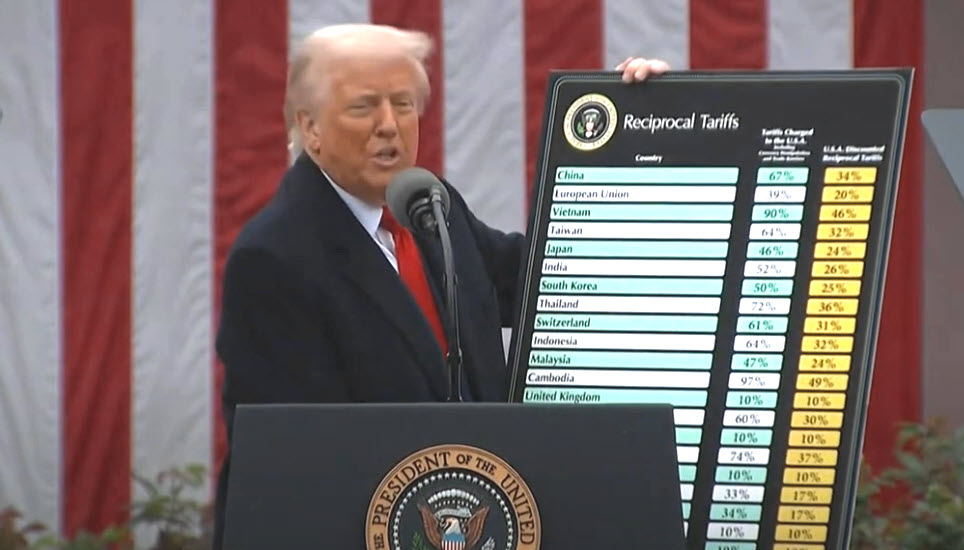

A major escalation in the White House’s trade agenda this week introduced new tariffs on imports from major global partners—while sparing Canada and Mexico in a move important for construction and development.

Recap

Implications for CRE

For now, deep uncertainties around trade and the administration’s tariff strategy leave long-term planning for investment and development in limbo. This latest round of tariffs is unlikely to be the last. RER will continue to track coverage on tariffs, and the implications for commercial real estate.

This week saw a major announcement from President Trump on sweeping new tariffs and movement in Congress as the Senate advances a compromise budget resolution, with big implications for tax and spending cuts.

Budget Resolution Moves Forward

Tax Policy Implications

Looking Ahead

The coming weeks are a critical time for the administration and congressional leaders on key issues, including trade and tax policy. RER will continue to engage with policymakers to advocate for pro-growth policies that support investment, job creation and healthy real estate markets.

The Real Estate Roundtable (RER) wrote to the sponsors of the Opportunity Zone tax incentives encouraging them to extend and improve the tax benefits, which have successfully mobilized private investment in historically underserved communities. The letter to Senator Tim Scott (R-SC) and Representative Mike Kelly (R-PA) emphasizes the need for a long-term extension and targeted reforms to maximize OZs’ economic impact. (Letter)

CRE Impact

Roundtable Policy Recommendations

Under current law, the OZ tax benefits are phasing down and will expire altogether for new investments made after December 31, 2026. First and foremost, RER is advocating for a long-term extension of OZ tax benefits to spur continued investment and provide certainty to the private sector. Additional recommendations include: provide certainty to the private sector. Additional recommendations include:

What’s Next

RER will continue engaging with lawmakers to advance these recommendations and ensure Opportunity Zones remain a powerful tool for economic development.

The Real Estate Roundtable (RER) and industry partners voiced strong support for Environmental Protection Agency’s (EPA) ENERGY STAR program in a letter to Administrator Lee Zeldin this week—urging continued support for the voluntary, market-driven platform that underpins building efficiency, grid reliability, and energy cost savings. (Letter)

Why It Matters

Facts and Stats

Driving the Energy Comeback

The real estate industry letter how ENERGY STAR supports EPA goals to:

Energy Hearings on Capitol Hill

RER remains committed to continued collaboration with EPA to advance the ENERGY STAR program as part of the administration’s 'all of the above' energy strategy, and goals to make the grid more resilient and reliable.

The Real Estate Roundtable mourns the loss of Donald B. Susswein, a longtime member, brilliant tax expert, and dedicated mentor who passed away April 2.

A funeral service is scheduled for Tuesday, April 8 at the Garden of Remembrance Chapel in Clarksburg, MD with a live stream available. In lieu of flowers, a donation in his memory can be made to the Special Olympics, Young Artists of America, and Donate Life DC. (See Obituary for details)