This week, the Federal Open Market Committee (FOMC) voted 9-2 to hold rates steady. Two Trump-appointed Fed governors, Michelle Bowman and Christopher Waller, voted against the decision, marking the first FOMC meeting since 1993 in which more than one board governor dissented from the majority.

The Fed’s Decision

- Fed officials continue to follow a “wait-and-see” approach regarding the impact of tariffs on the economy and the question of who will ultimately bear the costs.

- The central bank left borrowing rates unchanged at 4.25 percent to 4.5 percent after meeting on Wednesday, despite an aggressive push from President Trump to slash borrowing costs to 1 percent. (Financial Times, July 30)

- The FOMC’s post-meeting statement expressed only a couple of changes in its views on economic conditions since its last meeting in June.

- “The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated,” read the statement. At the FOMC’s June meeting, the committee had a more optimistic view, saying the economy “continued to expand at a solid pace.” (CNBC, July 31)

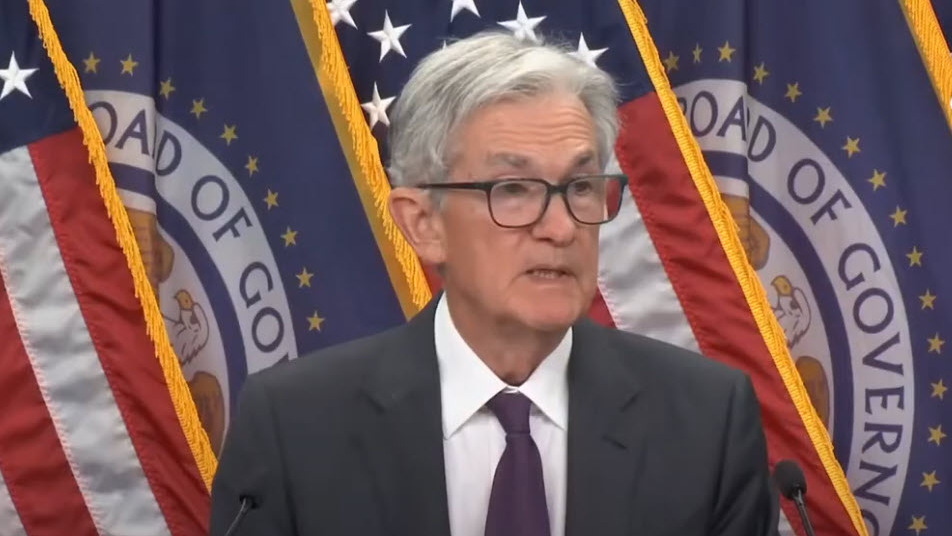

- Fed Chair Jerome Powell was committed to making sure any one-time increases in prices didn’t lead to more persistent inflation. “We want to [lower rates] efficiently… If you move too soon, you wind up maybe not getting inflation all the way fixed and you have to come back [and raise rates]. That’s inefficient. If you move too late, you might do unnecessary damage to the labor market,” said the chair.” (WSJ, July 30)

Implications for CRE

- Wednesday’s hold, which was widely expected, is unlikely to push investors in any new direction, as U.S. CRE capital markets are already outperforming forecasts this year. (BisNow, July 30)

- In parallel, many lenders have started the process of taking enforcement actions on loans past their maturity date while also tracking what may happen with interest rates before executing. (Commercial Observer, July 30)

- The Fed’s decision reinforces findings from RER’s Q2 2025 Sentiment Index, which indicated that the CRE executives expressed a decline in market confidence, as policy uncertainty, rising costs, and investor caution continue to cloud the outlook. (RW, June 20)

Looking Ahead

- Focus will now turn towards the September FOMC meeting, as the central bank confronts competing signals about the health of the U.S. economy. (WSJ, July 30)

- The Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, rose last month, suggesting that tariffs may be driving some prices higher. (CBS News, July 31)

- However, new economic data this week suggested that the U.S. economy so far seems to have avoided significant tariff-related inflation. (Semafor, July 30)

- The Commerce Department said U.S. gross domestic product—the value of all goods and services produced across the economy—rose at a seasonally and inflation adjusted 3% annual rate in the second quarter. That is up from a 0.5% contraction in the first quarter. (Wall Street Journal, July 30)

- Despite some encouraging signs, Chair Powell’s reluctance to signal a September rate cut was perceived as hawkish. (Financial Times, July 30)

- In the meantime, the coming months will likely come with more debate among political leaders around the role of the Fed in the U.S. economy.

- President Trump’s displeasure with the Fed’s resistance to cut rates has twice taken him to the verge of trying to fire Powell, spooking markets and raising concerns about the central bank’s independence. (Axios, July 31)

Chair Powell is expected to speak at the Jackson Hole Economic Symposium on August 22. With the labor market weakening, inflation holding steady, and political pressure mounting, the speech could offer hints about the likelihood of a rate cut in September. (Barrons, July 30)