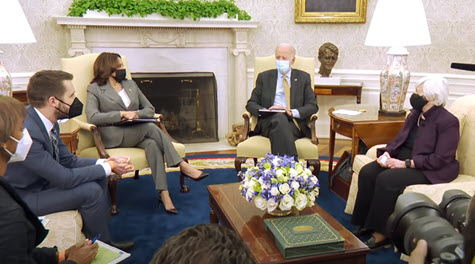

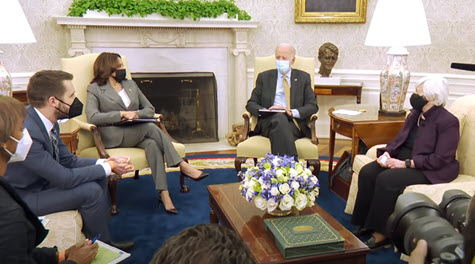

President Joe Biden this week met with a bipartisan group of policymakers about the details of his multitrillion infrastructure proposal as a bloc of moderate GOP senators stated they are developing a far less expensive counterproposal that would pare back the definition of what comprises “infrastructure” and fund it with unspecified user fees. (Washington Post, April 14)

- Sen. Mitt Romney (R-UT), who is involved in talks about an alternative infrastructure plan, said, "The pay-for ought to come from the people who are using it," suggesting that a transportation mileage charge could be applied to electric vehicle drivers. "Clearly by bringing in additional revenue from actual miles driven is going to create some additional revenue," Romney said. (Politico Pro, April 14)

- Rep. Donald Payne, Jr., chairman of the House Transportation Subcommittee on Railroads, attended the White House meeting where President Biden said he was “prepared to negotiate” on his new infrastructure-focused economic plan – and expressed support for the Gateway project, a major rail tunnel project between New York and New Jersey. (BGov, April 12)

SALT Caucus

- An effort by members of Congress to repeal the cap on state and local tax deductions (SALT) is adding to the complexity of negotiations over the White House infrastructure proposal. Yesterday, a bipartisan congressional “SALT caucus” was launched to push for the full repeal of the $10,000 limit on state and local deductions, which was enacted as part of the 2017 Republican tax overhaul. (Bloomberg, April 15)

- It is unclear how many members of the bipartisan caucus would link their support for Biden’s infrastructure proposal, and its increased corporate taxes, to action on the SALT cap. Reps. Josh Gottheimer (D-NJ) and Tom Suozzi (D-NY), who co-chair the SALT caucus, said they “will not accept any changes to the tax code that do not restore the SALT deduction.” (CNBC, April 15)

- Additionally, several New York Democrats sent a letter to House leadership on April 13 urging for a full repeal. “We will not hesitate to oppose any tax legislation that does not fully restore the SALT deduction,” according to the letter. (BGov and Wall Street Journal, April 13)

Energy-Efficient Buildings

- The White House’s infrastructure plan and the importance of energy efficient buildings was noted in a recent New York Times interview with White House National Economic Council Director Brian Deese.

- Deese stated during the April 9 Ezra Klein Show (podcast), “… it’s been true for multiple years that energy efficiency upgrades in commercial buildings should just happen, and they’re not. The built environment and industry get less attention but are extraordinary opportunities. And this [infrastructure] plan has a very significant investment in upgrading buildings and making them more energy efficient.”

- He added, “The jobs doing that happen all around the country. They’re construction jobs, building trades. A lot of it is actually high-value investment, where providing an incentive could actually unlock a bunch of private capital to invest, particularly in the commercial building space.”

- Deese is scheduled to participate in next week’s Roundtable Spring Meeting, along with U.S. Department of Transportation Secretary Pete Buttigieg. The remote discussions will be available on The Roundtable’s YouTube channel by April 21.

The Roundtable is part of the Build by the 4th coalition, led by the U.S. Chamber of Commerce, which encourages the Biden Administration and Congress to pass a comprehensive infrastructure deal by Independence Day 2021.

# # #