Over three-quarters of the Republican Members of the House Ways and Means Committee on Feb. 20 urged Treasury Secretary Steven Mnuchin to remove tax barriers to foreign investment in U.S. real estate and infrastructure.

- The congressional letter, led by Representative Devin Nunes (R-CA), encourages Treasury to withdraw section two of IRS Notice 2007-55. The Notice, which relates to the Foreign Investment in Real Property Tax Act (FIRPTA), effectively imposes U.S. capital gains tax on the liquidating distributions of a domestically controlled REIT.

- Domestically controlled REITs commonly are employed in joint ventures where a foreign investor is a minority partner in a U.S. real estate or infrastructure investment. Prior to the Notice, a liquidating distribution from a domestically controlled REIT was treated as nontaxable sale of stock for tax purposes.

- The 16 signatories of the February 20 letter wrote that “repealing the IRS Notice will restore the intent of Congress with respect to the tax law governing liquidations, provide parity to investors, and increase direct foreign investment in U.S. commercial real estate and infrastructure in every corner of the nation.”

- The Ways and Means Republican letter comes on the heels of a high-profile exchange on the broader economic harm caused by FIRPTA at a recent Ways and Means tax hearing. At the hearing, Rep. Kenny Marchant (R-TX), said that “FIRPTA is an outdated, discriminatory law. It applies to no asset class other than real estate and infrastructure . . . Economic studies indicate repealing FIRPTA could drive $65 to $125 billion in new investment.” Rep. Marchant is lead sponsor of the bipartisan Invest in America Act (H.R. 2210), a bill to repeal FIRPTA altogether. (Watch video of Feb. 11 FIRPTA exchange)

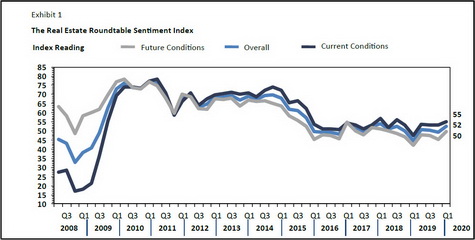

- In conjunction with The Roundtable’s Tax Policy Advisory Committee (TPAC) meeting on January 29, Darin Mellott, Director of Americas Research at CBRE shared updated data indicating that foreign capital represented only 10 percent of total transaction volume between 2007 and 2019 – further evidence that FIRPTA weighs heavily on potential inbound investment. In other asset classes, such as manufacturing, foreign capital represents a much larger share of overall investment.

- A letter similar to the House Republican letter was sent by a bipartisan group of 11 Senate Finance Committee Members to Secretary Mnuchin on December 18, 2019. The December letter was led by Sen. Robert Menendez (D-NJ), a longtime lead sponsor of bills to roll back FIRPTA, and Sen. Johnny Isakson (R-GA). A bipartisan House Ways and Means Committee letter urging repeal of the Notice and signed by 32 Representatives was sent to Secretary Mnuchin shortly before introduction of the Tax Cuts and Jobs Act of 2017 (TCJA). ( Roundtable Weekly , Dec. 20, 2019)

Members of the Roundtable’s Tax Policy Advisory Committee have met with Treasury officials on multiple occasions to discuss the harm caused by IRS Notice 2007-55. Since 2017, Treasury’s regulatory agenda has focused on implementing the TCJA. With TCJA implementation nearly complete, The Roundtable is now urging Treasury officials to give the Notice the attention it merits.