The Real Estate Roundtable’s Q1 2025 Sentiment Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, suggests a cautious optimism, fading expectations for additional interest rate cuts, rising insurance costs and larger policy shifts.

Roundtable View

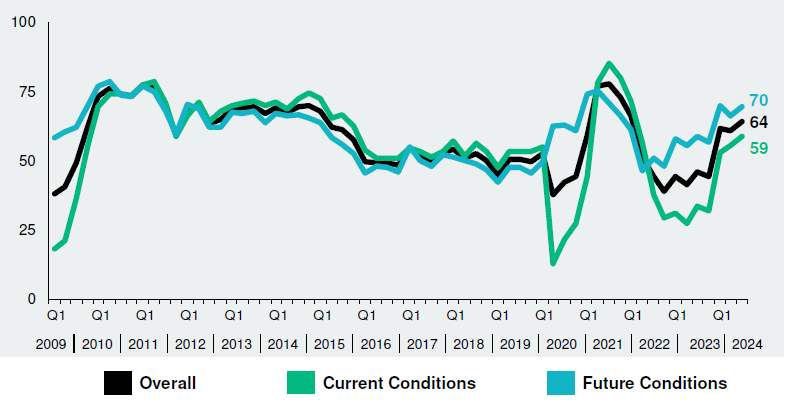

- The Q1 Index reported an overall score of 68, reflecting a 5-point decline from the previous quarter, and the Future Index posted a score of 70 points—a decrease of 7 points from the previous quarter—indicating that optimism for the impact of potential rate cuts has subsided.

- Roundtable President and CEO Jeffrey DeBoer said, “The commercial real estate industry remains in a transitional period. Although interest rate adjustments have provided some relief, the reality is that capital markets remain constrained, and investors are being more selective. While there are signs of market stability, there is lingering uncertainty over tariffs, expiring tax cuts, and regulatory reforms that could slow investment and economic growth.”

- He added, “There must be a supportive public policy environment that understands and addresses the multifaceted challenges the industry faces. The Roundtable remains committed to working with policymakers and the administration to advocate and demonstrate the importance of maintaining policies that encourage capital formation, reward entrepreneurial risk-taking, and support jobs and communities.”

Topline Findings

- The Q1 2025 Real Estate Roundtable Sentiment Index registered an overall score of 68, a decrease of 5 points from the previous quarter. The Current Index registered 65, a 4-point decrease compared to Q4 2024. The Future Index posted a score of 70 points, a decrease of 7 points from the previous quarter, indicating optimism for the impact of potential rate cuts has subsided.

- Nevertheless, survey participants are cautiously optimistic that transaction activity and capital deployment will continue to normalize in 2025. Interest rates, insurance costs and the implications of the Trump administration are top of mind for many investors.

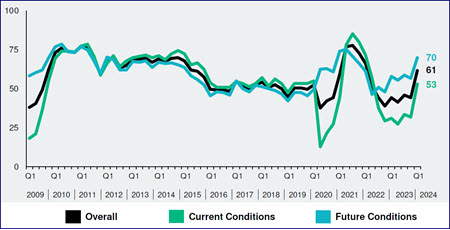

- Evolving market trends continue to shape the real estate landscape. A majority (70%) of Q1 survey participants expect general market conditions to show improvement one year from now. Additionally, 61% of respondents said conditions are better now compared to this time last year. Only 2% of Q1 participants expect general market conditions to be somewhat worse in a year. A substantial volume of industrial and multifamily assets came online in 2024, though activity is expected to slow in 2025. Return-to-office mandates thus far are not moving the needle on office assets, of which class B and C continue to struggle.

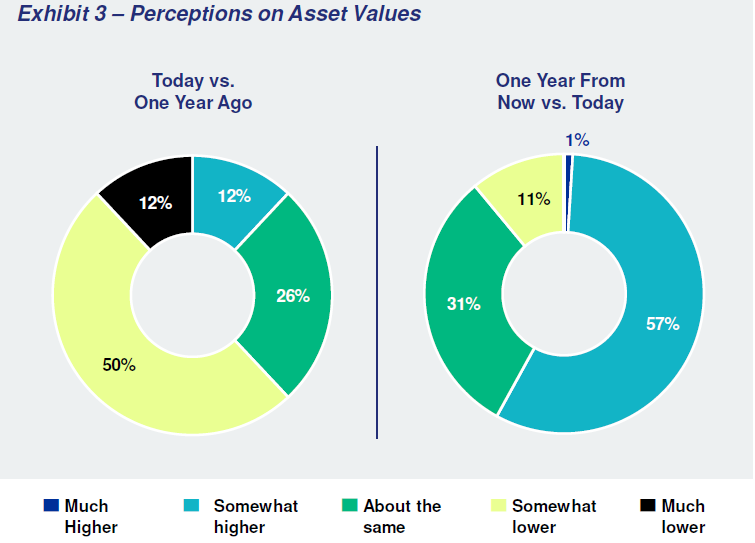

- A plurality of participants (45%) believe asset values have not meaningfully changed from where they were a year ago. However, respondents are overall optimistic, with most (56%) predicting that asset values will be higher one year from now.

- The real estate capital markets have seen steady improvement. 47% of respondents believe the availability of equity capital is better than it was a year ago, while 62% said the availability of debt capital has improved from last year. Looking forward, virtually all respondents believe that capital availability will be the same or better in one year (99% and 98% for equity and debt capital, respectively).

Data for the Q1 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf. Read the full Q1 report.