Negotiations about a pandemic relief package shifted dramatically this week in Washington, ranging from complete cancellation to industry-specific assistance to discussions reported today about a new $1.8 trillion White House proposal. (Wall Street Journal and PoliticoPlaybook Oct. 9)

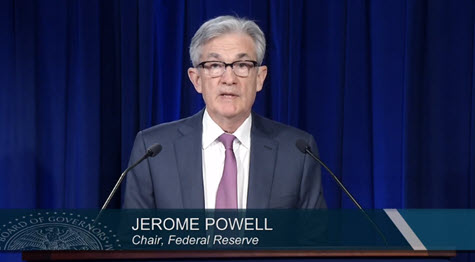

Powell also warned that the economic expansion and recovery from the coronavirus is far from complete. “Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods,” he said.

# # #

The Real Estate Roundtable on Oct. 5 submitted detailed comments to the Treasury Department and IRS on proposed regulations implementing the 3-year holding period requirement for carried interests to qualify for long-term capital gain treatment. (Roundtable comment letter)

-- The 3-year requirement is limited to the gain from a sale or exchange of a capital asset – and excludes gain from property used in a trade business (Section 1231 gain).

-- A useful “look-through” rule to help ensure REIT dividends paid to shareholders receive the same long-term gain treatment that would apply to assets owned individually or in partnership form.

-- A sensible exclusion to ensure a partner’s own capital contributions to the partnership are not subject to re-characterization under section 1061.

Recommendations for Additional Clarifications and Improvements

The Roundtable comment letter also recommends certain changes to the proposed regulations to bring the rules more in line with the legislative intent when Congress enacted section 1061. The Roundtable recommendations include the following:

Roundtable President and CEO Jeffrey DeBoer concludes the letter by noting, “Congress . . . narrowly drafted section 1061 to apply to specific situations. Our comments our aimed at preserving the drafters’ intent while avoiding unnecessary disruption to common, everyday real estate partnerships—small and large—throughout the country.”

The recommendations were developed by The Roundtable’s Tax Policy Advisory Committee (TPAC).

# # #