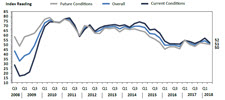

The Roundtable's Q2 2018 Economic Sentiment Index released yesterday shows that as plentiful financing and equity continue to drive commercial real estate investment activity, industry leaders continue to see balanced market fundamentals, despite rising costs of construction and an uncertain outlook for markets in 2019.

|

The Roundtable's Q2 2018 Economic Sentiment Index shows plentiful financing and equity continue to drive commercial real estate investment activity. |

The report's Topline Findings include:

|

Roundtable President and CEO Jeffrey DeBoer, "As our Q2 Index show, with debt and equity readily available for quality investments and new development opportunities, industry leaders are being forced to reevaluate, innovate, and reimagine their buildings – driven by an influx of the millennial generation and their new set of expectations for office and multifamily markets." |

"Real estate fundamentals continue to remain strong into 2018, where balance between supply and demand in almost every sector is healthy, while debt and equity for real estate as an asset class remains abundant," said Roundtable President and CEO Jeffrey DeBoer. "There are fears about political uncertainty, trade wars and interest rate increases, which are having some impact and creating a manageable amount of uncertainty for the markets for the remainder of 2018 and looking ahead to 2019."

DeBoer added, "As our Q2 Index shows, with debt and equity readily available for quality investments and new development opportunities, industry leaders are being forced to reevaluate, innovate, and reimagine their buildings – driven by an influx of the millennial generation and their new set of expectations for office and multifamily markets. It is vital for our industry to continue developing new technology solutions for the ever evolving demands of the market."

Data for the Q2 survey was gathered in April by Chicago-based FPL Associates on The Roundtable's behalf. The next Sentiment Survey covering Q3 2018 will be released in August.