The expansion of remote work in Washington, DC has dramatically reduced tax revenue from office buildings, which poses “a serious long-term risk to the District’s economy and its tax base,” according to a Feb. 28 revenue estimate from the city’s CFO Glen Lee. (Washington Post, March 1)

$464M Revenue Drop

- DC’s tax revenue is projected to plunge nearly a half-billion dollars from 2024-2026 due to remote work’s influence, reduced office transactions, and dropping asset values. (BisNow and DCist, March 1)

- The quarterly report notes that tax revenue from District commercial properties —particularly large office buildings valued over $50 million—significantly declined in the past fiscal year and was the main reason for a reduction in overall real property tax revenue in FY 2022.

- The city’s forecast, according to Lee’s letter to District Mayor Muriel Bowser and Council Chairman Phil Mendelson, has also been “revised downward by $81 million in FY 2024, $183 million in FY 2025, and by approximately $200 million in FY 2026.”

- The report states that although real property revenue from hotels, restaurants and retail properties is expected to continue on a path of recovery, “this growth is expected to be more than offset by a deeper loss in tax revenue from office properties.”

The Roundtable View

- Mayor Bowser this week stated, “With the ongoing impacts of telework and national political uncertainties, we face another significant test to our local economy.” (Bowser Statement, Feb. 28)

- In January, Bowser reiterated views expressed by The Real Estate Roundtable to President Biden the previous month about the need to get more federal workers back to the workplace and convert underutilized commercial real estate spaces into affordable housing. (Roundtable Weekly, Jan. 6)

- The letter from Real Estate Roundtable Chair John Fish, above right, (SUFFOLK Chairman & CEO) and President & CEO Jeff DeBoer, left, also urged Biden “to direct federal agencies to enhance their consideration of the impact of agency employee remote working on communities, surrounding small employers, transit systems, local tax bases and other important considerations.” (Roundtable letter, Dec. 12, 2022)

- City officials in New York, Washington, Chicago, Houston, San Francisco, and Boston have also recently encouraged city workers to return to their downtown offices. (Wall Street Journal, Jan. 24)

Economic Consequences

- The DC revenue forecast also warned, “The population decline observed during the pandemic, coupled with the increasing prevalence of remote work, may lead to demographic shifts and economic repercussions. With fewer commuters, there may be less demand for public transportation and office space, leading to a potential reduction in real estate prices. Policymakers will need to carefully monitor and respond to these changes.”

- Separately, The Wall Street Journal reported on Feb. 28 that return-to-office rates in Paris and Tokyo have climbed to over 75%, while U.S. office occupancy stands at about half of prepandemic levels, depending on the city. (WSJ, “As Americans Work From Home, Europeans and Asians Head Back to the Office”)

The consequences of remote work on CRE—and potential policy solutions—will continue to be a focus of The Roundtable.

# # #

Tax provisions affecting individuals and small businesses originally enacted as part of the Tax Cuts and Jobs Act (TCJA) of 2017—along with the state and local tax (SALT) deduction cap—would be made permanent under legislation reintroduced this month by House Ways and Means Committee Vice Chairman Vern Buchanan (R-FL), above. (

Tax provisions affecting individuals and small businesses originally enacted as part of the Tax Cuts and Jobs Act (TCJA) of 2017—along with the state and local tax (SALT) deduction cap—would be made permanent under legislation reintroduced this month by House Ways and Means Committee Vice Chairman Vern Buchanan (R-FL), above. (

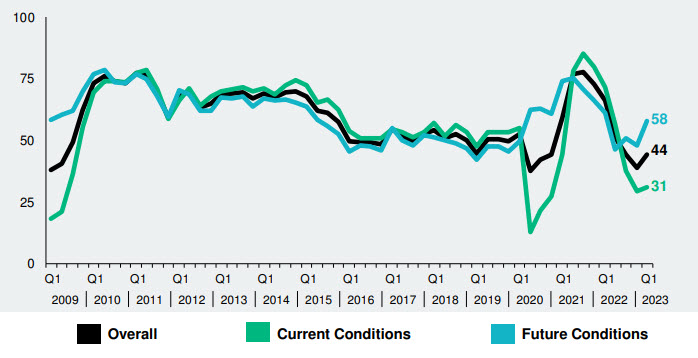

This week, commercial real estate was a prominent focus of the Federal Reserve’s quarterly senior loan officer opinion survey and announcement about the hypothetical scenarios that 23 banks will be stress-tested against in 2023. (

This week, commercial real estate was a prominent focus of the Federal Reserve’s quarterly senior loan officer opinion survey and announcement about the hypothetical scenarios that 23 banks will be stress-tested against in 2023. (