The Real Estate Roundtable (RER) submitted a letter of support this week for the Main Street Capital Access Act (H.R. 6955). RER praised the bill as a long-overdue step toward “common sense tailoring” of bank regulation in comments sent to House Financial Services Chairman French Hill (R-AR) and Financial Institutions Subcommittee Chairman Andy Barr (R-KY). (Letter, Jan. 8)

Background

- Introduced on Jan. 7, the Main Street Capital Access Act looks to ease regulations on small and mid-size banks and increase their access to capital.

- The measure bundles 29 bills that advanced through the full House Financial Services Committee last year, several of which received overwhelming bipartisan support.

- The package is a cornerstone of Chairman Hill’s “Make Community Banking Great Again” agenda. (House Financial Services Committee Press Release, Jan. 7)

- Chairman Hill said, “Over the past year, the Subcommittee on Financial Institutions under Chair Barr’s leadership has worked tirelessly to examine outdated regulations, listen directly to small businesses, and confront barriers to access capital for small and mid-sized banks. I am proud to introduce the Main Street Capital Access Act with Chair Barr to reinvigorate our community banks and return commonsense back to Main Street.”

- Chair Barr will be a featured speaker at RER’s State of the Industry Meeting next week.

- The package includes legislation that promotes new bank formation, expands local community access, tailors bank regulation, fosters fair and transparent bank supervision, and supports competition, innovation, and responsible bank partnerships.

Roundtable Advocacy

- RER’s letter emphasizes that community and regional banks are vital to the financing ecosystem for commercial and residential real estate, and therefore play a key role in addressing the nation’s housing shortage.

- “The Main Street Capital Access Act will help revitalize communities across the nation by encouraging local bank formation and enhancing credit capacity,” wrote RER President and CEO Jeffrey DeBoer. “By easing outdated regulatory burdens for community banks, it will help unlock more capital for housing and small businesses and permit Main Street community lenders to focus on serving families and local economies, making life more affordable for Americans.”

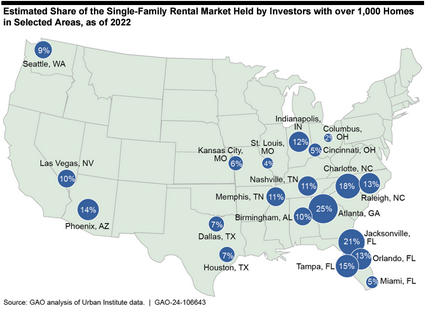

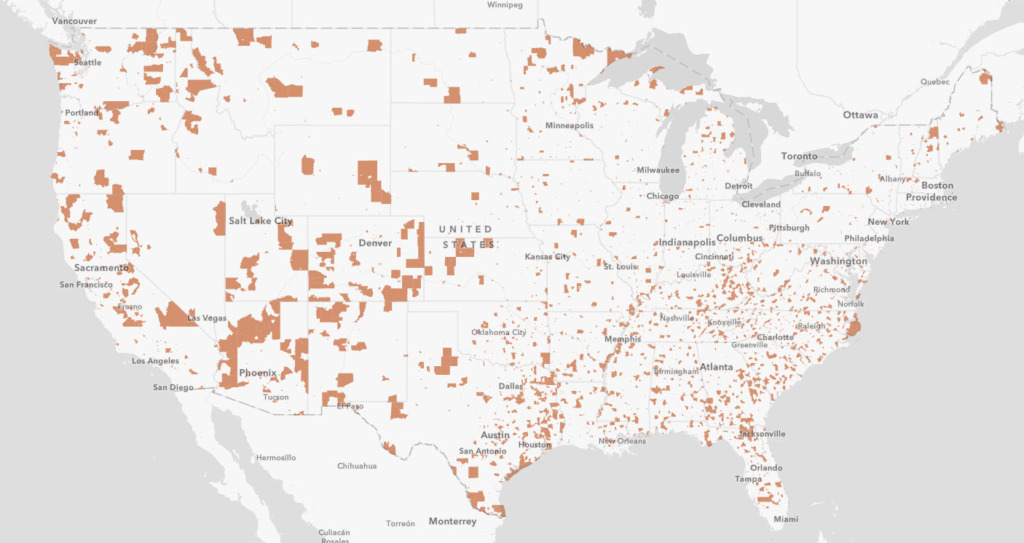

- DeBoer also underscored the impact of the decline in new bank formation in recent years. “This lack of ‘de novo’ or ‘new’ bank activity, coupled with ‘banking deserts’ that are common in rural areas, has led to higher costs for households and less access to capital and investment for small and medium-sized businesses,” DeBoer added.

Why It Matters

- Community banks serve as a primary capital source for local housing and commercial real estate projects, particularly in underserved markets where larger institutions may have little presence.

- RER has consistently advocated for right-sized financial regulation that promotes liquidity in the CRE market while maintaining safety and soundness in the banking system. The Main Street Capital Access Act aligns with this principle by streamlining oversight and promoting innovation in the small-bank sector.

Next Steps

RER will continue to work with Congress and the administration to advance policy measures that encourage capital formation, enhance credit capacity, support housing production, and foster economic development in communities around the country.