| Real Estate Roundtable President and CEO Jeffrey DeBoer |

The House of Representatives on Sept. 11 passed the Secure and Fair Enforcement (SAFE) Banking Act [H.R. 1595 (116)] – a Roundtable-supported bill that would allow federally regulated banks to provide mortgage and financial services to state-licensed, cannabis-related businesses (“CRBs”) without the threat of federal penalties. (Wall Street Journal, Sept. 25)

- The SAFE Banking Act would also provide protection from the threat of federal enforcement action for real estate owners, law firms and other businesses that provide services to state-approved CRBs.

- The bill – authored by Reps. Ed Perlmutter (D-CO) and Denny Heck (D-WA) and cosponsored by Reps. Steve Stivers (R-OH) and Warren Davidson (R-OH) – passed by a vote of 321 to 103.

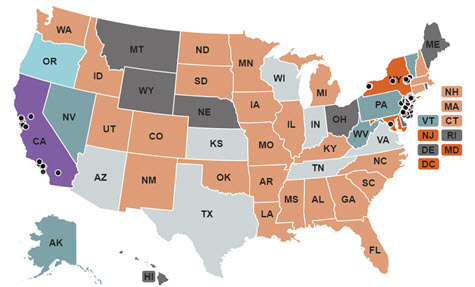

- Today, 47 states, four U.S. territories, and the District of Columbia – representing 97.7 % of the U.S. population – have legalized some form of recreational or medical marijuana, including CBD oil. (Rep. Perlmutter news release, Sept. 25)

- Rep. Perlmutter stated, “Thousands of employees, businesses and communities across this country have been forced to deal in piles of cash because of the conflict between state and federal law. After six years of working on this bill, the SAFE Banking Act will go a long way in getting cash off our streets and providing certainty so financial institutions can work with cannabis businesses and employees.”

- The Real Estate Roundtable sent a letter urging swift enactment of SAFE Act in March to the leadership of the House Financial Services and Judiciary Committees. Roundtable President and CEO Jeffrey DeBoer noted in the letter, “H.R. 1595 clarifies that banks could not take adverse action on a loan to a real estate owner solely because that owner leases property to a legitimate CRB. The measure also protects sellers and lessors of real estate and other CRB ‘service providers’ by clarifying that proceeds from legitimate marijuana-related transactions do not derive from unlawful activity, and thus do not provide a predicate for federal criminal money laundering.” (Roundtable letter, March 25, 2019)

- In the Senate, the Banking, Housing and Urban Affairs Committee in July held a hearing on the banking-related challenges faced by CRBs. The hearing featured testimony by Sens. Cory Gardner (R-CO) and Jeff Merkley (D-OR), co-sponsors of the SAFE Banking Act (S. 1200).

- Sen. Gardner stated on Wednesday, “The conflicting federal and state marijuana laws make it difficult for legitimate businesses to use basic financial services, and this bipartisan legislation gets Washington out of the way and gives them the access they need to do business and pay taxes. Today’s historic action in the people’s House adds to the momentum the SAFE Banking Act gained following the Banking Committee’s hearing in July. The Senate should move forward with the SAFE Banking Act and deliver it to the President for his signature.” (Gardner news release, Sept. 25)

- In an interview with Politico, Senate Banking Chairman Mike Crapo (R-ID) said, “”This is an issue in which I have seen strong support not only across the country from various banking institutions, even the small community banks in states that don’t have the issue, but also among colleagues on both sides of the aisle,” he said. “I think there will be good support for it.” (Politico, Sept. 27)

- Sen. Crapo also said he may consider new additions to a Senate cannabis banking bill that could include anti-money laundering measures.

Amendments were added to the House SAFE Banking Act to make it more appealing to Senate leadership, yet prospects for the bill’s passage in the Senate remain uncertain. (MarketWatch and Politico, Sept 26)

# # #