A broad business coalition urged Congress in a September 17 letter to swiftly pass a long-term reauthorization of the Terrorism Risk Insurance Act (TRIA), which is currently set to expire at the end of 2020. Nearly 350 companies and organizations signed the letter including The Real Estate Roundtable. (Coalition Letter )

Absent TRIA, there is not sufficient insurance and reinsurance capital available to provide comprehensive terrorism coverage to U.S. insurance buyers,” the coalition states. (Reinsurance News, Sept. 17)

# # #

California lawmakers passed legislation (AB 1482) September 11 that imposes a statewide cap limiting annual rent increases to 5% after inflation – the latest measure from a growing list of jurisdictions seeking to address housing affordability though rent regulations. California Governor Gavin Newsom (D) has said he will sign the bill. (New York Times, Sept. 11 and NMHC, Sept. 12)

Housing and Urban Development Secretary Ben Carson recently offered a strategy to boost affordable housing by encouraging localities to ease their own building restrictions. (Politico, June 14). Secretary Carson is scheduled to discuss housing policy issues with Roundtable members during the organization’s Fall Meeting on October 30 in Washington.

# # #

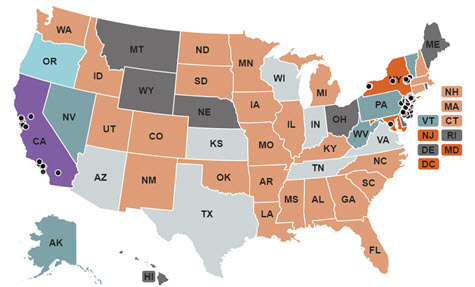

The Treasury Department yesterday issued proposed regulations to comprehensively implement the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which seeks to more closely scrutinize certain investments and real estate transactions potentially affecting national security. (New York Times, Sept. 17)

The Roundtable plans to prepare comments, which are due by October 17, 2019 before the law is scheduled to go into effect in February, 2020.

# # #

The Roundtable on August 21 wrote to Treasury Secretary Steven Mnuchin requesting regulatory relief from existing tax accounting rules that unfairly accelerate federal income tax liability for new condominium construction. (Roundtable letter )

A House bill introduced in the last Congress by Reps. Carlos Curbelo (R-FL) and Joe Crowley (D-NY) aimed to correct this disparity. Although the Fair Accounting for Condominium Construction Act (H.R. 3659) stalled in 2017, it could serve as a template for development of new legislation to correct current condominium tax accounting rules.

# # #