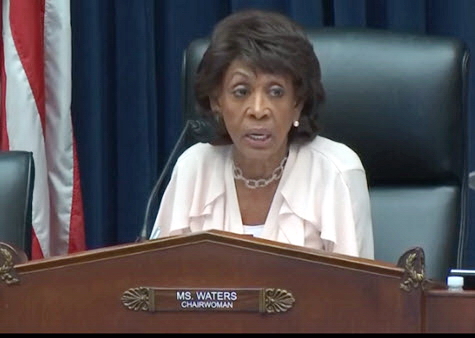

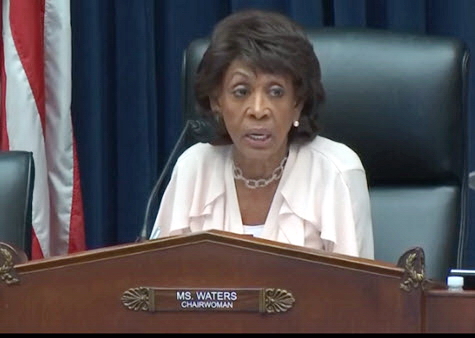

House Financial Services Committee Chairwoman Maxine Waters (D-CA), above, yesterday announced an Oct. 16 subcommittee hearing that will focus on “Protecting America: The Reauthorization of the Terrorism Risk Insurance Program.” (Committee news release, Oct. 3)

- Additionally, Financial Services Committee Member Carolyn Maloney (D-NY) will host a roundtable discussion on the reauthorization of the Terrorism Risk Insurance Act (TRIA) on Oct. 8 in New York City.

- With TRIA currently set to expire at the end of 2020, a long-term, clean reauthorization is a top priority for The Real Estate Roundtable. Yesterday, TRIA was a key topic of discussion during meetings of The Roundtable’s Homeland Security Task Force and Real Estate Capital Policy Advisory Committee in New York City.

- TRIA was originally enacted in 2002 in response to the inability of insurance markets to predict, price and offer terrorism risk coverage to commercial policyholders. The law was extended in 2005, 2007 and again in 2015 – following a 12-day lapse when Congress failed to complete their work on reauthorization at the end of 2014.

- The Roundtable and nearly 350 companies and organizations urged Congress last week to swiftly pass a long-term TRIA reauthorization. (Roundtable Weekly, Sept. 20)

- The Sept. 17 coalition letter notes, “The American business community remembers all too well the twelve-day lapse in the program in early 2015 and the disruption that lapse played in a variety of markets. We urge Congress to help provide much needed certainty by passing a long-term reauthorization of this important program without delay.”

- Absent TRIA, there is not sufficient insurance and reinsurance capital available to provide comprehensive terrorism coverage to U.S. insurance buyers,” the coalition states. (Reinsurance News, Sept. 17)

- A 2019 Marsh study shows the highest “take-up” rates for terrorism risk insurance are in the education, media, financial institutions, real estate, hospitality and gaming, and health care sectors – all above 70%.

During an October 1 podcast episode of “Through The Noise,” Roundtable President and CEO Jeffrey DeBoer noted, “Businesses and facilities of all types need to see the terrorism risk insurance program extended. This need applies to hospitals, all commercial real estate buildings, educational facilities, sports facilities, NASCAR and theme parks, and really any place where commercial facilities host large numbers of people.”

# # #