The White House informed federal agencies yesterday that they have 30 days to develop plans to “substantially increase” their employees in-person work at headquarters. The new guidance is an important step forward that is supported by The Real Estate Roundtable, which sent letters to President Joe Biden in December and the Senate this week about the need to get more federal workers back to the workplace. (Commercial Observer and The Hill, April 14 | Roundtable Weekly and Letter to President Biden, Dec. 2022)

The White House informed federal agencies yesterday that they have 30 days to develop plans to “substantially increase” their employees in-person work at headquarters. The new guidance is an important step forward that is supported by The Real Estate Roundtable, which sent letters to President Joe Biden in December and the Senate this week about the need to get more federal workers back to the workplace. (Commercial Observer and The Hill, April 14 | Roundtable Weekly and Letter to President Biden, Dec. 2022)

Remote Work & Agency Policies

- Office of Management and Budget (OMB) Deputy Director Jason Miller commented, “The guidance we are releasing today directs agencies to refresh their Work Environment plans and policies—with the general expectation that agency headquarters will continue to substantially increase in-person presence in the office—while also conducting regular assessments to determine what is working well, what is not, and what can be improved,” Miller wrote. (OMB blog post, April 13)

- The OMB guidance also informs federal agencies that the impact on local communities should be considered when determining future physical space requirements. The memo’s examples for measuring community needs includes the “location and use of agency-occupied office space and other real estate.” (Page 19, OMB guidance, April 13)

- The OMB memo to federal agencies comes after President Biden signed a bipartisan congressional resolution on April 10 that immediately ended the three-year Covid-19 national emergency declaration. Many of the two million civilian federal employees began working remotely after the original March 2020 declaration. (Reuters, April 13)

- A White House official told CNN, “To be clear, ending the National Emergency will not impact the planned wind-down of the Public Health Emergency on May 11.”

Impact on Communities & Real Estate

- Roundtable President and CEO Jeffrey DeBoer, above, stated, “The OMB remote work guidance is a welcome step toward increasing in-person work by Federal Agency employees. Widespread Federal agency remote work was appropriate during the COVID-19 national emergency. With that emergency now officially behind us it is very appropriate that the Federal Government now asks its Agencies to refresh their remote work policies with an eye toward less remote work.”

- Roundtable Senior Vice President Ryan McCormick added, “However, welcome as this new guidance is, more concrete action may be required for the new guidance to have meaningful, positive impact on communities, small businesses, and the overall health of our nation’s cities. We look forward to understanding the true impact of the new guidance, and we will continue to offer positive insights into why strong workplace attendance is so important.”

- In December, DeBoer and Real Estate Roundtable Chair John Fish (SUFFOLK Chairman & CEO) urged President Biden “to direct federal agencies to enhance their consideration of the impact of agency employee remote working on communities, surrounding small employers, transit systems, local tax bases and other important considerations.” (Roundtable letter, Dec. 12, 2022)

- In January, DC Mayor Muriel Bowser reiterated The Roundtable’s views about the need to get more federal workers back to the workplace and convert underutilized commercial real estate spaces into affordable housing. (Roundtable Weekly, Jan. 6)

Roundtable Calls for Senate Action

- The Roundtable on Wednesday also called upon all U.S. Senators to suspend current federal telework rules and return agencies to their pre-pandemic workplace practices. (ConnectCRE, April 13 and Roundtable letter to the Senate)

- The April 12 letter explained how remote work is undermining the health of cities, local tax bases, and small businesses. The letter also notes that the vast majority of state and local governments, congressional offices, and private sector employers are instituting return-to-workplace policies.

- The House of Representatives recently passed legislation—the Stopping Home Office Work’s Unproductive Problems (SHOW UP) Act (H.R. 139)—that would require all federal agencies to revert to pre-pandemic telework office arrangements and allow employees 30 days to return to their offices. (GovExec, Feb. 1 and The Hill, Feb. 2)

- Last week, The Roundtable’s DeBoer commented on federal remote work and potential Senate action. “We’re trying to get Congress to pass a rule that will require the agencies to go back to pre-pandemic rules. Now, if they’re at home and they’re not downtown, the small businesses suffer, the transportation suffers, safety issues suffer, and the tax base suffers. And so we’re focused on getting people back to the office as much as possible.” (Walker Webcast, 32:58)

The impact of return-to-the office on the industry, communities, and the economy will be a focus of discussion during The Roundtable’s April 24-25 Spring Meeting in Washington, DC. (Roundtable-level members only).

# # #

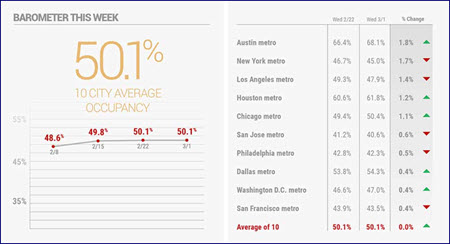

The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk,

The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk,