A new Real Estate Roundtable report—Commercial Real Estate By The Numbers: 2023— illustrates CRE’s significant contributions to the economy, statistics on climate and the industry, and the important role of tax policy in CRE investment. (18-page report)

Statistical CRE Reference

- Roundtable President and CEO Jeffrey DeBoer said, “Our compilation of publicly available data shows the vital role commercial real estate plays as a driving force in the American economy. Whether it is real estate’s positive contributions to GDP, the workforce, local tax bases, or Americans’ retirement savings, this report serves as a valuable resource in understanding the important role of CRE in our society.”

- DeBoer added, “Our report also presents data on CRE’s climate footprint, information on the economic impact of real estate tax proposals, facts on the affordable housing shortage, and statistics on the physical footprint of U.S. commercial real estate. We intend for this reference to be a ‘living document’ that can be updated when new government and private sector statistics become available.”

Public Data

- The report’s findings, footnoted throughout the publication, include:

- The total value of America’s commercial real estate is estimated between $18- $22 trillion. The value of America’s commercial real estate is nearly 39%-47% of the market capitalization of all U.S. publicly traded companies. The U.S. multifamily housing sector alone is worth $3.8 trillion—worth more than the value of Microsoft, Google, and Amazon combined.

- The combined economic contributions of new commercial building development and the operations of existing commercial buildings contributed an estimated $2.3T to GDP in 2022.

- If U.S. commercial real estate was a country it would have the eighth-largest economy in the world as measured by GDP.

- The commercial real estate industry supports 15.1 million jobs in the U.S.

- CRE pays $559B in property taxes to local governments annually—comprising 72% of all local tax revenue. Commercial real estate owners pay property taxes that are 1.7X more, on average, than the tax rates paid by homeowners.

- Pension funds, educational endowments, and charitable foundations have invested $900B in real estate. 87% and 73% of public and private sector pension funds, respectively, contain real estate investments.

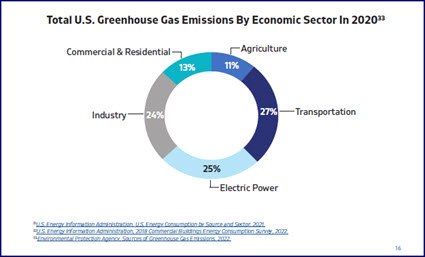

- The commercial and residential sectors represent 13% of total U.S. greenhouse gas emissions. This figure does not include “Scope 3” supply chain emissions beyond the direct control of CRE owners and developers—such as from tenant operations in leased spaces, and carbon embodied in the manufacturing process of cement, steel and other construction materials. (See March 17 Roundtable Weekly, “Reports Confirm Challenges in Scope 3 Reporting”)

Download the 18-page pdf of The Roundtable’s Commercial Real Estate By The Numbers: 2023.

# # #