Commercial real estate executives continue to view current conditions as significantly less favorable than previous quarters due to rising interest rates, increased inflation, supply chain disruptions, and labor shortages. However, leaders’ views of where the markets will be one year from today have improved, indicating a cautiously optimistic outlook for the future, according to The Real Estate Roundtable’s Q3 2022 Economic Sentiment Index.

Roundtable President and CEO Jeffrey DeBoer said, “Our Q3 Sentiment Index reflects many of the challenges our economy and industry have faced since early 2022. While these challenges will continue to be bottlenecks in the near term, CRE leaders are optimistic about the future, as underlying real estate fundamentals, such as housing, remain in high demand.

DeBoer added, “Industrial and multifamily continue to be a source of strength, but office and retail still struggle to regain momentum following the pandemic. These are uncertain times, but quality assets and owners will persevere as they continue to meet fundamental demand.”

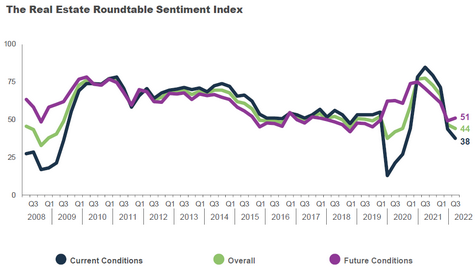

The Roundtable’s Overall Q3 2022 Sentiment Index—a reflection of the views of real estate industry leaders—registered an overall score of 44. The Economic Sentiment Overall Index is scored on a scale of 1 to 100 by averaging the scores of Current and Future Indices. Any score over 50 is viewed as positive. The Current Index registered at 38, a 19-point decrease compared to Q2 2022; however, the Future Index registered a score of 51, a 5-point increase from the previous quarter, reflecting leaders’ optimism in future conditions.

Topline findings:

Data for the Q3 survey was gathered in July 2022 by Chicago-based Ferguson Partners on The Roundtable’s behalf. Read the full Q3 report.

# # #