In a positive development for the commercial real estate industry, federal regulatory agencies issued a joint policy statement yesterday on CRE loan accommodations and workouts that calls for “financial institutions to work prudently and constructively with creditworthy borrowers during times of financial stress.” (Agencies’ joint statement, June 29)

Real Estate Roundtable President and CEO Jeffrey DeBoer, above, said, “We enthusiastically welcome and applaud the action of federal regulators to accommodate commercial real estate borrowers and lenders as the industry endures a time of historic, post-pandemic transition. Maturing office loans in particular face a new environment of higher operating and financing costs, much tighter bank lending requirements, and uncertainty in business space needs. This major step forward by federal regulators provides the flexibility that The Roundtable has consistently encouraged, and the relief many in the industry need, as the economy and communities struggle to move beyond the repercussions of the global pandemic.”

CRE Relief

CRE Part of Fed Stress Test

“We need to consider whether examiners have the appropriate tools and support to identify important issues and demand prompt remediation,” Bowman stated. “Increasing capital requirements simply does not get at this underlying concern about the effectiveness of supervision.” She added, “It is abundantly clear that regulatory and supervisory reform is on the way.” (Bowman speech and Bloomberg, June 25)

# # #

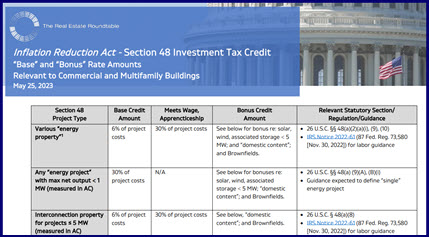

The Real Estate Roundtable submitted comments today on a proposed rule from the IRS and Treasury Department regarding “bonus” tax credits for renewable energy investments in low-income communities, passed by Congress as part of the Inflation Reduction Act (IRA). (Roundtable Comment Letter, June 30)

Solar, Wind Bonus Credits

Roundtable Comments

Prior comments, information and summaries on The Roundtable’s advocacy efforts regarding clean energy tax incentives are available on our Inflation Reduction Act resources page and in Roundtable Weekly (Dec. 2, 2022 and Nov. 4, 2022).

# # #

Bipartisan legislation recently introduced in the Senate and House would reauthorize and extend the National Flood Insurance Program (NFIP) for five years, providing greater stability for real estate markets, homeowners, and small business owners as the nation continues to struggle with inflationary pressures and increased threats of extreme weather. The National Flood Insurance Program Reauthorization (NFIP-RE) Act of 2023 would also implement a series of sweeping reforms to reduce program costs, make generational investments in communities to reduce flood risk, and establish a fairer claims process for policyholders. (Legislative text and PoliticoPro, June 22)

Risk Mitigation

Proposed Changes

Sen. Menendez said, “With disastrous flooding events becoming all the more common, we must work to create a more sustainable, resilient, and affordable flood insurance program that invests in prevention and mitigation efforts, and all while ensure hard-working Americans can have peace of mind in the event of a disaster.” (Menendez news release, June 22)

# # #