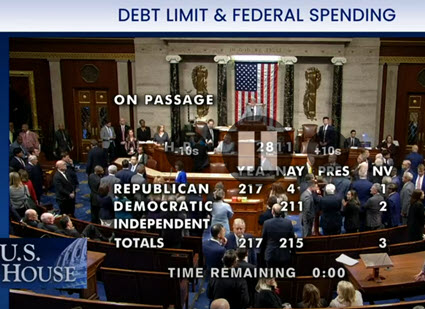

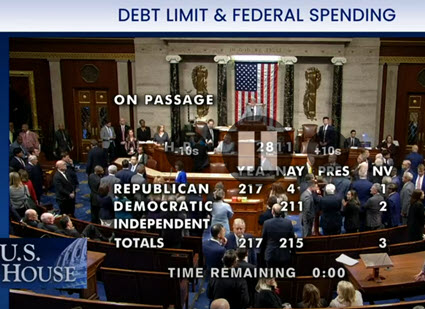

House Republicans this week narrowly passed legislation—the Limit, Save, Grow Act (H.R. 2811)—that would slash government spending and rescind much of the Biden administration’s climate-related incentives in an effort to spur bipartisan talks on raising the nation’s $31.4 trillion debt ceiling. (Roll Call, April 26 and Reuters, April 27)

Avoiding Default

- The White House issued an April 25 Statement of Administration Policy that the GOP bill would be vetoed if it ever made it to President Biden’s desk. Biden added he is willing to meet with House Speaker Kevin McCarthy (R-CA), but that extending the debt limit is “not negotiable.” Senate Majority Leader Chuck Schumer (D-NY) responded to passage of the House bill by stating it “has no hope of ever becoming law.” (Schumer Floor Remarks, April 27)

- The Congressional Budget Office released an analysis this week showing that H.R. 2811 would reduce $4.8 trillion from the deficit by setting caps on federal spending over the next 10 years—with an additional $570 billion in savings coming from rescinding energy tax provisions passed in the Inflation Reduction Act. (Tax Notes, April 27 and Roundtable Weekly, Aug. 12, 2022)

- Mark Zandi, the chief economist at Moody's Analytics testified before Congress last month that if no resolution to the debt limit is reached before mid-August, “a default would be a catastrophic blow to the already-fragile economy.” (Zandi’s written testimony, March 7)

- A previous standoff over the debt limit in 2011 led to a downgrade of the government's credit rating, which pushed borrowing costs higher. (ABC News, Jan. 24)

Roundtable Response

- The Roundtable and 13 other national real estate organizations sent a joint letter last month urging congressional leaders to raise the debt limit to avoid agitating the stability of U.S. financial markets and roiling significant sectors of the American economy unnecessarily. (Coalition letter, March 29)

- Real Estate Roundtable Chair John Fish, right above, (Chairman and CEO, SUFFOLK) and President and CEO Jeffrey DeBoer, left, have also called on Roundtable members to contact both policymakers in Congress and the White House to raise the debt ceiling. (Roundtable Weekly, Jan. 20)

- DeBoer said, “Some threats to the U.S. economy are unavoidable, others are ones of our own making and entirely unnecessary. The potential for a default on the federal debt is a needless and inexcusable risk with potentially dire consequences for U.S. real estate, workers and retirees, and the entire economy. The full faith and credit of the United States government should not be open to negotiation.”

The impact of negotiations over federal spending and raising the debt ceiling on the national economy and CRE markets was a focus of discussion during The Roundtable’s Spring Meeting this week (see story above). It is possible that intense discussions among DC policymakers on these issues will be underway during The Roundtable’s all-member meeting on June 13-14 in Washington, DC.

# # #