The Real Estate Roundtable's 2019 Q1 Sentiment Index released today reveals confidence from commercial real estate industry executives that today's fundamentally sound CRE markets will prove resilient when the decade-long expansion of the U.S. economy inevitably slows down.

|

The Real Estate Roundtable's 2019 Q1 Sentiment Index released today reveals confidence from commercial real estate industry executives that today's fundamentally sound CRE markets will prove resilient when the decade-long expansion of the U.S. economy inevitably slows down. |

- The historically long economic expansion, stable interest rates and demand driven supply have sustained the current healthy real estate market conditions. Unpredictability about the future longevity of the economic expansion tempers the forward looking industry outlook.

- "The unsettling year-end capital market turbulence caused a degree of early 2019 industry concern. However, as the first quarter moved forward, the equity markets strengthened and positive job creation continued to fuel steady economic growth. These conditions bolstered the already well-balanced commercial real estate markets in Q1," said Roundtable CEO and President Jeffrey D. DeBoer. "Looking ahead, our CRE executive survey reveals the timing of a natural economic cycle slowdown is concerning, but that is moderated by fundamentally sound commercial real estate markets," DeBoer added.

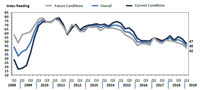

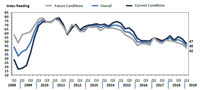

- The Roundtable's Q1 2019 Sentiment Index registered at 45 - a five point drop from the previous quarter. [The Overall Index is scored on a scale of 1 to 100 by averaging Current and Future Indices; any score over 50 is viewed as positive.] This quarter's Current-Conditions Index of 47 decreased six points from the previous quarter, while this quarter's Future-Conditions Index of 42 came in at five points lower compared to Q4 2018.

DeBoer noted, "Over the last decade, the commercial real estate industry has not overbuilt or over-leveraged, resulting in disciplined markets that could act as a resilient buffer to any potential slowdown in the U.S. economy. Our Q1 survey shows industry executives have concerns over unpredictable influences on the economy, such as the recent government shutdown and uncertain outcome of ongoing international trade talks. Policymakers need to focus on bipartisan pro-growth policies designed to encourage further investment, spur job creation and propel the economy forward for all."

Economic Slowdown Forecasts

St. Louis Fed President James Bullard told CNBC yesterday he expects the economy to slow to a 2.25% annual rate this year from 3% in 2018. Bullard is a voting member of the Federal Reserve's Federal Open Market Committee, which meets regularly to set the direction of U.S. monetary policy and interest rates.

|

St. Louis Fed President James Bullard told CNBC yesterday he expects the economy to slow to a 2.25% annual rate this year from 3% in 2018. |

- "It does seem the economy is slowing down some – not terribly – but some. That's not a terrible outcome. I don't really think we're in any trouble," Bullard said. (CNBC full interview, Feb. 21)

- Additionally, Fannie Mae yesterday released its February Economic Outlook, which forecasts s GDP growth of 2.2% this year, down from 3.1% in 2018. (Fannie Mae's Economic & Strategic Research Group, Feb. 21)

- "We reduced first quarter growth expectation slightly, but our forecast for full-year 2019 growth remains unchanged" said Fannie Mae Chief Economist Doug Duncan. "The labor market is strong, unemployment is at a very low level historically, and wages are rising modestly, enticing workers to come off the sidelines. Uncertainty regarding terms of trade remains a downside risk, as does slowing global economic growth."

Dr. Ken Rosen (Chairman, Rosen Consulting Group) led a discussion during The Roundtable's Jan. 29 State of the Industry Meeting about recent Fed actions, stock market volatility and how signs of weakness in the Chinese economy may affect future U.S. growth. (Roundtable Weekly, Feb. 1)