects that generate under 5 megawatts of electrical output. The Roundtable requested a more straightforward rule for what constitutes a “single project” for purposes of this output threshold.

- The IRA’s text requires that multifamily building owners must share “financial benefits” of renewable energy produced on-site with tenants. The Roundtable’s comments stressed that any such benefits should not depend on utility bill savings that accrue directly to tenants—because owners cannot measure, track or control energy consumption in sub-metered leased units.

- Low-income housing supported by non-federal programs through state- and local-level housing finance agencies or public housing authorities should also be eligible for the IRA’s low-income bonuses.

- The proposed rule would offer a preference, not based in the statute, for non-profit owners to receive bonus credit allocations. The Roundtable’s comments urge there should be no bias against business taxpayers to receive the bonus to further the Biden administration’s climate policy goals for rapid deployment of renewable energy investments in low-income communities.

- The bonuses are available only for solar or wind projects that generate under 5 megawatts of electrical output. The Roundtable requested a more straightforward rule for what constitutes a “single project” for purposes of this output threshold.

- Future Roundtable comments on IRA topics are in the works. Feedback on a proposed rule to buy-and-sell certain clean energy credits is due August 14. In addition, proposed rules to implement the 179D tax deduction for energy efficient retrofits of commercial buildings are expected this summer.

Prior comments, information and summaries on The Roundtable’s advocacy efforts regarding clean energy tax incentives are available on our Inflation Reduction Act resources page and in Roundtable Weekly (Dec. 2, 2022 and Nov. 4, 2022).

# # #

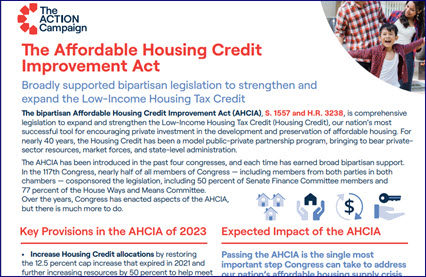

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “