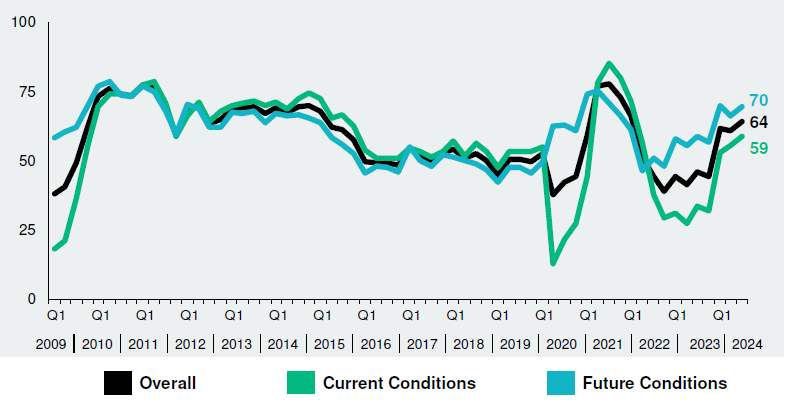

(WASHINGTON, D.C.) — The Real Estate Roundtable’s Q3 2024 Sentiment Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, suggests a growing confidence in the future of the commercial real estate market despite ongoing challenges. The Q3 Sentiment Index reported an overall score of 64, reflecting an increase of three points from the previous quarter, and the Future Index at 70, up four points from the previous quarter. This rise in sentiment marks an 18-point increase in the overall score since last year.

Roundtable President and CEO Jeffrey DeBoer said, “The increase in our Q3 Sentiment Index indicates that while uncertainty remains, the industry is gradually regaining confidence. Leaders are seeing signs of stabilization in asset values and a potential improvement in the availability of capital, which are encouraging signals as we navigate this complex environment.”

He added, “The results of the report reflect the resilience of the commercial real estate industry. The fact that a majority of executives expect better conditions in the coming year is a strong signal that although serious challenges remain, the worst may be behind us.”

The Q3 Sentiment Index topline findings include:

Some sample responses from participants in the Sentiment Index’s Q3 survey include:

“Investors still want to allocate dollars to real estate, but there is still sentiment for defensive positioning and risk mitigation.”

“Pricing is all over the board and has reset since the post-Covid boom. The magnitude of the reset depends on where the asset is in its life cycle and its financing structure.”

“Banks have pulled back, but insurance companies have a reasonable level of capital and pricing has been stable. For higher quality assets, there’s demand.”

“Spreads are tightening on construction loans, but acquisition financing is more available. There is a lot of debt capital on the sidelines for high quality asset acquisitions.”

Data for the Q3 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in July. See the full Q3 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #