Elevated commercial real estate valuations are increasingly viewed as a near-term risk that could stress the U.S. financial system, according to the Federal Reserve’s October 2023 Financial Stability Report. The central bank’s semiannual report also cited inflationary pressures, interest rate increases, and global economic volatility as vulnerabilities—even though survey data was collected before the recent escalation of geopolitical tensions in the Middle East. (Fed’s Financial Stability Report, Oct. 2023)

CRE Risk Emphasized

- Seventy-two percent of all participants in the Fed’s survey cited the potential for large losses on commercial real estate and residential real estate—along with persistent inflation and monetary tightening—as major risks.

- The CRE asset valuation problem noted in the Fed Report is influenced by an ongoing lack of price discovery, which creates significant refinancing challenges. GlobeSt reported Oct 24 on the report, noting that “With transactions down and many sellers holding off, waiting for improved pricing while a lot of buyers look for bargains in distress, it’s hard to tell how much properties should be worth.”

WorkPlace Return Pressure

- The Fed report warns, “If the economy were to slow unexpectedly … investor risk appetite and asset prices might decline, and valuations in the office building sector appear particularly vulnerable given the ongoing uncertainty surrounding post-pandemic norms regarding return to work. A correction in office property valuations accompanied by even a mild recession could result in significant losses for a range of financial institutions with sizable exposures, including some regional and community banks and insurance companies.”

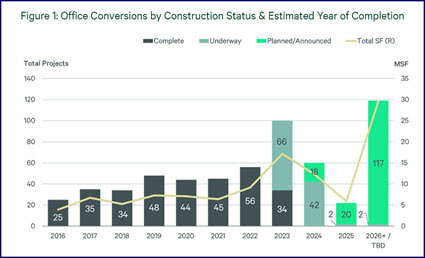

- As workplace return concerns linger, The Wall Street Journal reported on Oct. 21 about how cities are developing proposals to recast office districts into neighborhoods where people live, work and raise families. (WSJ, “America’s Downtowns Are Empty. Fixing Them Will Be Expensive”)

Additional risks that continued to feature prominently in the Fed survey were associated with the reemergence of banking-sector stress, market liquidity strains, and volatility.

# # #