The Federal Reserve on Wednesday held its benchmark interest rate at 4.25-4.5 percent, signaling a “wait-and-see” posture amid renewed economic uncertainty and lingering inflation. (FOMC Statement, June 18)

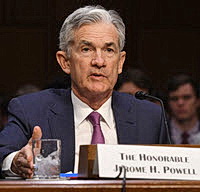

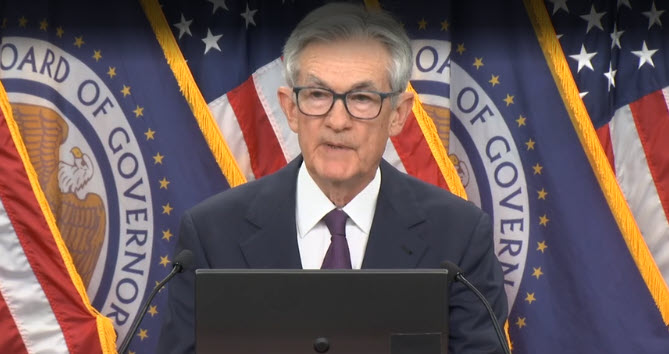

The Fed’s Decision

- At his Wednesday press conference, Fed Chair Jerome Powell said that policymakers are “well positioned to wait” before moving further on rates. He added, “we’re beginning to see some effects” of tariffs on inflation. (CNBC, June 18)

- The Federal Open Market Committee (FOMC) still expects to make two rate reductions later this year. (Axios, June 18)

- When discussing the tariffs, Powell told reporters, “There’s the manufacturer, the exporter, the importer, the retailer, and the consumer, and each one of those is going to be trying not to be the one to pay for the tariff. But together they will all pay for the tariff.” (Yahoo Finance, June 18)

- Hours before the decision, President Donald Trump called Powell “stupid” and asked whether he could “appoint myself” to the Fed. “We have a man who just refuses to lower the Fed rate. Just refuses to do it,” said Trump. (Financial Times, June 18; Fox Business, June 18)

Looking Ahead

- To resume rate cuts that started last year, Fed officials are likely to need to see either labor markets soften or stronger evidence that price increases due to tariffs will be relatively muted. Projections released Wednesday suggest officials were open-minded about whether they would have that evidence after the summer. (WSJ, June 18)

- Markets are now pricing in a rate cut as soon as September or October, though officials cautioned that durable inflation or geopolitical risks could delay those cuts. (Seeking Alpha, June 18)

- The Fed also raised its inflation forecast to around 3 percent this year—well above its 2 percent target—while reducing GDP growth estimates to approximately 1.4 percent, reinforcing its cautious stance. (The Guardian, June 18)

Implications for CRE

- The decision to keep rates flat means access to—and the cost of—capital will remain a hurdle for investors across the commercial real estate landscape. (BisNow, June 18)

- The Fed’s decision reinforces findings from RER’s Q2 2025 Sentiment Index , which indicated that the CRE executives expressed a decline in market confidence, as policy uncertainty, rising costs, and investor caution continue to cloud the outlook. (RW, May 23)

What’s Next

- The Federal Reserve will hold a June 25 board meeting to consider revising the supplementary leverage ratio (SLR) standards.

- These revisions aim to address potential issues and ensure the SLR remains an effective backstop to risk-based capital requirements, potentially easing constraints on bank activities, particularly in the Treasury market.

These potential revisions could have positive implications for real estate financing and the broader market. RER plans to submit comments on the anticipated notice of proposed rulemaking.