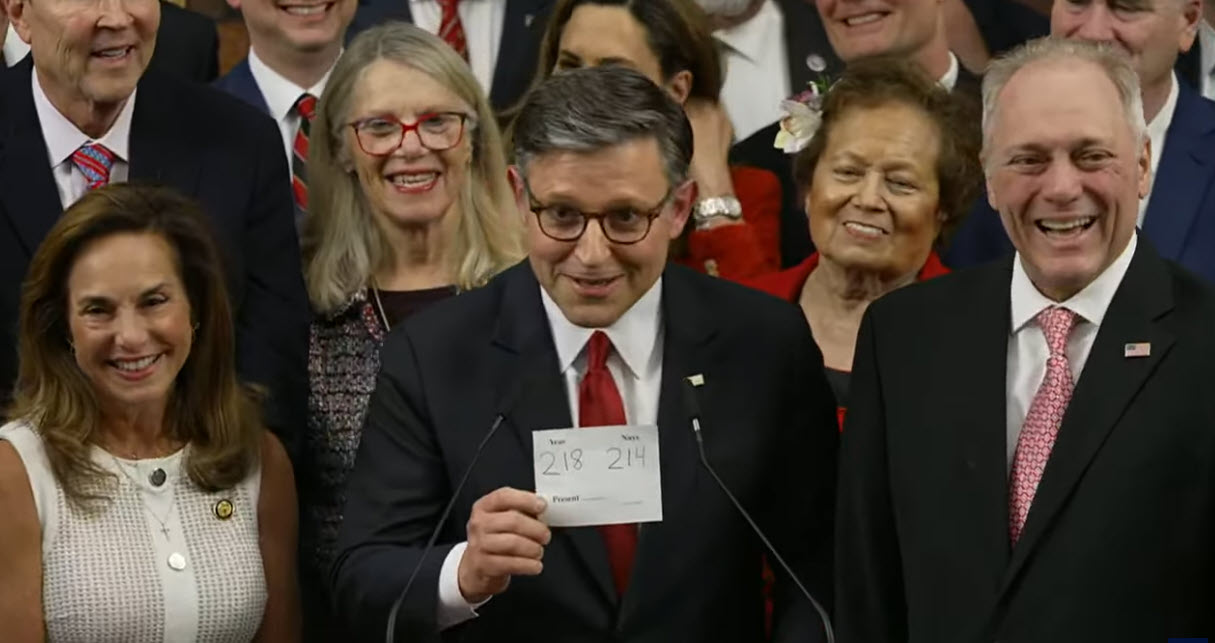

The Senate Appropriations Committee on Thursday advanced bills to fund rental assistance, transit-oriented development loans, ENERGY STAR, and other key programs important to real estate, for the federal fiscal year that starts Oct. 1. The measures come as congressional leaders rush to complete appropriations work ahead of the Sept. 30 funding deadline to avoid a government shutdown.

HUD Programs

- The full Senate Appropriations committee passed the “T-HUD” bill to fund the Departments of Transportation and Housing and Urban Development, on a strong bipartisan vote (27-1). (Senate Press Release, July 24) (PoliticoPro, July 24)

- The bill allocates $73.3 billion overall to HUD—maintaining or increasing funding for rental assistance, homelessness services, and economic development. (Bill Summary | Text )

- Project-based rental assistance would receive $17.8 billion, a roughly $900 million increase above FY25 enacted levels. This funding provides a full renewal of housing contracts serving about 1.2 million households.

- Tenant-based rental assistance would receive $33.9 billion to renew Section 8 vouchers. (THUD bill report, p. 115) The Senate’s funding levels contrast with the Trump Administration’s May 2 proposal to significantly cut both tenant- and project-based assistance.

- The Community Development Block Grant (CDBG) program would receive $3.1 billion, with $1.2 billion allocated for the HOME Investment Partnership program.

- Last week, the House Appropriations Committee passed its version of T-HUD funding (Bill Text | Summary). The full House of Representatives has yet to vote on it. (Roundtable Weekly, July 18)

DOT Programs

- The U.S. Department of Transportation (DOT) would receive $26.5 billion under the Senate T-HUD bill. (Senate press release, July 24).

- This includes a modest increase (over current FY levels) for the Build America Bureau (BAB), which oversees the TIFIA/RRIF federal loan programs. These programs can provide favorable, long-term, low-interest federal loans for transit-oriented developments, including housing and property conversions near mass transit. (FAQs)

- The funding bill’s underlying report (p. 22) explains that DOT and HUD shall establish a “task force” to improve the TIFIA/RRIF loan process, with a report due back to the House and Senate on ideas for removing “administrative and statutory barriers” to access financing.

- RER has long advocated for policies to streamline TIFIA/RRIF underwriting. (Roundtable Weekly, Dec. 1, 2023; April 19, 2024; Letter, April 15, 2024).

EPA – ENERGY STAR

- Senate appropriators on Thursday also passed a bill to fund EPA and related agencies. The strong bipartisan vote (26-2) approved a $600 million increase over the House version that passed earlier this week. (PoliticoPro, July 24) (Bill Summary | Text)

- The Senate’s bill text specifies $36 million next fiscal year, for the popular ENERGY STAR program, recognizing leadership in energy-efficient buildings, homes, and products.

- The underlying report language for the Senate bill states that the Appropriations Committee “recognizes the value of and continues to support ENERGY STAR” – with a directive for EPA to “report back” on its plans for the program’s future implementation.

- On the House side on Tuesday, the Appropriations Committee likewise showed support for ENERGY STAR. It passed a “manager’s amendment” on voice vote, instructing EPA to fund ENERGY STAR in FY’26. (PoliticoPro, July 22)

- RER has long urged the “business case” to support the ENERGY STAR program. It is working with multi-industry partners in the real estate, manufacturing, consumer tech, and retail sectors to explain to Congress and the Administration why ENERGY STAR is critical to the national “energy dominance” agenda. (Roundtable Weekly, June 6; May 23).

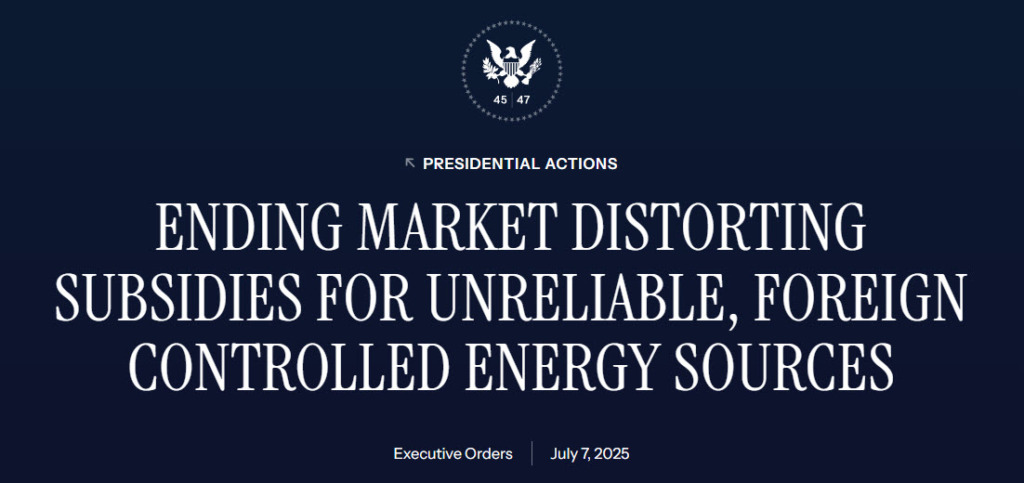

Agency Reorganizations

- It is not yet clear how any FY’26 funds appropriated by Congress may interact with particular internal plans from federal agencies to reorganize and eliminate programs.

- An 8-1 decision in July by the U.S. Supreme Court allows the Trump administration to move forward with large-scale staff reductions and structural overhauls across 19 federal departments. (Politico, July 8)

- As part of government-wide efforts triggered by the DOGE Executive Order, restructuring plans and layoffs are under consideration at the EPA. (Politico, July 17)

What’s Next

- Senate Majority Leader John Thune (R-SD) has indicated that he wants to sign as many spending bills into law as possible, then use a short-term stopgap measure to cover the remaining agencies and avert a shutdown before the Sept. 30 deadline. (PoliticoPro, July 23)

- Any specific agency reorganization and staff layoff plans may be released in the coming weeks.

RER will continue to monitor all developments on matters of appropriations and federal agency reorganizations relevant to real estate.