The Real Estate Roundtable (RER) and a coalition of real estate organizations sent a letter to Senate Majority Leader John Thune (R-SD) and Finance Committee Chair Mike Crapo (R-ID) this week, calling for changes to the House-passed Section 899 tax proposal to prevent harm to U.S. real estate investment, property values, and economic growth. (Letter, June 12)

Why it Matters

- The retaliatory tax provision is part of the broader House reconciliation package and would impose steep tax increases on investors from countries that enact “unfair” taxes on U.S. businesses. (Bloomberg, June 12)

- The coalition letter cautions that, without changes, the retaliatory tax measure could potentially drive up borrowing costs, depress property values, and significantly deter foreign investment in housing, commercial developments, and infrastructure projects nationwide. (PoliticoPro, June 13)

- As drafted, the policy would apply broadly to both equity and debt investments in U.S. real estate, including capital gains, REIT dividends, and interest income—regardless of whether the investor has any controlling stake in the U.S. property.

- The coalition urges the Senate to revise Section 899 to exempt non-controlling real estate investments—passive holdings that do not involve day-to-day management.

- The coalition is also seeking to ensure the exemption applies to both new and existing transactions made under current law and tax treaties, and prevent an unintended retroactive tax increase that could disrupt capital markets and undermine confidence in U.S. investment stability. (Letter, June 12)

- On Institutional Real Estate, Inc.’s podcast this week, RER President & CEO Jeffrey DeBoer emphasized the importance of maintaining stable, predictable tax policy to attract investment and fuel economic growth—echoing the coalition’s call for Senate revisions to Section 899 that avoid discouraging capital formation in U.S. real estate. (IREI Podcast, June)

- Speaking at the NYU Federal Real Estate and Partnerships Tax Conference today, RER Senior Vice President and Counsel Ryan McCormick warned that Section 899 “would impose higher tax rates on foreign capital that is critical to U.S. real estate, impacting interest income, REIT dividends, and direct property investments. Without an exemption for passive investors, it would have a chilling impact on investment, raise borrowing costs, and slow economic growth.”

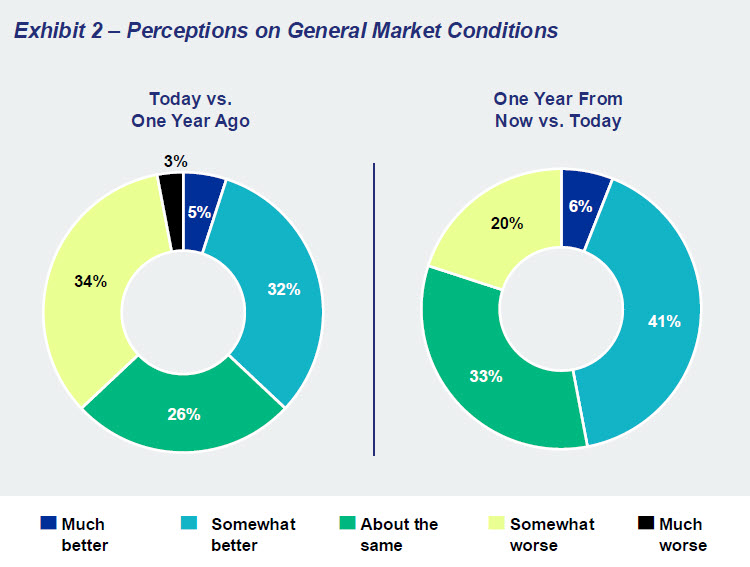

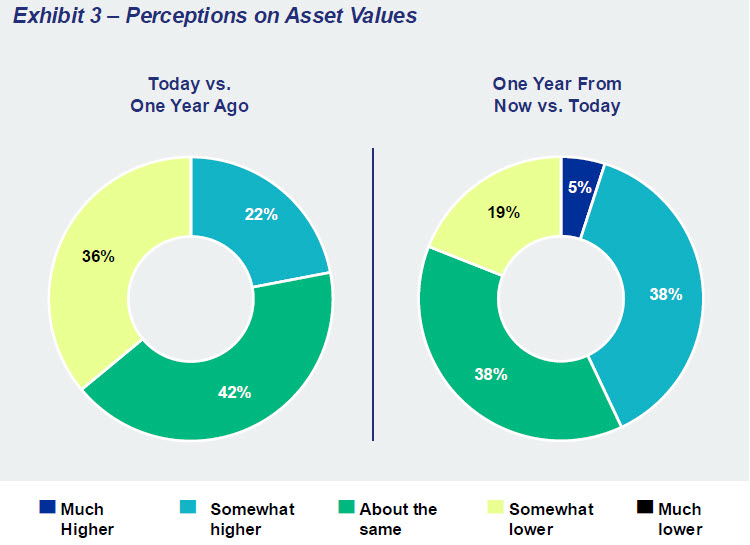

By the Numbers

- Over the past five years, foreign sources have invested more than $213 billion in U.S. commercial real estate, including $57 billion in multifamily housing. This cross-border capital supports construction, jobs, housing affordability, and local tax revenue. (Letter, June 12)

- The Joint Committee on Taxation has projected that Section 899 would lead to a “decline in foreign demand for U.S. investment” and ultimately reduce Treasury revenues. (AP News, June 10)

- The Global Business Alliance, which represents foreign multinationals with U.S. operations, released a new study on Tuesday that found Section 899 would result in $100 billion a year in lost gross domestic product. ( PoliticoPro, June 11)

View from Capitol Hill

- Republican senators have said they’re taking a deeper look at that provision and could make changes when the Senate Finance Committee’s version of the tax bill is released. (PoliticoPro, June 13)

- During a House Ways and Means Committee hearing on Wednesday, Treasury Secretary Scott Bessent defended the so-called revenge tax in the GOP megabill, in the face of concerns that it could deter foreign investment. (Watch Hearing | PoliticoPro, June 11)

- Secretary Bessent also testified at the Senate Finance Committee hearing on the president’s fiscal 2026 budget request for the Treasury and tax reform on Thursday.

- Sen. Thom Tillis (R-N.C.), who’s questioned the proposal, told reporters Tuesday that he at least expects a delay in the proposal. (Bloomberg, June 10)

- House Ways and Means Chair Jason Smith (R-MO) indicated the preferred outcome would be for the revenge tax never to take effect, urging foreign governments to eliminate discriminatory measures, such as digital services taxes. (PoliticoPro, June 11)

What’s Next

Senate Finance Republicans are expected to release revised legislative text of the One Big Beautiful Bill Act in the coming weeks. “We’re working as aggressively as we can to move as fast as we can,” Senate Finance Chair Mike Crapo (R-ID) said. (Politico, June 9)

RER continues to advocate for smart tax policy that avoids unintended consequences while maintaining the U.S. real estate market’s global competitiveness.