As the U.S. commercial real estate sector enters a critical recovery period, industry leaders are urging policymakers to retain key tax policies from the Tax Cuts and Jobs Act of 2017 (TCJA), many of which expire at the end of 2025. (Reuters, Oct. 28)

Tax Landscape

- The outcome of the November presidential election will play a critical role in shaping year-end tax bill discussions.

- If either candidate secures the presidency and achieves unified control of Congress, they may urge their congressional allies to delay any tax negotiations until 2025.

- The Roundtable is preparing for potential tax legislation in the lame-duck session, though action may be delayed until next year’s debate when major provisions in the TCJA expire. (Roundtable Weekly, Oct. 25)

- In early October, RER submitted comments to Capitol Hill on the pending expiration of the TCJA and ways in which tax policy can support long-term investment, economic stability, and the creation of affordable housing. (Roundtable Weekly, Oct. 4)

Industry Advocacy

- Speaking to Reuters, Real Estate Roundtable President and CEO Jeffrey DeBoer noted the difficult economic backdrop for real estate as the tax debate has gathered steam, “Over the last 18 months … operating costs have … risen dramatically at the same time the availability of capital and credit have diminished…. All of that creates stress and challenges in the CRE marketplace.” (Reuters, Oct. 28)

- With the tax reform debate heating up in Washington, maintaining sound tax rules that both reflect the economics of real estate transactions and encourage capital formation is a priority for the CRE industry.

- “Depreciation deductions and interest expense deductions. They’re not tax breaks. They’re the cost of doing business,” said Ryan McCormick (SVP & Counsel, RER) while discussing housing policy in Politico’s Morning Tax. (Politico, Oct. 28)

- RER Member Hessam Nadji (President & CEO, Marcus & Millichap) appeared on CNBC International Squawk Box this week and spoke on the upcoming elections, international investor re-engagement with U.S. CRE, zoning and private-public partnerships, and the impact of government policies, particularly regarding housing.

RER Tax Priorities

Roundtable tax priorities heading into 2025 include:

- Capital formation and capital gains: Preserving key elements of the tax code (e.g., capital gains preference, like-kind exchanges, step-up in basis at death) that encourage productive real estate investment, risk-taking, and growth.

- Strong partnership, pass–through, and entity choice rules: Extending tax provisions like section 199A that allow pass-through businesses to compete on a level playing field with public corporations.

- Affordable housing and community development incentives: Advocating for tax incentives tied to affordable housing, energy efficiency, Opportunity Zones, and commercial-to-residential conversions.

- Removing barriers to job-creating foreign investment: The tax system should avoid discriminatory policies that discourage job-creating foreign investment in US real estate and infrastructure.

Tax Bill Negotiators to Watch

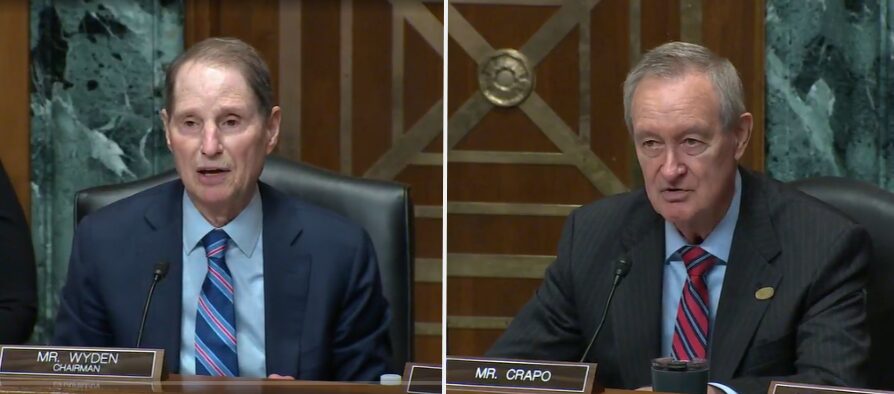

- Sen. Mike Crapo (R-ID): If Republicans take control of the Senate, Crapo is poised to lead the Senate Finance Committee in 2025. Given his influence over Senate Republicans, many of whom followed his opposition to this year’s bipartisan tax bill, Crapo’s stance on a year-end tax deal will be pivotal.

- Sen. Ron Wyden (D-OR): Wyden has shown a willingness to strike deals, as evidenced by his work with Rep. Smith on this year’s agreement. He might be eager to pass as much of that legislation as possible during the lame-duck session.

- Rep. Jason Smith (R-MO): As chair of the House Ways and Means Committee, Smith’s perspective will be highly influential in the lame-duck session, with Republicans still holding the House majority.

The Roundtable is committed to working with lawmakers to ensure the U.S. maintains a competitive tax code that encourages capital formation, rewards entrepreneurial risk-taking, and supports critical policy objectives, including accessible and affordable housing and safe and healthy communities.