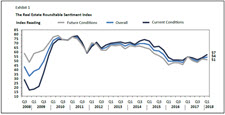

Commercial real estate industry leaders continue to acknowledge positive conditions in the economy and current real estate markets, while expressing some caution about 2019, according to The Real Estate Roundtable’s Q1 2018 Economic Sentiment Index released yesterday.

|

Participants in the Q1 survey responded they are feeling comfortable about the stability of the real estate market in 2018, but many expressed concerns about what the market may look like in 2019. — Full Report — |

“As our Q1 Index shows, commercial real estate executives continue to anticipate strong near term asset values and capital availability,” said Roundtable President and CEO Jeffrey DeBoer. “Strong, growing commercial real estate markets go hand in hand with overall positive economic growth. Moreover, healthy commercial real estate markets directly benefit local communities by providing significant revenue to support local budgets and services,” DeBoer added.

The report’s Topline Findings include:

While the Q1 index came in at 54, there is a noticeable gap between the scores for current conditions (57) and future conditions (51). Responders are feeling comfortable about the stability of the real estate market in 2018, but many expressed concerns about what the market may look like in 2019.

With asset values nearing perceived peaks in gateway cities, the real estate community has demonstrated discipline many feel was absent in the previous cycle. Debt and equity sources of capital are making thoughtful, risk-weighted decisions.

Asset values continue to increase in secondary and tertiary markets as investors chase yield. In gateway and coastal cities, many responders feel that markets are nearing peak values.

For high quality investments in primary markets, responders feel there are many sources of debt and equity capital. Many responders suggested alternative lending platforms are providing increased competition.