Commercial real estate executives report solid fundamentals are countering concerns about economic uncertainty and geopolitics, maintaining an optimistic outlook for market conditions in 2020, according to The Real Estate Roundtable’s 2019 Q4 Economic Sentiment Index released today.

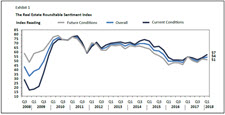

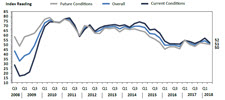

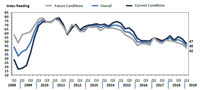

- The Q4 Sentiment Index dropped one point from the previous quarter to register a score of 49, which shows a positive view regarding the U.S. economy and real estate market conditions. The Overall Economic Sentiment Index is scored on a scale of 1 to 100 by averaging Current and Future Indices and a score of approximately 50 is viewed as positive.

- For Q4, the Current-Conditions Index of 53 remains the same as the previous quarter. The Q4 Future-Conditions Index of 45 decreased three points from Q3. The Overall Sentiment Index has registered between 49 and 77 every quarter since Q3 2009 – except for Q1 2019 (45 score) and Q4 2016 (48 score).

- “Our Q4 Sentiment Index shows that macro real estate markets remain fundamentally sound and reasonably leveraged, with balanced supply and demand,” said Real Estate Roundtable President and CEO Jeffrey DeBoer (above). “The markets continue to benefit from business and consumer spending, encouraged by low unemployment, rising wages and low energy prices.”

The report’s Topline Findings include:

- The Real Estate Roundtable Q4 2019 Economic Sentiment Index registered a score of 49 – a one-point decrease from the previous quarter. Survey participants remain confident in stable market fundamentals, but are concerned about recession talk, troubled international markets and politics.

- Sixty-two percent of Q4 survey respondents believe markets conditions will be about the same or better in 2020. Approximately 82% of respondents see today’s market as about the same or better compared to the same time last year.

- More than 65% of respondents anticipate asset values to maintain their current level or be somewhat higher going into 2020. Additionally, half also suggested asset values increased over the past year. Respondents consistently suggested the number of buyers for assets was decreasing, a factor which is creating challenging selling and buying circumstances.

- Most respondents feel debt and equity capital are readily available for quality investments. The availability of capital and refinancing opportunities are offsetting a decline in buyers/investors in some markets.

DeBoer added, “Real estate leaders cautiously await the outcome of several unpredictable influences on the global and domestic economies. Despite the uncertainty, U.S. real estate markets have shown consistent stability, which positions them well to withstand potential economic gyrations in the future.” He also said, “Washington policymakers need to keep their focus on policies that encourage long-term job creation and support economic growth in local communities.”

Data for the Q4 survey was gathered in October by Chicago-based FPL Associates on The Roundtable’s behalf. For the full survey report, visit www.rer.org/q4-2019-sentiment-index-report

# # #