Congressional Democrats racing to enact President Biden’s landmark $1.9 trillion COVID-19 relief package before unemployment benefits expire March 14 passed The American Rescue Plan Act of 2021 (H.R. 1319) early Saturday morning on a near party-line vote. The massive aid bill now goes to the 50-50 Senate where Democrats cannot afford to lose a single vote. (Associated Press, Feb. 27 and Politico, Feb. 26 and text of the bill)

- More than 170 corporate CEOs from the New York City area – including 34 members of The Real Estate Roundtable – issued a public letter to leaders of Congress days before the vote, urging rapid, bipartisan adoption of a stimulus package on the model of the American Rescue Plan. (CNBC, and Partnership for New York City, Feb. 24)

- The House bill provides $638 billion in tax cuts, offset by $45 billion in tax increases, representing over 2% of GDP in 2021 and a significant individual income boost for low- and middle-income Americans. While there is no business tax relief in the bill, it includes:

- $245 billion to extend enhanced unemployment benefits through August;

- $350 billion in fiscal assistance for States and localities;

- $170 billion for schools and colleges – and $85B for vaccine distribution.

- $30.5 billion in grants to mass transit

- Key elements of the bill affecting real estate include:

- $19 billion for residential rental assistance through Sept. 30, 2027, which adds to the existing $25 billion in rental assistance provided in December’s omnibus legislation;

- $10B homeowner assistance fund to help prevent foreclosure or eviction due to the pandemic;

- a new $25B Restaurant Revitalization Fund to provide cash grants to food and beverage establishments.

- See The Roundtable’s Summary and Analysis of Key Economic Provisions in The American Rescue Plan.

- The House at this time is not expected to include an increase in the minimum wage in the legislative package, after the Senate’s parliamentarian ruled yesterday that the measure does not comply with reconciliation rules, and could not be included in a Senate bill. (Axios, Feb. 25 and Feb. 26 / Wall Street Journal and Politico, Feb. 25)

Fed Concerns on Pandemic & CRE

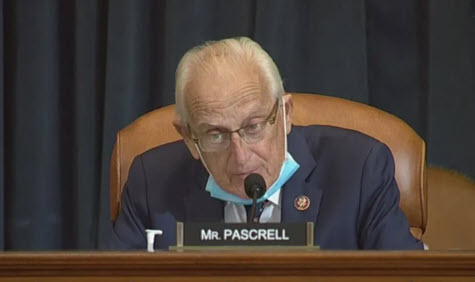

As the $1.9 trillion relief package made its way through the House this week, Federal Reserve Chairman Jerome Powell testified before congressional committees on the Fed’s semiannual monetary policy report to Congress before the Senate Banking, Housing and Urban Affairs Committee on Feb. 23 and the House Financial Services Committee on Feb. 24.

- The Fed’s Feb. 19 Monetary Policy Report warned of significant risks to the economy as a result of the ongoing national impact of the pandemic. The report noted, “Commercial real estate prices remain at historically high levels despite high vacancy rates and appear susceptible to sharp declines, particularly if the pace of distressed transactions picks up or, in the longer term, the pandemic leads to permanent changes in demand.” (Bloomberg, Feb. 19, “Fed Sounds Alarm on Commercial Real Estate, Business Bankruptcy”)

“We don’t have a plan specifically for commercial real estate,” Powell testified. “I will say that we do see a number of sectors of commercial real estate that are under pressure, particularly office [and] hotels … which are directly affected by a pandemic. The best thing that can happen for the commercial real estate sector is [to] … get the pandemic behind us.” (Powell House Testimony)

# # #