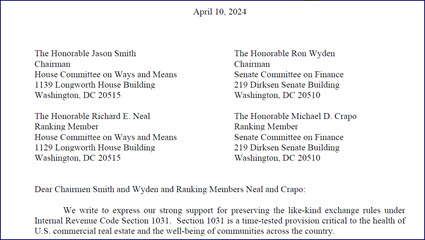

This week, The Real Estate Roundtable and 35 other national business organizations urged leaders of the Senate and House tax-writing committees to preserve long-standing tax rules governing like-kind exchanges (LKEs). The April 10 letter encouraged policymakers to reject proposals, such as those in President Biden’s budget, to restrict the use of LKEs. (Coalition letter, April 10)

Value of LKEs

- The letter, sent to the chairs and ranking members of the House Ways and Means and Senate Finance Committees, details the importance of LKEs to the health, recovery, and realignment of U.S. commercial real estate in the post-pandemic economy.

- Exchanges have helped offset reduced transaction activity associated with high interest rates and other sources of economic uncertainty. Without LKEs, many properties would languish—underutilized and underinvested—because of the tax burden that would apply to an outright sale.

- The letter notes how LKEs increase economic mobility for cash-poor small business owners, farmers, and entrepreneurs—including minorities, women, and veterans—while contributing to environmental conservation efforts, housing affordability, and redevelopment in economically struggling cities and towns.

Widespread Use

- Academic and other economic research has repeatedly demonstrated the positive economic contribution of LKE. Research by Professors David Ling (University of Florida) and Milena Petrova (Syracuse University) estimates that 10 to 20 percent of commercial real estate transactions involve a like-kind exchange.

- A recent Marcus & Millichap analysis demonstrates the value of LKEs to the health and financing of the commercial real estate industry, particularly during market corrections and liquidity shortages. (Roundtable Weekly, Dec. 1, 2023)

House Tax Hearings

- Separately, congressional hearings in the House this week considered tax provisions scheduled to expire at the end of 2025 that were enacted in the 2017 Tax Cuts and Jobs Act (TCJA).

- On April 10, a House Small Business Committee hearing focused on a Roundtable-supported provision within the TCJA that may be subject to reform in 2025—the 20 percent section 199A pass-through deduction. (Tax Notes, April 11 and Roundtable Weekly, May 19, 2023)

- During an April 11 House Ways and Means Committee hearing, Chairman Jason Smith (R-MO) stated, “With the expiration of the 199A small business deduction, we will see even more ‘closed for business’ signs up and down Main street when their federal tax rate jumps to over 40 percent.”

- Chairman Smith added that strong bipartisan support for key TCJA provisions exists in the House after passage earlier this year of the Tax Relief for American Families and Workers Act (H.R. 7024) by a vote of 357-70. (Roundtable Weekly, Feb. 2)

The $79 billion tax package passed by the House includes Roundtable-supported measures on business interest deductibility, bonus depreciation, and the low-income housing tax credit (LIHTC), but continues to face hurdles in the Senate. The Roundtable and 21 other industry organizations that comprise the Housing Affordability Coalition urged the Senate on Feb. 15 to pass the tax package.