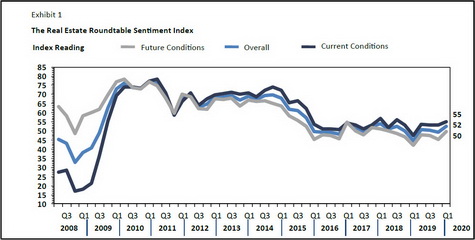

The Real Estate Roundtable’s 2020 Q1 Economic Sentiment Index released this week registered a three point increase over the 2019 fourth quarter index. Commercial real estate (CRE) industry executives continue to experience generally balanced market fundamentals across nearly all product types, with limited overbuilding and conservative overall industry debt. CRE executives also positively noted the continued macro-economic job growth and low interest rates. Election year politics and international tensions somewhat temper the overall optimistic sentiment causing some CRE executives to prepare for potential market disruptions later in 2020.

“As our Q1 index shows, we are beginning a new decade optimistic about continued overall economic growth,” said Roundtable President and CEO, Jeffrey D. DeBoer. “Commercial real estate markets remain fundamentally sound; supply and demand are in relative balance; debt and equity capital markets are functioning and disciplined; wages are rising; and, unemployment is low,” DeBoer added.

The Roundtable’s Q1 2020 Sentiment Index registered at 52 – a three point increase from the previous quarter. [The Overall Index is scored on a scale of 1 to 100 by averaging Current and Future Indices; any score over 50 is viewed as positive.] This quarter’s Current-Conditions Index of 55 increased two points from the previous quarter, while this quarter’s Future-Conditions Index of 50 came in at five points higher compared to Q4 2019.

The report’s Topline Findings include:

- The Real Estate Roundtable Q1 2020 Sentiment Index registered a score of 52, a three point increase over the last quarter of 2019. Respondents feel the overall economy is stable and the commercial real estate market continues to be supported by strong market fundamentals. Many respondents have stopped attempting to predict an end to this cycle as they see no apparent economic hurdles to current market stability.

-

Despite respondents finding comfort with the current market climate, many are anticipating two phases of the 2020 calendar year: pre-election and post-election. Many noted that election years are notoriously unpredictable and point to a large volume of transactions already underway as platforms attempt to execute before the summer.

-

Asset values remain elevated across most property types and geographies. While certain respondents suggest that asset values have room to grow, others view current pricing as being at peak levels.

-

Debt and equity capital are perceived as widely available in most markets. Many respondents noted the high level of discipline they are witnessing in the debt markets on behalf of lenders. This level of discipline suggests a healthy state in the capital markets, and is a contributing factor to the continuation of the current cycle.

DeBoer noted, “There is natural concern regarding the uncertainty of the coming presidential election. However, the commercial real estate industry’s leading executives are positive about today’s economy and optimistic about future market conditions. As the year progresses, The Roundtable will continue working with national policymakers to maintain and strengthen pro-growth policies to create jobs, expand housing opportunities, and benefit the overall economy.”

Data for the Q1 survey was gathered in January by Chicago-based FPL Associates on The Roundtable’s behalf. For the full survey report, visit http://www.rer.org/Q1-2020-Sentiment-Index/