The 2024 election cycle concluded this week, with Donald J. Trump elected as President of the United States. The Roundtable congratulated the President-elect and the newly elected members of Congress. As the nation transitions to new leadership, The Roundtable is looking forward to collaborating with the new administration and Congress on policies critical to the economy, jobs, housing, and the health of real estate markets.

Election Results

Focused Hard Work Ahead Regarding Tax Legislation, Deregulation, and Housing Policy Shifts

Roundtable Statement

Earlier this week, Roundtable President and CEO Jeffrey D. DeBoer issued a statement congratulating President-elect Trump and pledging to work with the new administration and Congress on pressing commercial real estate issues.

“We look forward to working with the President-elect and his team to advance policies that will expand the nation’s economy, boost job creation, increase the supply and affordability of housing, and address the many important national policy issues related to constructing, financing and maintaining modern real estate, work, living, and recreational buildings.

Strong real estate markets provide millions of American jobs, support strong local budgets, and help millions of people plan for retirement through their pension and retirement savings investments in real estate.

The strength of real estate and the benefits the industry provides to all Americans, depends on fair, consistent, and forward-looking policies at all levels of government.

Real estate public policies are nonpartisan. The Real Estate Roundtable supports policies based on objective economic principles that are responsive to changing economic cycles and sensitive to societal demands.

Tax and financial regulatory reform, housing investment, immigration issues, energy policy, and physical and cyber security each present opportunities to advance the economy and stability of U.S. real estate markets.

We are excited to offer our support, expertise and assistance to President-elect Trump and the new Congress. We are honored to contribute meaningfully to the strength and prosperity of our nation,” said DeBoer.

On Thursday, the Federal Reserve reduced the federal funds rate by 0.25 percentage points, setting the new target range at 4.5% to 4.75%. This marks the second consecutive rate cut, following a 0.5 percentage point reduction in September, as the Fed responds to moderating inflation and evolving economic conditions. (FOMC Statement, Nov. 7)

Fed’s Decision

Impacts on CRE

Looking Ahead

DeBoer was a featured speaker at the FSU Real Estate Center’s 30th Real Estate TRENDS conference this week, where he shared economic and political insights on the recent elections, on the Fed’s rate cuts, ongoing economic trends in CRE, and the industry’s upcoming political and regulatory landscape.

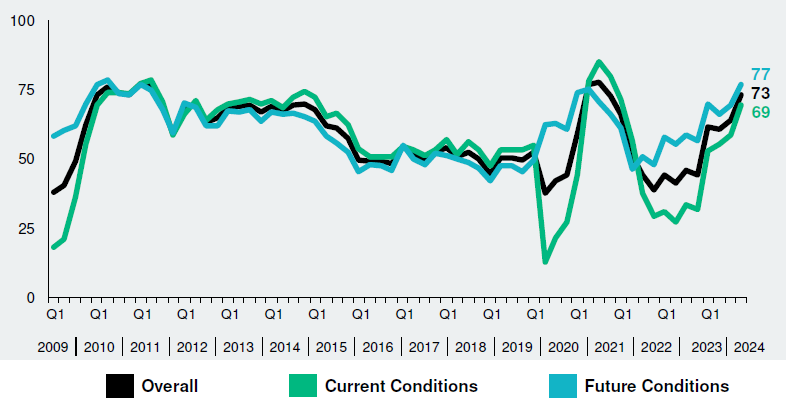

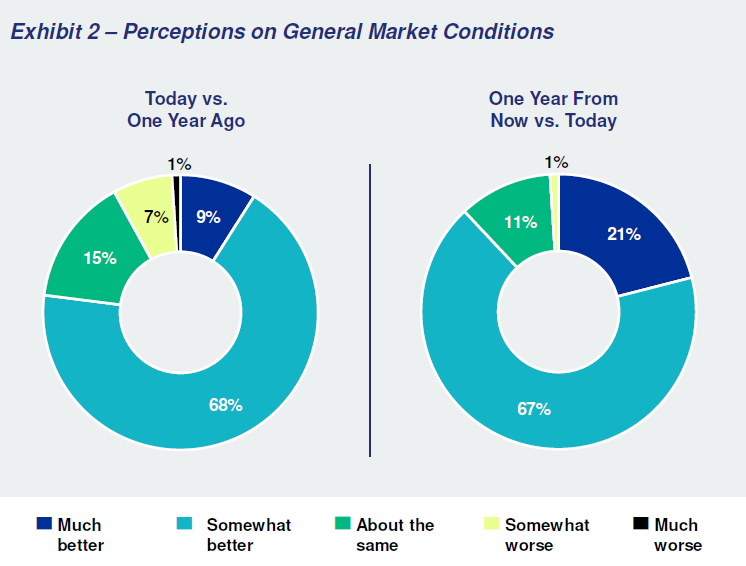

The Real Estate Roundtable’s Q4 2024 Sentiment Index reached an overall score of 73, up 9 points from the previous quarter and marking its highest score since Q4 2021. The three year high reflects industry leaders’ cautious optimism that commercial real estate markets are stabilizing, showing signs of recovery and becoming well positioned for activity in 2025.

The Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, is scored on a scale of 1 to 100 by averaging the scores of Current and Future Economic Sentiment Indices. Any score over 50 is viewed as positive.

Roundtable Perspective

Topline Findings

Data for the Q4 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in October. See the full Q4 report.